Audit Revision

The ultimate aim of the audit process is for the auditors to be in a position to express their opinion to the shareholders as to whether the financial statements have been prepared, in all material respects, in accordance with the applicable financial reporting framework.

An item might be deemed material due to its:

• Impact (for example, the $1.00 journal that turns a profit into a loss.)

• Nature (such as transactions with directors)

• Value (such as a significant asset acquired)

Between ½% and 1% revenue

Between 1% and 2% of total assets; or

Between 5% and 10% of profit before tax.

| Nature of circumstances | Material but not pervasive | Material and pervasive |

|---|---|---|

| Financial statements are materially misstated | QUALIFIED OPINION | ADVERSE OPINION |

| Auditor unable to obtain sufficient appropriate audit evidence | QUALIFIED OPINION | DISCLAIMER OF OPINION |

AR = IR * CR * DR

Audit Inherent Control Detection

Audit risk is the ‘risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated’.

Control risk is the susceptibility of an assertion to a misstatement that could be material, either individually or when aggregated with other misstatements, assuming that there were no related internal controls.

ROMM(Risk of material misstatements) is the risk that a misstatement could occur in an assertion that could be material, either individually or when aggregated with other misstatements, that will not be prevented, or detected and corrected, on a timely basis by the entity’s internal control.

Detection risk is the risk that the auditor’s procedures will not detect a misstatement that exists in an assertion that could be material either individually or when aggregated with other misstatements.

Audit planning

Accounting issue

When describing RoMMs, an effective approach is to use the following steps to construct your answer

1. 计算重要性 Calculate and conclude on the materiality of the issue where sufficient information is available.

2. 简述规定 Briefly describe the relevant financial reporting requirement.

3. 对应的风险 Relate the risk in the scenario to the accounting treatment.

4. 对报表影响(overstate/understate) Illustrate the impact of the risk on the financial statements

IAS2 Inventory

Several customers have returned equipment due to faults.

Inventory should be valued at the lower of cost and NRV.

For items which have been returned, there is a risk that the NRV falls below the costs.

This would result in an overstatement of inventory(or assets) in the statement of financial position and an understatement of cost of sales, therefore an overstatement of profit.

IAS12 Income Taxes

IAS 12 Income Taxes requires deferred tax to be recognised in respect of temporary differences which arise between the carrying amount and tax base of assets and liabilities, including the differences from the revaluation of non-current assets.

The finance director’s suggestion that deferred tax should not be provided for is therefore incorrect, and at present liabilities are understated.

According to IAS 12 Income Taxes, a deferred tax asset is recognized for an unused tax loss carry-forward or unused tax credit if, and only if, it is considered probable that there will be sufficient future taxable profit against which the loss or credit carry-forward can be utilised.

While it appears that some of the deferred tax asset has been utilised this year, there remains a risk that if it is no longer recoverable, then the amount would need to be written off.

This would result in an overstatement of the deferred tax asset.

IAS16 Property, Plant and Equipment

The decision to revalue the company’s manufacturing sites and the revaluation gain recognised in equity represents 3·9% of total assets and is therefore material to the financial statements.

IAS 16 Property, Plant and Equipment requires all assets in the same class to be revalued.

There is a risk that any properties which are manufacturing sites have not been included in the revaluation exercise.

This would result in the amounts recognised will not be correct.

There is also a risk that depreciation has not been recalculated on the new, higher value of the properties, leading to overstatement of non-current assets and understatement of operating expenses.

According to IAS 16 Property, Plant and Equipment, modernisation costs which give rise to enhanced future economic benefit should be capitalised, whereas costs which do not create future economic benefit should be expensed.

There is a risk that the amounts capitalised into non-current assets are not correct in that capital and revenue expenditure may not have been correctly identified and accounted for separately.

This would result in a misstatement of the assets’ carrying values and depreciation expense.

IAS 16 requires that each part of an item of property, plant and equipment with a cost which is significant in relation to the total cost of the item must be depreciated separately.

There is a risk that the various components of each warehouse have not been treated as separate components and depreciated over a specific useful life.

The change to the estimated useful lives of property, plant and equipment has increased profit by $5 million, which represents 17·9% of profit before tax and is therefore material to the financial statements.

This change in accounting estimate is permitted, but the audit team should be sceptical and carefully consider whether the change is justified.

There is a risk that the change might be inappropriate.

This would result in an overstatement of profit ($5 million)and an overstatement of asset($5 million).

IAS20 政府补助

A grant is recognised as income over the period necessary to match the grant received with the related costs for which they are intended to compensate.

Therefore, the $2 million relating to costs incurred this year should be recognised as income, but the remainder should be deferred and released to profit on a systematic basis.

The risk is that the grant has been recognised on an inappropriate basis leading to over or understated profit for the year.

IAS21 外币

According to IAS 21 The Effects of Changes in Foreign Exchange Rates, transactions should be initially recorded using the spot rate, and monetary items such as trade payables should be retranslated at the year end using the closing rate.

The risk is that the incorrect exchange rate is used for the translation and retranslation, or that the retranslation does not happen at the year end, in which case trade payables and profit could be over or understated.

IAS 23 Borrowing Costs

A qualifying asset is an asset which takes a substantial period of time to get ready for its intended use or sale. If modernisation meets the definition of a qualifying asset, then borrowing costs should be capitalised during the period.

IAS33 Earnings per Share

IAS 33 requires EPS to be calculated based on the profit or loss for the year attributable to ordinary shareholders as presented in the statement of profit or loss.

The earnings figure used as the basis of the calculation should also not be based on profit before tax but on the post-tax profit.

The denominator should be based on the weighted average number of shares which were in issue during the financial year.

(There is a risk relating to inadequate disclosure, for example, a diluted EPS needs to be presented, as does a comparative for the previous year.)

IAS36 Impairment

The management should consider whether there are indicators of impairment and if necessary perform an impairment review on the licence.

Goodwill should be tested annually for impairment regardless of whether indicators of potential impairment exist.

IAS37 Provisions, Contingent Liabilities and Contingent Assets

A provision should be recognised where a reliable estimate can be made in relation to a probable outflow of economic resources and an obligating event has taken place. A contingent liability should be disclosed if there is a possible, rather than probable, outflow of economic benefit.

The risk is that either a necessary provision is not recognised, understating liabilities and expenses, or that a contingent liability is not appropriately disclosed in the notes to the financial statements.

(The risk is that no provision or an insufficient provision in relation to the warranty has been recognised, leading to understated liabilities and operating expenses.)

Assuming that these criteria have been met, it would be reasonable to expect the full amount to be provided.

IAS 38 Intangible Asset

Research costs must be expensed and Development costs are capitalised only after technical and commercial feasibility of the asset for sale or use have been established, and an intention and ability to complete the development and that it will generate future economic benefits.

The cost of acquiring patents for products should be capitalised and recognised as an intangible asset.

If patent costs have been expensed rather than capitalised, this would understate assets and overstate expenses.

Once recognised, patents should be amortised over the period of their duration, and non-amortisation will overstate assets and understate expenses.

IAS 38 Intangible Assets states that an intangible asset with a finite useful lifeis amortised, and an intangible asset with an indefinite useful life is not.

There is a risk that the assumption that the brand has an indefinite life is not correct, and that the asset is overstated and operating expenses understated through the lack of an annual amortisation charge.

The amortisation method should reflect the pattern of benefits and Amortisation should begin when the asset is available for use.

IAS 40 Investment Property

According to IAS 40 Investment Property, an entity can use either the fair value model or the cost model to measure investment property. When the fair value model is used the gain is recognised in profit or loss.

IFRS 2 Share-based Payment

IFRS 2 Share-based Payment states that the liability in respect of the plan should be measured at fair value at the year end.

IFRS 2 Share-based Payment requires an expense and a corresponding entry to equity to be recognised over the vesting period of a share-based payment scheme, with the amount recognised based on the fair value of equity instruments granted.

IFRS 8 Operating Segments

Being a listed entity, ZCG should provide segmental information in the notes to the financial statements in accordance with IFRS 8 Operating Segments.

There is a risk that the segmental information provided is not sufficiently detailed.

There are some unusual trends in the segmental revenue figures from the management accounts. For example, revenue from south east Asia appears to have increased significantly –, the projected revenue from that segment is $49·5 million, an increase of 65% compared to 2015.

There is a risk that revenues have been misallocated between segments and that the disclosure is inaccurate.

IFRS 8 Operating Segments requires listed companies to disclose in a note to the financial statements the performance of the company disaggregated over its operating or geographical segments.

IFRS9 Financial Instruments

speculative 投机性的 FV through P/L

IFRS 9 requires Speculative investments in equity sharesshould be measured at fair value through profit or loss.

The treasury management function is involved with forward exchange contracts, meaning that derivatives exist and should be accounted for in accordance with IFRS 9 Financial Instruments.

This is a complex accounting issue, and there are numerous audit risks arising.

There is also a risk in determining the fair value of the derivative at the year end, as this can be judgemental and requires specialist knowledge.

IFRS15 Revenue from Contracts with Customers

Revenue should be recognised over time or at a point in time when control is passed. Such points will be determined by the contractual terms. Payments received in advance of control passing should be recognised as deferred income.There is a risk that revenue might be recognised early when payment is received rather than being deferred.

This would result in an overstatement of revenue and an understatement of liabilities for deferred revenue.

Revenue should be recognised over time or at a point in time when control is passed. Such points will be determined by the contractual terms.

There is a risk that the revenue from the sale of a licence should not be deferred at all.

ZCG is supplying customers with a multiple-element contract and is providing access to a mobile phone network and a fixed landline and broadband service.

The elements of the contract should be accounted for separately and the revenue from the contract should be allocated to each component.

Contracts vary in length, lasting two or three years.

The timing of revenue recognition should be in line with meeting its performance obligations.

Analytical procedures

Why analytical procedures are performed as a fundamental part of our risk assessment at the planning stage of the audit. 3不用背

Analytical procedures are the evaluation of financial information through analysis of plausible relationships between both financial and non-financial data.

Analytical procedures include comparisons of the financial information with:

Comparable information for prior periods

Comparable information from competitors.

Analytical procedures performed at the planning stage help the auditor to identify and respond appropriately to risk, and to assist the auditor in obtaining an understanding of clients.

alert the auditor

plan appropriate audit procedures to obtain sufficient appropriate audit evidence

identify the existence of unusual transactions or events

Audit Risk

先分析 AP ,再找可能理由,列出可能风险。

Operating margin = Operating profit / Revenue

ROCE = PBIT / TALCL

Interest cover = PBIT / Interest paid

Effective tax rate = Tax expense / PBT

Receivable days = TR / Revenue * 365

Current ratio = Current asset / Current liability

Rearing ratio = Debt / Equity

Profitability

Revenue trend, Expense trend, Margin trend, ROCE trend

Interest cover

偿债能力

1. 债 -> 财务成本升高

2. covenant 违背 (Interest cover降低)

Gearing

同上

Liquidity

变动 -> 可能错报

现金情况

Effective tax rate

Deferred tax liability 增加,应当导致利润表 Tax expense 增加。

或者直接 This is a complex issue. There is a risk that the tax expense is understated.

Business risk

- 抄题目

- 影响 -> Audit (Revenue/Cost/☆CF

☆ /GoingConcern) / Business / Why

题目中每一段都有得分点

现金流状况 分析(正/负)现金流、可持续经营假设(现有现金)。

诉讼 -> reputation damage, 影响市场占有率, 增加监管。

拓展市场可能导致额外成本以及加大现金流压力

Overtrading 特征:收入增加,盈利能力下降,流动性恶化。注意 Going Concern。

Audit evidence

audit procedures, additional information, audit evidence

MJ’s Approach

重大交易——三兄弟

1. Agreement/Contract

2. Authorized? – Board minutes

3. Cash book and bank statement (收支)

事件推动 — Case

Accounting issue

1. Disclosure

2. Confirm

3. 专业的话

Impairment

When there is an indicator of potential impairment of the assets, management should have conducted an impairment review to determine the recoverable amount.

The recoverable amount is the greater of the fair value less cost to sell and the value in use of the assets.

As a cash generating unit the impairment should firstly be allocated against any goodwill relating to the cash generating unit and then be allocated against the remaining assets on a pro-rata basis.

Intangible asset

It would seem appropriate that the licence is recognised as an intangible asset as it has been purchased as a separable asset without physical substance and has a reliable cost. Management should be able to demonstrate the economic benefit that has been, or is expected to be, derived from the licence. (外购)

Review management accounts and cash flow forecasts to confirm that Farland is generating an income stream and is predicted to continue to generate cash.

Obtain a written representation from management confirming that there are no indications of impairment of the licence of which management is aware.

Consider whether there are any indicators of potential impairment at the year end by obtaining pre year-end sales information and reviewing terms of contracts to supply the products to pharmacies.

IAS 1 Presentation of Financial Statements requires that an individual item of income or expense which is material should be disclosed separately.

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

A disposal group is a group of assets to be disposed of together as a group in a single transaction and liabilities directly associated with those assets that will be transferred in the transaction.

An entity shall classify a non-current asset (or disposal group) as held for sale if its carrying amount will be recovered principally through a sales transaction rather than through continuing use.

The asset (or disposal group) must be available for immediate sale in its present condition, subject only to usual and customary sales terms, and the sale must be highly probable(Price reasonable / Management committed / Active programme / within one year).

On classification of the non-current asset (or disposal group) as held for sale, it is written down to fair value less costs to sell (if less than carrying amount).

not depreciated/amortised

normally disclosed as current assets and liabilities (not offset).

A discontinued operation is a component of an entity that either has been disposed of or is classified as held for sale and:

a) represents a separate major line of business or geographical area of operations, or

b) is part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations, or

c) is a subsidiary acquired exclusively with a view to resale.

It is not sufficient to simply put management’s justification for the accounting treatment on the audit file and conclude that it is correct.

Using management accounts, determine whether the factory is a separate major line of business in which case its results should be disclosed as a discontinued operation.

Completing the audit

ISA 560: Subsequent events

Events after the reporting period: events, both favourable and unfavourable, that occur between the end of the reporting period and the date when the financial statements are authorised for issue.

Adjusting events

Events which provide evidence of conditions which existed at the end of the reporting period.

Non-adjusting events

Events that relate to conditions which arose after the end of the

reporting period.

ISA 570: Going concern

Net liability or net current liability position (CA无法抵CL)

Negative operating cash flows

Withdrawal of financial support

Inability to obtain financing for essential new product development or other essential investments

Inability to comply with terms of loan agreements (covenant)

The xxx event represents a material uncertainty which may need to be fully disclosed in the financial statements.

Audit procedures

Analyse and discuss the cash flow and profit forecasts with management and review assumptions to ensure they are in line with management’s strategy and auditor’s knowledge of the business.

Obtain and review management accounts for the period after the reporting date and any interim financial accounts which have been prepared. Perform analytical review to ascertain the trends in profitability and cash flows since the year end.

Audit procedures for Cash Flow Forecast

Review the outcome of previous forecasts prepared by management to assess how effective management has been in the past at preparing accurate forecasts.

Obtain a copy of the latest interim financial statements and compare the actual post year-end sales performance with the forecast sales upon which the cash flow forecast is based.

Agreement of the opening cash position to the audited financial statements and general ledger or bank reconciliation, to ensure accuracy of extracted figures.

Confirmation that casting of the cash flow forecast has been reperformed to check arithmetical accuracy.

Comparison of the cash flow forecast for the period August–November 2013 with management accounts for the same period, to ensure accuracy of the forecast.

Impact on audit report

The note should include a description of conditions giving rise to the significant doubt, and the directors’ plans to deal with the conditions.

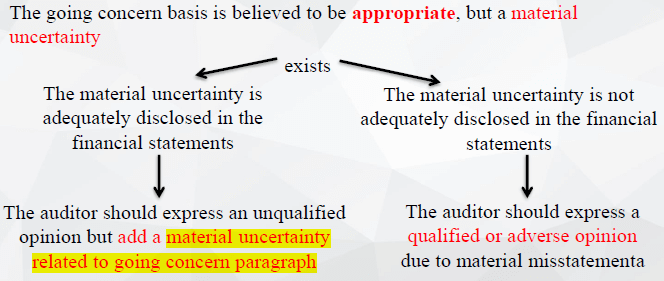

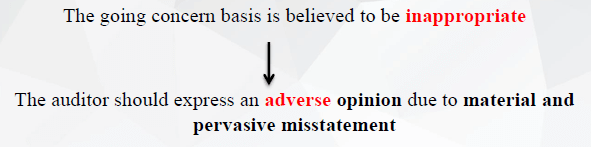

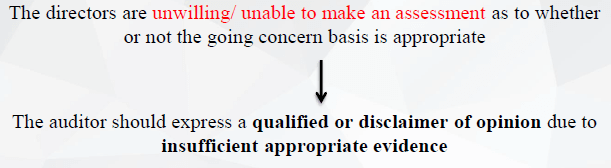

If the note contains adequate information on going concern issues, the audit opinion should not be modified. The auditors should modify the auditor’s report by adding a material uncertainty related to going concern paragraph. The material uncertainty paragraph should contain a brief description of the uncertainties, and also refer explicitly to the note to the financial statements where the situation has been fully described.

If note does not contain adequate information on going concern, the auditors should express a modified opinion. The auditor would need to use judgement to decide whether a qualified or an adverse opinion should be given.

ISA450 EVALUATION OF MISSTATEMENTS

ISA 450 requires that ‘the auditor shall accumulate misstatements identified during the audit, other than those that are clearly trivial’.

ISA 450 also requires that ‘The auditor shall communicate on a timely basis all misstatements accumulated during the audit with the appropriate level of management, unless prohibited by law or regulation. The auditor shall request management to correct those misstatements.’

ISA 450 requires the auditor to obtain an understanding of management’s reasons for not making the corrections, and to take that understanding into account when evaluating whether the financial statements as a whole are free from material misstatement. Discuss WHY

ISA 450 requires the auditor to communicate uncorrected misstatements to those charged with governance and the effect that they, individually or in aggregate, will have on the opinion in the auditor’s report.

In addition the auditor is required to request a written representation from management and, where appropriate, those charged with governance with regard to whether they believe the effects of uncorrected misstatements are immaterial, individually and in aggregate, to the financial statements as a whole.

Three categories of misstatements

Factual misstatements are misstatements about which there is no doubt. 事实错报

Judgmental misstatements are differences arising from the judgments of management concerning accounting estimates that the auditor considers unreasonable, or the selection or application of accounting policies that the auditor considers inappropriate. 判断错报

Projected misstatements are the auditor’s best estimate of misstatements in populations, involving the projection of misstatements identified in audit samples to the entire populations from which the samples were drawn. 推断错报

ISA 520 Overall review of the financial statements

1. 查 AP 是否与理解相同 检查是否有未发现风险点。

2. 查附注

3. 评价为改正错报

ISA 720 Other information

At this stage, the auditor should also read the other information to be issued with the financial statements for consistency with the financial statements.

ISA 580 Written Representations

1. 声明报表责任

2. 会计估计得假设均合理

3. 关联方

4. 所有期后事项

5. 未改的错报不重大

Reporting

a) Title

b) Addressee

c) Opinion paragraph

d) Basis for opinion paragraph (当意见修改)

e) Material uncertainty related to going concern paragraph (if relevant)

f) Emphasis of matter paragraph (if relevant)

g) Key audit matters (KAM) paragraph (for audits of listed entities only)

h) Other matter paragraph (if relevant)

i) Responsibilities of management and those charged with governance for the financial statements

j) Auditor’s responsibilities for the audit of the financial statements

k) Report on other legal and regulatory requirements (if relevant)

l) Name of audit engagement partner

m) Signature of audit engagement partner and/or audit firm

n) Auditor’s address

o) Date of the auditor’s report

Unmodified opinion

In our opinion the financial statements present fairly, in all material respects.

Emphasis of matter paragraph

An emphasis of matter paragraph is a paragraph included in the auditor’s report which aims to draw users’ attention to a matter:

1) Which is appropriately presented or disclosed in the financial statements; but

2) Which is of such importance, in the auditor’s judgement, that it is fundamental to users’ understanding of the financial statements.

Pervasive

From ISA 705, the term ‘pervasive’ has the following definitions:

1) Are not confined to specific elements, accounts or items of the financial statements;

2) If so confined, represent or could represent a substantial proportion of the financial statements; or

3) In relation to disclosures, are fundamental to users’ understanding of the financial statements. (Going concern)

Material

quantification

Implications of the matters

1. 评价重要性

2. Accounting issue

3. Further evidence

4. 对报告影响 (量化)

A qualified ‘except for’ opinion should be given, and the Basis for Qualified Opinion paragraph should explain the reason for the qualification, including a quantification of the misstatement.

The Emphasis of Matter paragraph should include a clear reference to the matter being emphasised and to the note to the financial statements where the matter is disclosed. The paragraph should also make it clear that the audit opinion is not modified in respect of this matter.

If management refuses to amend “Other information”, the auditor should include an Other Matter paragraph in the audit report to describe the material inconsistency.

The auditor may also seek legal advice if management refuses to amend the KPI to remove the material inconsistency.

All of the matters affecting the auditor’s report should be discussed with those charged with governance.

Uncorrected misstatements

1. 审计师责任

During the completion stage of the audit, the effect of uncorrected misstatements must be evaluated by the auditor.

The auditor shall obtain an understanding of management’s reasons for not making the corrections

The auditor shall communicate with those charged with governance about uncorrected misstatements and the effect that they, individually or in aggregate, may have on the opinion in the auditor’s report.

2. 讨论影响

1. 重要性

2. 专业的话

3. 对报告的影响(是有影响的)

Despite the amount being immaterial, it should not be disregarded, as the auditor should consider the aggregate effect of misstatements on the financial statements. ISA 450 does state that the auditor need not accumulate balances which are ‘clearly trivial’

具体影响

1. 累计重要性

2. 是否致命

3. 什么意见

4. 报告什么样

The basis for qualified opinion paragraph should contain a description of the matters giving rise to the qualification. This should include a description and quantification of the financial effects of the misstatement.

Key Audit Matter

Those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period.Key audit matters are selected from matters communicated with those charged with governance.

Three types of matter

1 Areas of higher assessed risk of material misstatement, or significant risks identified. 高风险

2 Significant auditor judgments relating to areas in the financial statements that involved significant management judgment, including accounting estimates that have been identified as having high estimation uncertainty. 判断

3 The effect on the audit of significant events or transactions that occurred during the period. 重大交易

Include

1. WHY

2. How the matter was addressed in the audit.

Auditors’ reports to those charged with governance

Matters to be communicated

1. Going concern

2. disagreements with management over accounting treatments or disclosures

3. any expected modifications to the audit report

4. material weaknesses discovered in the internal systems and controls

Group audits

Subsidiary, Joint venture, Associate

Subsidiary line-by-line (全部进)

Joint venture / Associate Equity (按%进)

An entity with joint control of, or significant influence over, an investee shall account for its investment in an associate or a joint venture using the equity method.

The company’s loss for the year should be consolidated from the date of acquisition.

Equity accounting requires the investment in the associate to be recognised on one line in the statement of financial position, and the income from the associate to be disclosed on one line of the statement of profit or loss.