01 Concepts of strategy

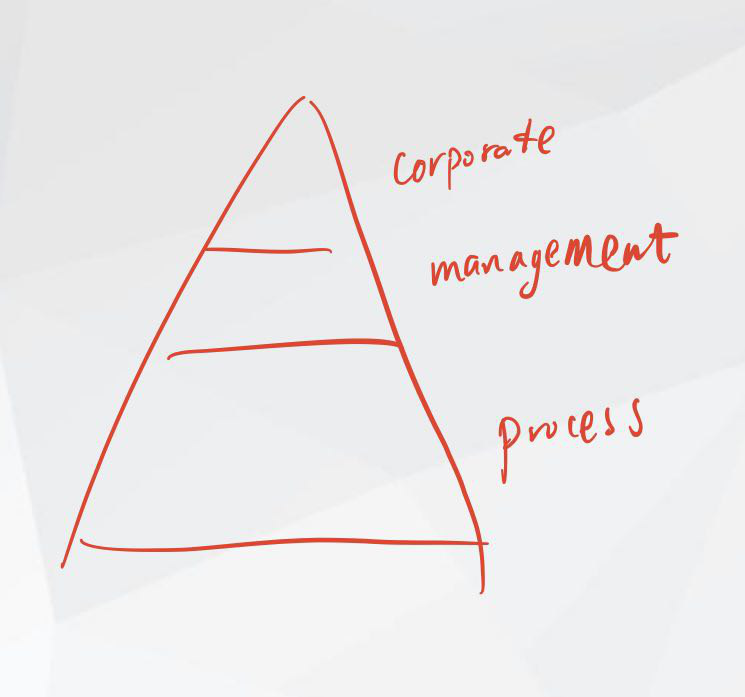

Levels of strategy

- Corporate

- Business-level

- Operational

Strategic planning

- Strategic position

- Strategic choices

- Strategic implementation

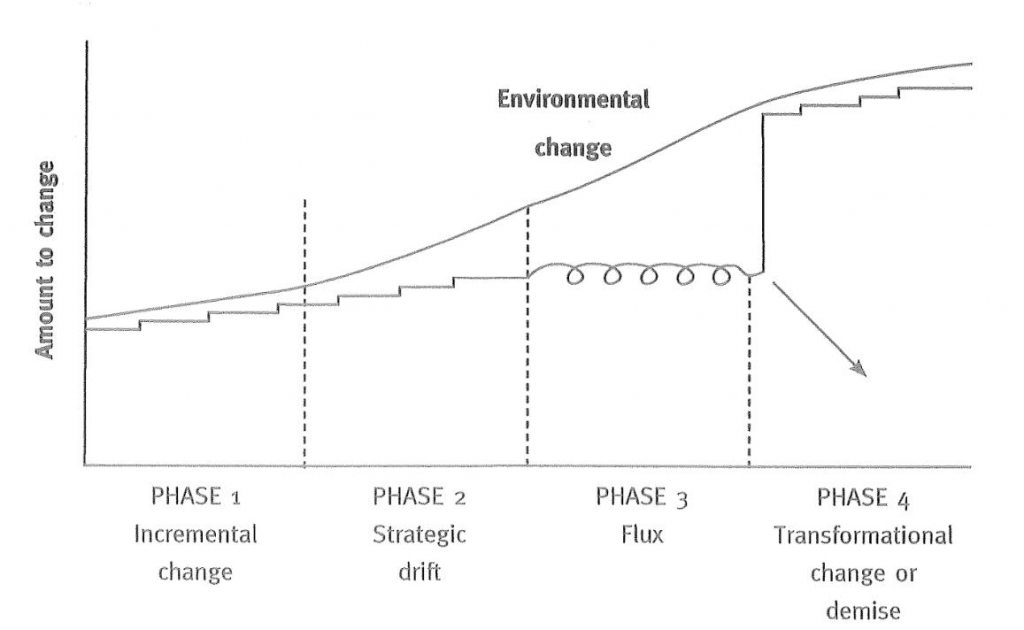

Strategic drift

02 External environment

The environment is particularly important as a source of threats (external changes which could damage our business) and opportunities (external changes which we could exploit to our advantage).

PESTEL

General environment

Political

Economy

Social

demographics, changes in taste

Technology

Environmental

Legal

employment law, health & safety, data protection, industry-specific regulations

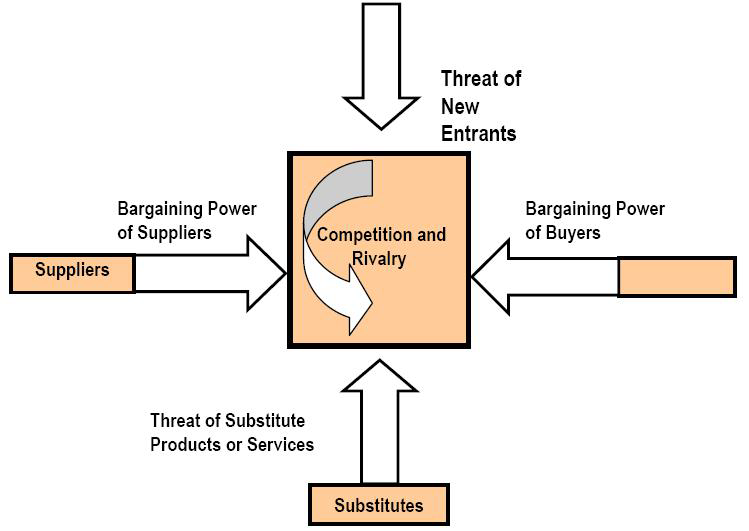

Porter’s five forces

Industry or sector environment

Industry competition and so profitability is influenced by the pressures of five competitive forces.

Bargaining power of buyers

- force price cuts and/or quality improvements

- high proportion

- A buyer makes a low profit.

- similar alternative products

Bargaining power of suppliers

- charge higher prices

- switching costs

- one or two dominant suppliers

- uniqueness

Rivalry

行业内部竞争

- Number and relative strength of competitors (monopoly)

- Rate of growth (maturity)

- High fixed costs

- Buyers can switch easily

- Exit barrier

Threat of new entrants

- The strength of the barriers to entry.

- Economies of scale

- Product differentiation

- Capital requirements

- Access to distribution channels

- Cost advantages of existing producers

Threat of substitute products

This threat is across industries (e.g. rail travel versus bus travel versus private car) or within an industry (e.g. long life milk as a substitute for delivered fresh milk).

Substitutes limit the potential returns … by placing a ceiling on the price which firms in the industry can profitably charge. 替代品限制盈利空间(天花板ceiling)

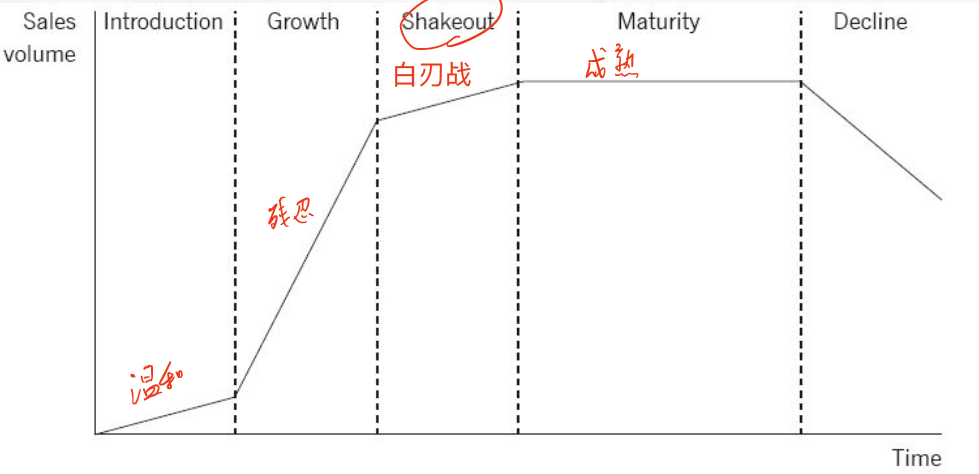

Life cycle

Scenario planning

Think about other potential future market positions.

In scenario planning the key environmental factors are identified and the firm then considers how these might change in the future. Plans are then considered for each of these eventualities.

- The most likely scenario

- The best case scenario

- The worst case scenario

The organisation can then evaluate how it might react to these changes.

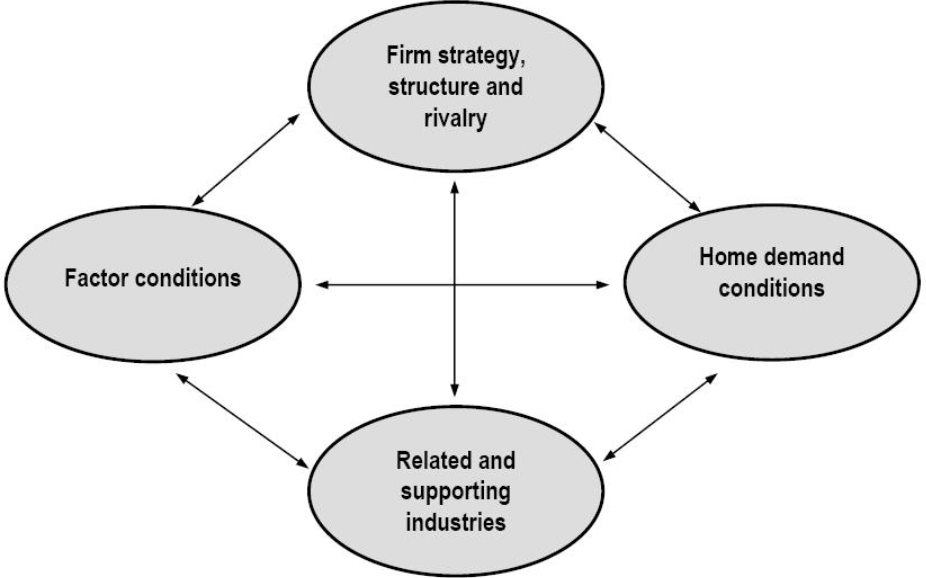

National environment

Porter’s competitive advantage of nations (CAN)

Factor conditions

- Basic factors – natural resources, climate, unskilled labour

- Advanced factors – education of the workforce, research capability

Demand conditions

Strong demand and sophisticated customers tastes will drive quality up and costs down through economies of scale and the learning curve.

Related and supporting industries

Local supply chain

Firm strategy, structure, rivalry

03 Understanding and delivering value

Strategic capability

- Resources: Tangible/Intangible

- Competences: The methods an organisation use its resources

Cannot easily imitate or obtain –> unique resources, core competences

Critical success factor CSF

Critical success factors (CSFs) are the essential areas of the business that must be performed well if the mission, objectives and goals of the business are to be achieved. They are the few key areas where things must go right for the business to flourish.

The product features which are particularly valued by a group of customers and where the organisation must excel to outperform its competitors.

CSFs are what an organisation needs to be good at, while competences focus on what an organisation is good at.

- (Lack of focus)

- Align with the organisation’s objective

- CSFs should not have specific time-bound targets associated with them.

Organisational knowledge

An organisation’s knowledge of its environment (such as expected technological changes, changes in substitute availability etc.) can make it stand out from rivals.

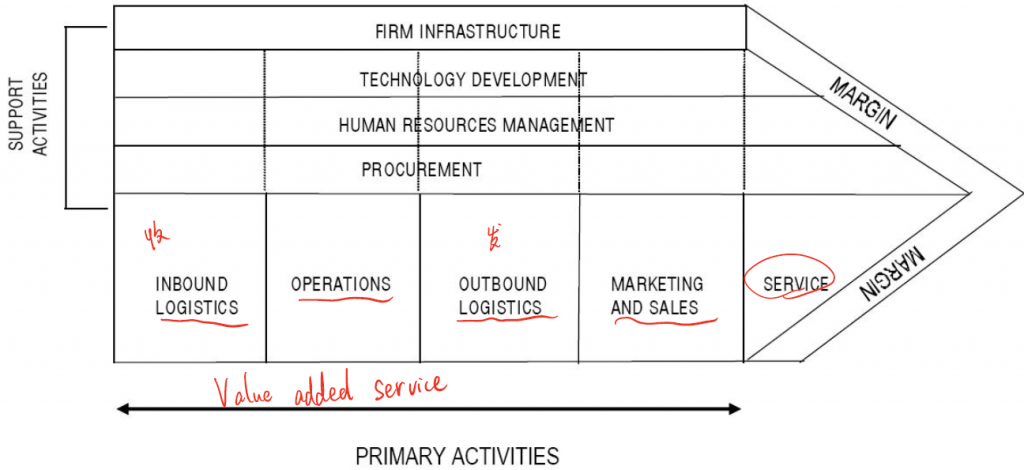

Value chain

PRIMARY

- Inbound logistics – receiving, storing and handling stocks of raw materials

- Operations – processing raw materials into finished goods

- Outbound logistics – storing finished goods and distributing them to customers

- Marketing and sales – the activities which make the buyer aware of the product (marketing) and also provide a means by which the buyer can purchase the product (sales).

- Service – after or during sales services separate from the product (eg warranties)

SUPPORT

- Procurement – purchasing function

- Human resources – all functions related to staff recruitment and development

- Technology development – management of IT and R&D functions

- Infrastructure – everything else! (eg senior managers and finance function)

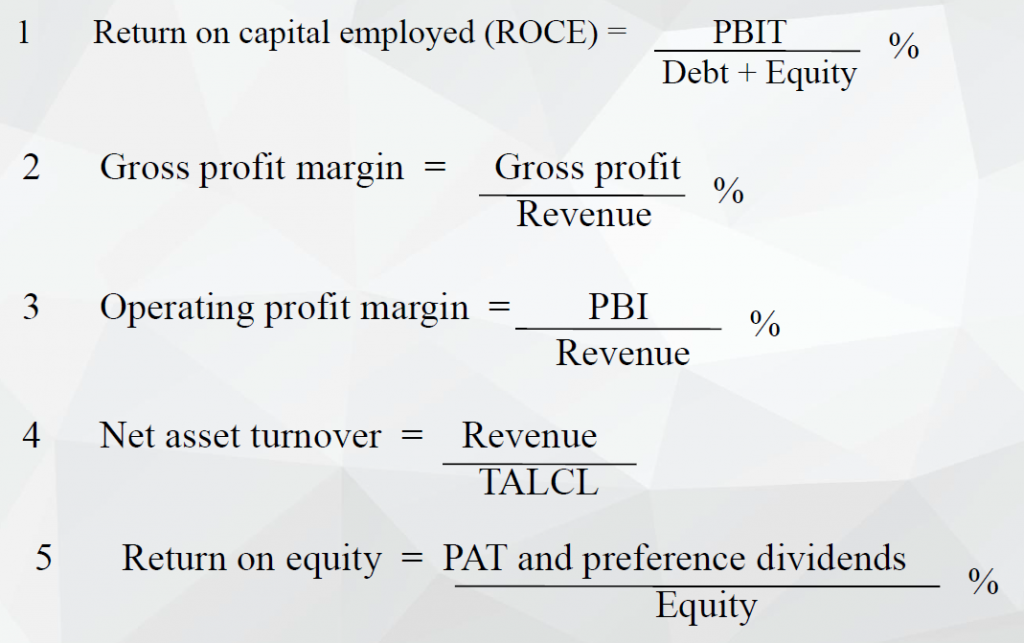

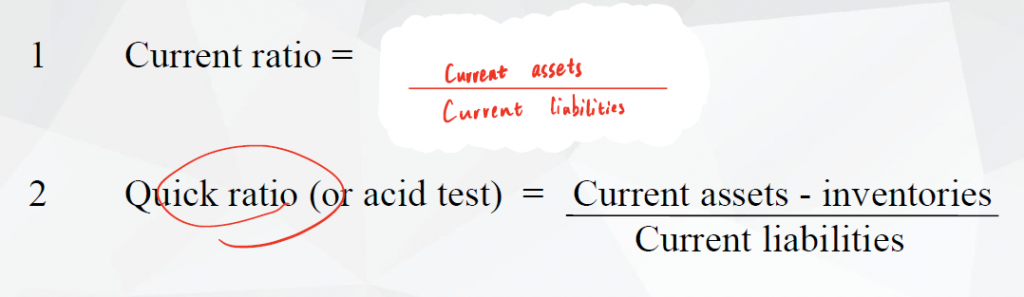

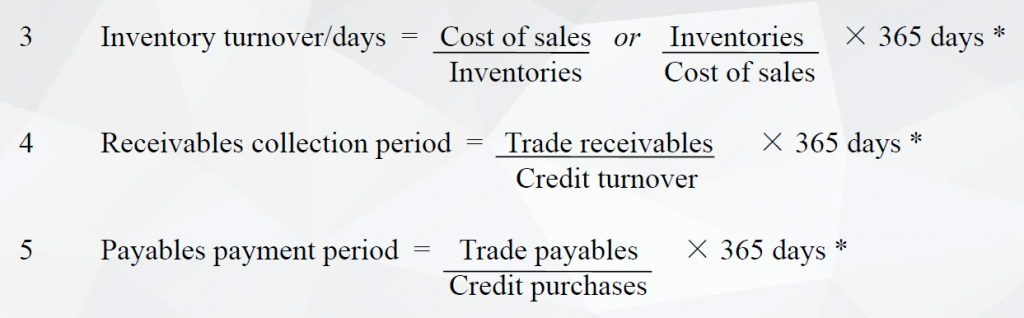

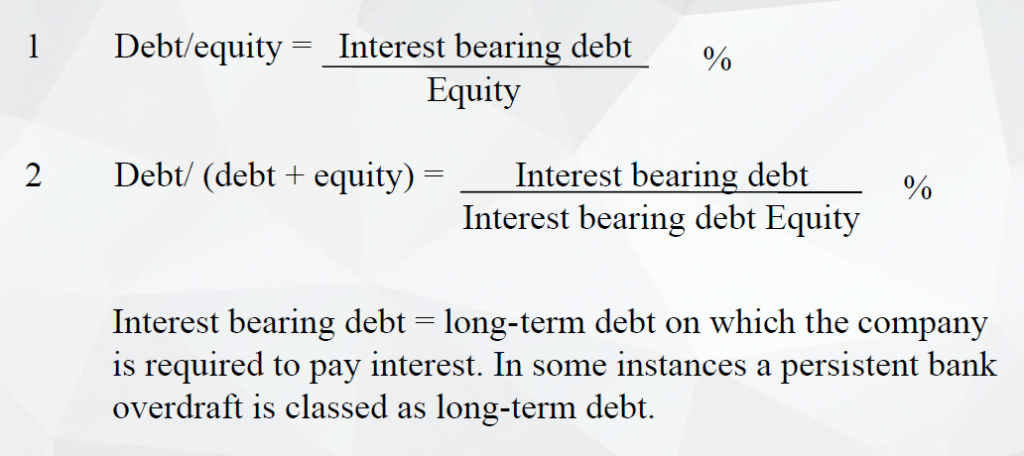

Ratios

Profitability

Liquidity

Gearing

Key performance indicators KPI

KPIs are the measurements used to monitor the achievements of the CSFs.

KPIs should be quantifiable, such that they can be compared to a standard or target.

KPI should not be given specific values. These specific values will be given in performance objectives which relate to defined timeframes. This allows the KPI to remain the same, but the performance objective can change.

Benchmarking

Benchmarking is where one organisation compares its performance in a specific area to another organisation, the benchmark, to identify how much room there is for improvement. It then attempts to implement improved practices to narrow the gap between its own performance and the performance of the benchmark.

- Internal – division against division

- Competitive – company against competitor

- Functional/Activity – single function against same function in a different industry

- Generic– similar process

Competitive benchmarking

- The competitor information is not available or that competitors use different measurement techniques.

- There is likely to be an absence of supporting information. A cannot be sure how B has actually achieved XXX. So it does not know what it needs to put in place to improve its XXX performance.

Functional benchmarking

- Non-competing organisations are more likely to share data than competitors

- With external functional benchmarking it is more likely that the comparator will not only share results, but also the process which has achieved these results.

- Different industry –> Effective? Usefulness?

The balanced scorecard

- Financial perspective: this considers whether an organisation is achieving its financial targets and meeting the needs of shareholders

- Customer perspective: this considers the organisation from a customer point of view to determine whether the organisation is meeting customer needs

- Innovation perspective: this considers whether the organisation is continuing to improve and develop

- Internal business process perspective: this considers whether the organisation’s processes are efficient as well as whether employees are satisfied and motivated

Baldrige performance excellence

- Leadership

- Strategy

- Customers

- Workforce

- Operations

- Results

- Measurements, analysis, and knowledge management

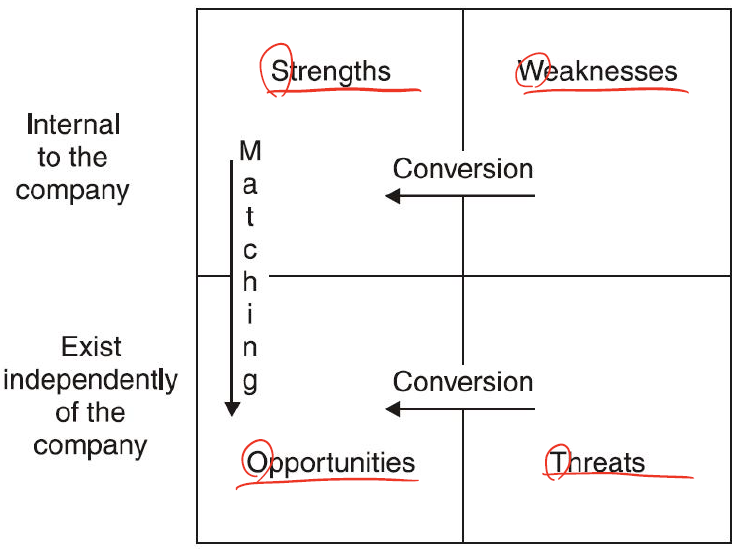

SWOT

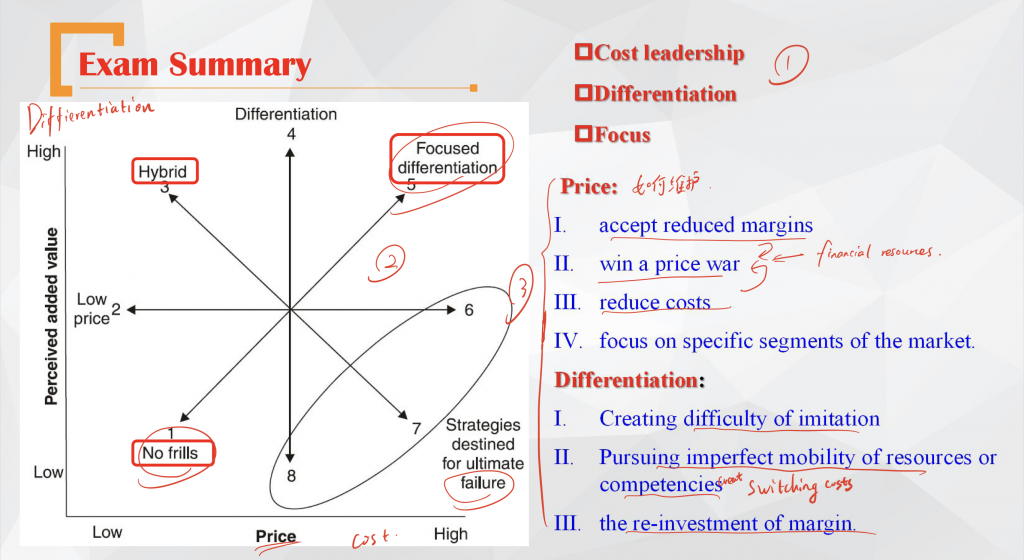

05 Strategic choice

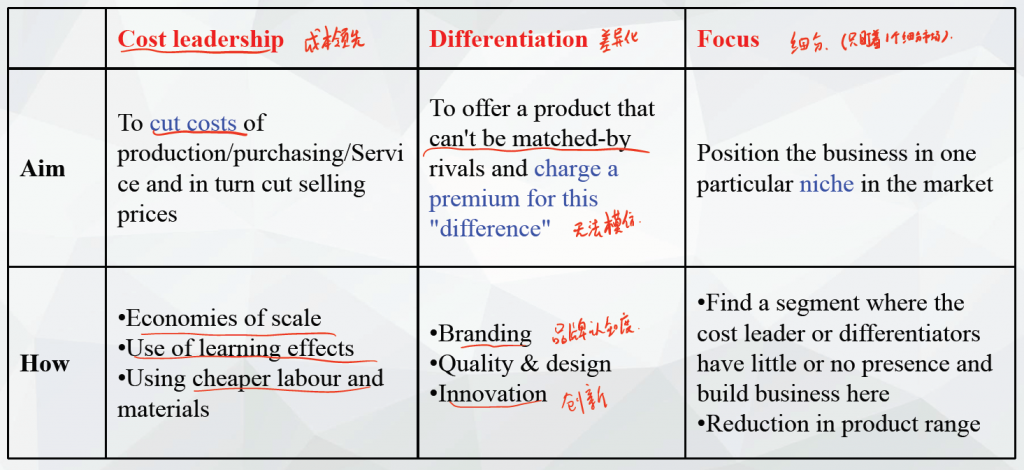

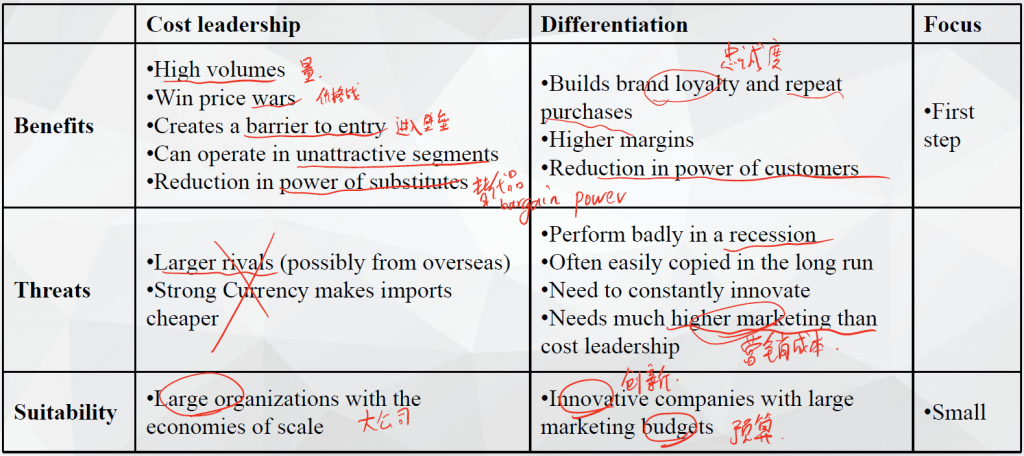

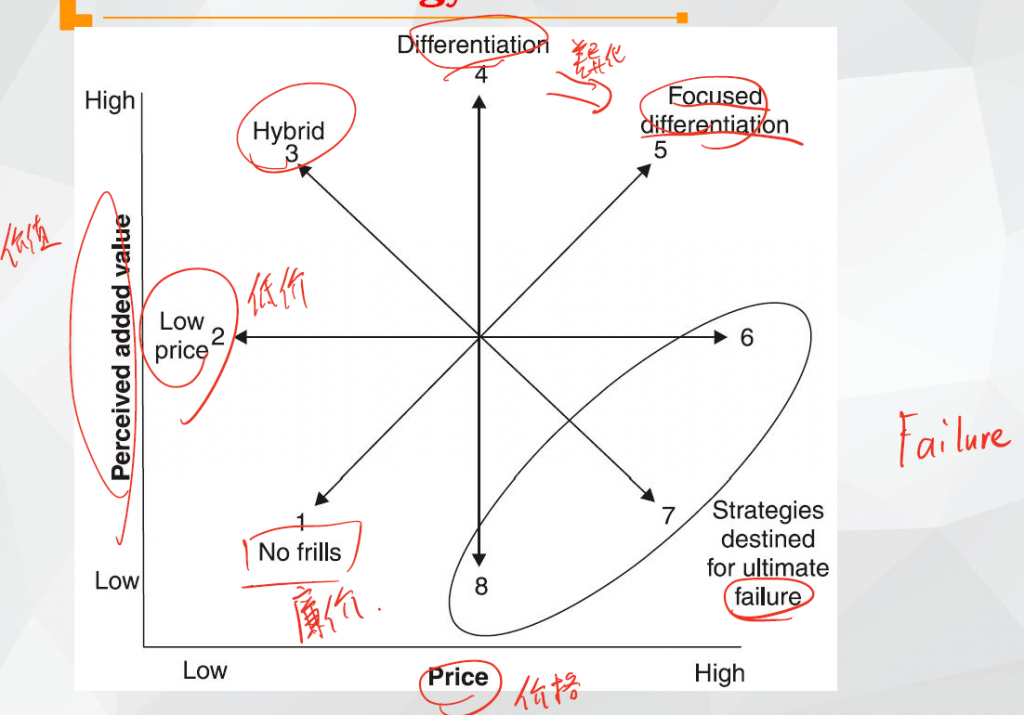

Competitive Strategy

- Generic strategy

- Cost leadership

- Differentiation

- Focus

- The Strategic Clock

- perceived products/services benefits

- price

- Sustainable competitive advantages

Generic strategy

The Strategic Clock

- (1) A no frills approach seeks to deliver the lowest possible price. It is most appropriate where customers are price-sensitive, switching costs are low and there is little opportunity to compete on product features.

- (2) A low price strategy seeks to provide a similar value of product or service to competitors, but at a lower price. This is relatively easy for competitors to copy, so will only be sustainable if the company has a cost advantage over its competitors for a given level of quality.

- (3) The hybrid approach attempts to simultaneously price lower than competitors while delivering enhanced value to customers. This may be achieved by producing higher volumes than competitors, or focusing very clearly on one aspect of added value or a particular market segment.

- (4) Differentiation is a strategy aiming to provide services which are different or unique in terms of value provided to customers. This may be based on factors such as product quality, marketing or innovation. Differentiation allows customers to earn a higher margin by charging higher prices, or gain market share by offering more value at the same price as competitors.

- (5) Focused differentiation means providing high perceived value to justify charging a significantly higher price than other products. This usually means targeting a specific market segment.

- (6), (7) & (8) which combine high price and low perceived value will most likely fail.

Sustainable competitive advantage

To generate long-term value, any advantage based on price or differentiation must be sustainable, meaning it is hard for others to copy or obtain (see also Unique Resources and Core Competences in before chapter).

To sustain a price-based strategy:

- Lowest cost base

- Greater financial resources & win a price war

- Willingness to accept lower margins, sell a more volume / cross-subsidise

- Focus on a price-conscious customer segment

To sustain a differentiation strategy

- Creating a difficulty of imitation

- Creating switching cost

- The re-investment of margin

Lock-in: Product becomes the industry standard and other products must be compatible with it.

Collaboration: Boundary-less organisations

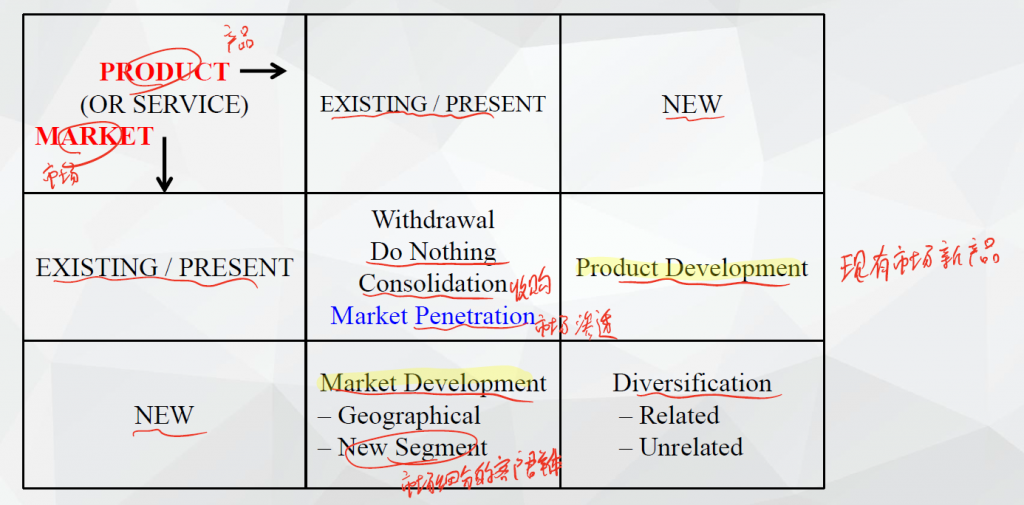

Ansoff’s matrix

Market Penetration

Market Penetration means increasing market share of existing products via promotions, price reductions.

Relatively low risk strategy

Market Development

Market Development means seeking new customers for existing products, e.g. exporting or selling via new distribution channels. Risk here is still reasonably low.

Product Development

Product Development is selling new products to existing customers (“cross-selling”). This is slightly riskier as it may involve investment in new products and its success may depend on the relationship a firm has with its customers.

Diversification

Diversification, selling new products to new customers, may offer significant growth potential but it is risky as it may require significant investment and new competencies.

Unrelated/conglomerate diversification

Vertical integration– this can take the form of forward or backward Integration

Horizontal diversification

Method of development

Internal development

Internal growth, sometimes called organic growth, takes place when the company grows by building on and developing its own existing competencies.

Familiar -This market knowledge is a core competence, creating and reinforcing competitive advantage.

A slower rate of change, associated with more gradual expenditure and sustainable growth, may also minimise disruption to other activities within the company.

Internal development – international expansion

However, international expansion is often very difficult to achieve with internal growth. This can be due to government restrictions.

Cultural differences also inhibit organic growth. The company will have little understanding of how business is done in the country, the expectations of stakeholders or the way that business transactions are agreed and executed.

Acquisition

An acquisition takes place when ownership is taken of another organisation.

A compelling reason to develop by acquisition is the speed of entry it apparently provides into a new product or geographical market.Rapid growth through acquisition may also offer immediate economies of scale.

Acquisition may provide an opportunity for an organisation to address a lack of resources or competencies in certain areas.

Internal development v.s. acquisition

The spread of cost may be easier to bear. Acquisitions usually require a major expenditure at a certain point in time.

Internal development avoids the political and cultural problems arising from post-acquisition integration.

Strategic alliances

Strategic alliances take place when two or more organisations share resources and activities to pursue a given strategy. Both companies seek to gain benefits through co-operation.

An alliance would be used to enter a new geographical market where an organisation needs local knowledge and expertise.

Strategic alliances – franchise

At the other end of the spectrum, MachineShop could consider a looser network arrangement where FRG would provide space in their stores for a MachineShop franchise to operate.

In return, FRG would receive a franchise fee which would help it improve its financial position, as well as it potentially benefiting from cross-purchases by customers attracted to the store by the MachineShop facility.

Such a loose arrangement could be put in place very quickly, compared to any formal joint venture, acquisition or organic expansion.

One of the main problems of strategic alliances is the ability of the initiator to find an appropriate partner.

There may also be a concern, at MachineShop, that once the partner understands the dynamics of the market, they will steal the idea and promote it as their own.

Strategic alliances – joint venture

A joint venture is an arrangement where a newly created organisation is jointly owned by the parents.

In this instance, a new company could be created in Ceeland with the local company providing labour, local expertise and countrywide knowledge.

MachineShop would provide the products, marketing

expertise and finance.

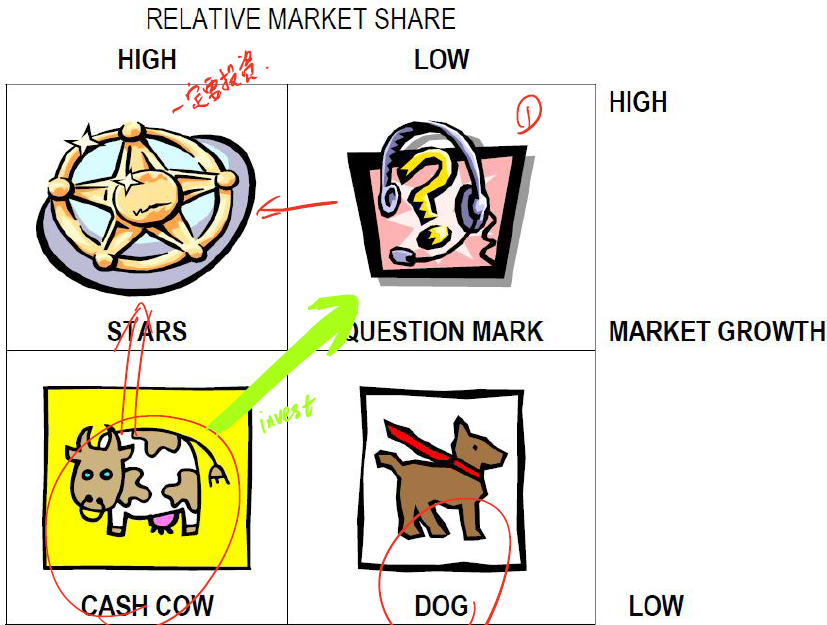

Portfolio analysis

SBU – Strategic business unit

Boston Consulting Group (BCG) matrix

The BCG matrix categorises SBUs in terms of market growth rate and relative market share. It assesses SBUs based on financial performance only and as such fits well with a portfolio manager approach.

Relative market share is measured by comparison with the largest competitor. High market share means that the SBU is the market leader, which will tend to lower costs per unit.

Question marks should be assessed to see whether they have the potential to become stars. If so, the parent should invest in them, if not, they should be sold or run down.

Stars offer good future returns so the parent needs to invest in and develop them. Due to the industry life cycle, stars will become cash cows in time.

Cash cows do not need much investment so will generate cash income. Parents can use this cash to invest in stars or simply provide a return to shareholders.

Dogs can tie up funds and provide a poor return. In general, they should be sold off / divest although may be retained if they are a useful niche business.

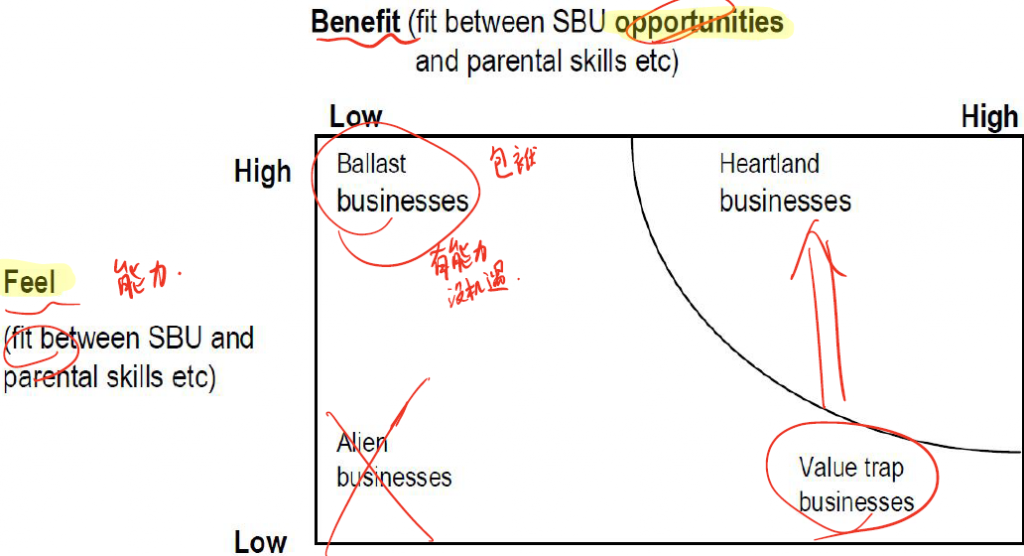

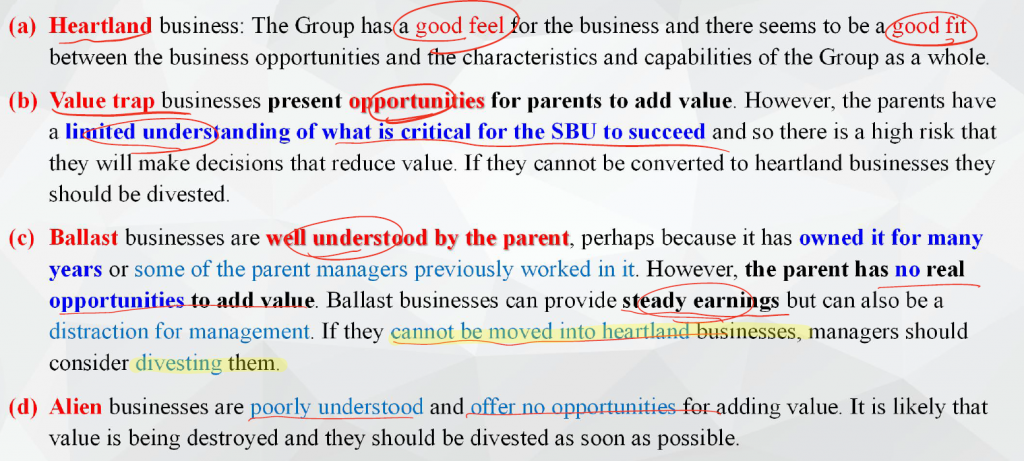

The Ashridge model

Feel / Ability to add value: The degree of fit between the parent’s skills and resources, and the CSFs of the SBU. This means how well the parent understands what the SBU must do well to succeed.

Benefit / Opportunity to add value: The degree of fit between the parent’s skills and resources and the SBU opportunities.

Public sector portfolio matrix

Evaluating strategies

Suitability is concerned with whether a strategy addresses the circumstances in which an organisations is operating, the strategic position.

Acceptability is concerned with the expected outcomes of a strategy. These can be seen in context of stakeholder reactions, risk and returns.

Feasibility is concerned with whether an organisation has the resources and competencies to deliver a strategy.

07 Governance

Agency theory

Agency relationship

Any agency relationship involves two parties: a principal and an agent. The agent is accountable to the principal. The relationship arises from the separation of management and ownership in public companies (and in other situations in society).

An agency relationship is one of trust between an agent and a principal which obliges the agent to meet the objectives placed upon it by the principal.

Fiduciary duty

Fiduciary duty is a duty of care and trust which one person or entity owes to another. It can be a legal or ethical obligation.

The agency problem

This separation of ownership from management can cause issues if there is a breach of trust by directors by intentional action, omission, neglect or incompetence.

This breach may arise because the directors are pursuing their own interests rather than the shareholders’ or because they have different attitudes to risk-taking to the shareholders.

The agency problem – solution

One power that shareholders possess is the right to remove the directors from office. But shareholders have to take the initiative to do this, and in many companies, the shareholders lack the energy and organisation to take such a step. Ultimately they can vote in favour of a takeover or removal of individual directors or entire boards, but this may be undesirable for other reasons.

To alleviate the agency problem, shareholders have to take steps to exercise control, such as attending AGMs or ultimately becoming directors themselves. However agency theory assumes that it will be expensive and difficult to:

• Verify what the agent is doing, partly because the agent has

more available information about his activities than the

principal does.

• Introduce mechanisms to control the activities of the agent.

Corporate governance

Corporate governance is a set of relationships between a company’s directors, its shareholders and other stakeholders. It also provides the structure through which the objectives of the company are set, and the means of achieving those objectives and monitoring performance, are determined.

Agency costs

The principals therefore incur agency costs, which are the costs of the monitoring that is required because of the separation of ownership and management.

Core principle

Transparency

Transparency means open and clear disclosure of relevant information to shareholders and other stakeholders, also not concealing information when it may affect decisions. It means open discussions and a default position of information provision rather than concealment.

It also includes all voluntary disclosure that is disclosure above the minimum required by law or regulation.

The main reason why transparency is so important relates to the agency problem that the potential conflict between owners and managers. Without effective disclosure the position could be unfairly weighted towards managers, since they have far more knowledge of the company’s activities and financial situation than owner/investors. (information asymmetry)

Publication of relevant and reliable information reassures investors and underpins stock market confidence in how companies are being governed and thus significantly influences market prices.

Accountability

Accountability is a key relationship between two or more parties. It implies that one party is accountable to, or answerable to, another. This means that the accountable entity can reasonably be called upon to explain his, her or its actions and policies.

This has the potential to influence the behaviour of the accountable party, because of the knowledge that they will have to answer for it when they give that account.

Reputation

Reputation is determined by how others view a person, organisation or profession. Reputation includes a reputation for competence, supplying good quality goods and services in a timely fashion, and also being managed in an orderly way.

Company boards must enjoy the full confidence of several important stakeholders in order to enjoy full access to resource and product markets. A poor reputation can quickly affect a company’s ability to, for example, attract high quality employees, sell its products or attract capital.

Integrity

Integrity means straightforward dealing and completeness. What is required of financial reporting is that it should be honest and that it should present a balanced picture of the state of the company’s affairs. The integrity of reports depends on the integrity of those who prepare and present them.

Probity/honesty

Hopefully this should be the most self-evident of the principles. It relates not only to telling the truth, but also not misleading shareholders and other stakeholders.

Independence

Independence is the avoidance of being unduly influenced by vested interests and being free from any constraints that would prevent a correct course of action being taken.

managerial capture, uncontaminated decision

Judgement

Judgement means that the board making decisions that enhance the prosperity of the organisation. This means that board members must acquire a broad enough knowledge of the business and its environment to be able to provide meaningful direction to it.

The decision-makers’ personal attitudes to risk, ethics and the timescale of likely returns are likely to be important factors in how a person judges a given decision.

Fairness

The directors’ deliberations and also the systems and values that underlie the company must be balanced by taking into account everyone who has a legitimate interest in the company, and respecting their rights and views. (考虑其他 stakeholder 利益)

Innovation

The needs of businesses and stakeholders can change over time.

Scepticism

The UK Corporate Governance Code encourages non-executive directors (NEDs) to adopt an air of scepticism so that they can effectively challenge management decisions in their role of scrutiny.

A healthy corporate culture and environment is one that encourages and enables such scepticism to thrive.

Responsibility

There must be a system in place that allows for corrective action. Responsible management should do, when necessary, whatever it takes to set the company on the right path. 纠偏

Rules-based approach 一定会写

In a rules-based approach to corporate governance, provisions are made in law and a breach of any applicable provision is therefore a legal offence.

This means that companies become legally accountable for compliance and are liable for prosecution in law for failing to comply with the detail of a corporate governance code or other provision.

Principles-based approach 一定会写

When, for whatever reason, a company is unable to comply in detail with every provision of a code, the listing rules state that the company must explain, usually in its annual report, exactly where it fails to comply and the reason why it is unable to comply. The shareholders, and not the law, then judge for themselves the seriousness of the breach.

Comply or explain

Comply or explain is intended to allow latitude in compliance with details of corporate governance provision, but is not ‘optional’ in the usual meaning of the term. Listing rules insist on compliance with codes in many countries with ‘comply or explain’ allowed when compliance with detail is not possible or desirable, usually in the short to medium term.

If the shareholders are not satisfied with the explanation for lack of compliance, they can punish the board by several means including holding them directly accountable at general meetings, by selling shares (thereby reducing the value of the company) or by direct intervention if a large enough shareholder.

It enables the policing of compliance by those who own the entity and have a stronger vested interest in compliance than state regulators who monitor compliance in a legal sense. This places the responsibility for compliance upon the investors who are collectively the legal owners of the company.

‘Comply or explain’ statement

- Level of compliance (specify)

- Exactly (details)

- Why

- Resolutions

Principles or rules – For & Against 一定会写

Pros of principles

- Less costly (expense of compliance)

- Flexible (industries with different levels of risk)

- Transitional

Cons of principles

- Confusion over rules

- Investor misunderstanding (capable of understanding?)

- Consistency and full compliance

08 Stakeholder Theory

Stakeholder

Stakeholders are any entity (person, group or possibly non-human entity) that can affect or be affected by the achievements of an organisation’s objectives. It is a bi-directional relationship.

Stakeholder claim 背

Stakeholder claims mean the demands that stakeholder interests make upon organisations, based on the view that the impact of companies is so great that they have responsibilities to different sections of society, not just to shareholders.

Management has to decide on the legitimacy and relative strength of different stakeholder claims.

Roles of stakeholders

Employees

员工的诉求: pay, working condition, career path, information requirement

Trade unions

- protect employee interests, help employees to satisfy their claims (depend on the percentage of union members)

- poor CG, whistleblowers

- lax control and risk environment (health and safety)

- balance the directors’ abuses

Suppliers

Bargaining power: material costs & quality

They will need to rely on suppliers for reliability of delivery. If the relationship with suppliers deteriorates because of a poor payment record, suppliers can limit or withdraw credit and charge higher rates of interest. They can also reduce their level of service, or even switch to supplying competitors.

Customers

- Customers have increasingly high expectations of the goods and services they buy. These include not just low costs, but value for money, quality and service support.

- Deep moral needs

- With increasingly competitive markets, consumers are able to exercise increasing levels of power over companies.

- Dissatisfied customers are more likely to make their views known than satisfied customers. Moreover businesses now believe that normally the costs of retaining existing customers are significantly less than those of obtaining new customers.

Regulators

Regulation can be defined as any form of interference with the operation of the free market.

Ensure confidence in information

Actively promoting competition

Social implication: quality and safety issues

Classifications of stakeholders

Internal, Connected & External ICE

proximity, 距离

Employees and management are not external stakeholders.

Legitimate & Illegitimate

valid claims

How the legitimacy of each stakeholder’s claim is viewed may well depend on the ethical and political perspective of the person judging it.

Direct & Indirect

- Those who know they can affect or are affected by the organisation’s activities

- unaware of the claims, or cannot express their claim directly (无声的)

Although they cannot express their claim directly to the organisation, this does not necessarily invalidate their claim.

Known & Unknown

existence is known, unknown

Recognised & Unrecognised

- managers consider when deciding upon strategy

- aren’t taken into account

Narrow & Wide

- SH most affected by the organisation’s policies

- less affected

The degree of impacts on stakeholders

Primary & Secondary

- without whose participation

- loss of participation won’t affect

The degree of the stakeholders’ impacts on company

Voluntary & Involuntary

- Voluntary stakeholders are those that engage with an organisation of their own choice and free will. They are ultimately (in the long term) able to detach and discontinue their stakeholding if they choose.

- Involuntary stakeholders have their stakeholding imposed and are unable to detach or withdraw of their own volition.

Active & Passive

- seek to participate

- do not seek to participate

whether the stakeholder actively participate

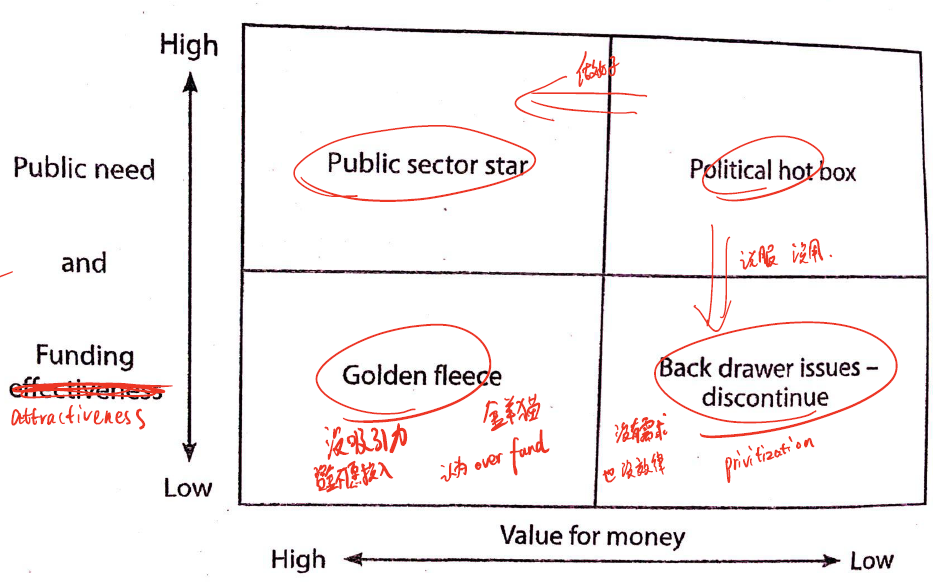

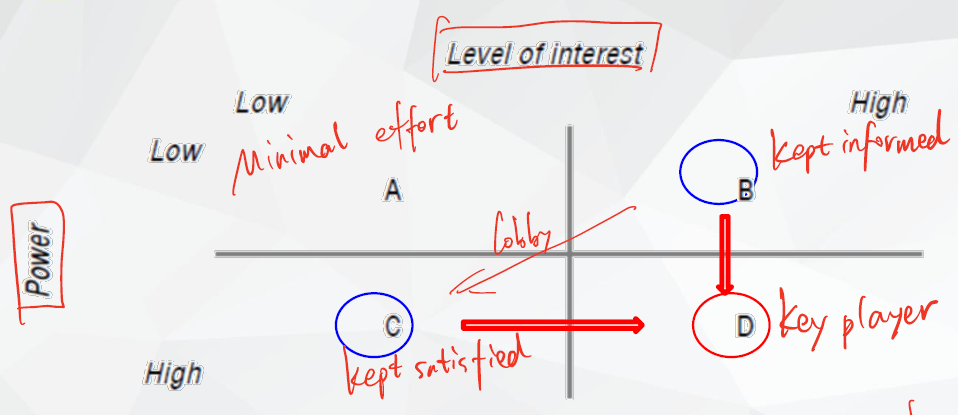

Assessing the relative importance of stakeholder interests

Mendelow

The Mendelow framework is a way of mapping stakeholders with regard to the two variables of interest and power. The combination of these is a measure of any given stakeholder’s likely influence over an entity.

The framework is dynamic in that stakeholders move around the map as their power and interest rise and fall with events.

- A: Minimal effort

- B: Kept informed do not have great ability to influence strategy, but their views can be important in influencing more powerful stakeholders, perhaps by lobbying. Eg. pressure group

- C: Kept satisfied must be treated with care. They are capable of moving to segment D. eg Large institutional shareholders

- D: Key players. The organisation’s strategy must be acceptable to them, eg major customer

Analysis focus

- WB’s power derives from its ability to conduct research and mobilise opinion, including among policymakers and trade organisations, against businesses like Hayho.

- WB has a variable degree of interest. It was news of our possible investment in Jayland that increased WB’s interest in Hayho.

- This, combined with its evident power, increases its net influence over Hayho. This makes WB difficult to ignore in our decision over whether to invest in Jayland or Pealand.

Importance of recognition of all of stakeholder claims

- Stakeholder recognition is necessary to gain an understanding of the sources of potential risk and disruption. (知道风险来源)

- Stakeholder recognition is important in terms of assessing the sources of influence. Stakeholder influence is assessed in terms of each stakeholder’s power and interest, with higher power and higher interest combining to generate the highest influence.

- Stakeholder recognition is necessary in order to identify potential areas of conflict and tension between stakeholders. ( 知道不同SH之间冲突点在哪里 )

- There is an ethical and reputational case for knowledge of how decisions affect stakeholders, both inside the organisation or external to it.

Stakeholder theory – Instrumental view (狭义)

A business does not have any moral standpoint of its own. It merely reflects whatever the concerns are of the stakeholders it cannot afford to upset, such as customers looking for green companies or talented employees looking for pleasant working environments.

Stakeholder theory – Normative view (广义)

moral, ethical

Assessment of the claims

对比与分类 , contestable

Tucker’s 5-question model

- Profitable?

- Legal?

- Fair and equitable? (How the legitimate and reasonable claim of … is weighted the claim of …)

- Right, which is prone to subjective judgement? (Depends upon the ethical perspective If/If)

- Sustainable or environmentally sound?

Corporate social responsibility

- Corporate social responsibility is a concept whereby organisations consider the interests of society by taking responsibility for the impact of their activities on wider stakeholders.

- This obligation can be seen to extend beyond statutory obligations to comply with legislation.

Carroll

- Economic

- Legal

- Ethical

- Philanthropic

Ethical stances

- An organisation’s ethical stance relates to how it views its responsibilities to shareholders, stakeholders, society and the environment.

- An organisation’s ethical stance is defined by Johnson and Scholes as the extent to which it will exceed its minimum obligation to stakeholders.

Social responsibility stances

- Pristine capitalists 原始资本主义 只谈钱

- The private property system is the best system, companies exist to maximise profits and seek economic efficiency. Businesses therefore have no moral responsibilities beyond their obligations to shareholders and creditors.

- Expedients 均衡理论 Long-term interests

- Economic systems do generate some excesses, therefore businesses have to accept some (limited) social legislation and moral requirements if such behaviour is in the business’s economic interests.

- Proponents of the social contract (Default position)

- Organisations should behave in a way broadly in conformance with the ethical norms in society because there is effectively a contract or agreement between the organisations in power and those who are affected by the exercise of this power.

- A business effectively enjoys a licence to operate. However this licence will only continue to be granted by society if the business’s actions deserve it. A business may therefore have to deliver benefits (or avoid causing harm) to society in general. It may also be responsible for delivering benefits to the specific groups from whom it derives its power (such as customers or employees).

- Social ecologists 生态主义者

- Businesses leave a social and environmental footprint. In particular, problems exist with the human environment that large organisations have created and need to eradicate. Economic processes that result in resource exhaustion, waste and pollution must be modified. Organisations must adopt socially responsible positions accordingly. This may involve going beyond what is required or regarded as desirable by society.

- Deep ecologists 激进生态主义

- Human beings have no greater rights to resources or life than other species and do not have the rights to subjugate social and environmental systems. Economic systems that trade off threats to the existence of species against economic objectives are immoral.

Corporate citizenship

- Corporate citizenship is the business strategy that shapes the values underpinning a company’s mission and the choices made each day by its executives, managers and employees as they engage with society.

- Three core principles define the essence of corporate citizenship, and every company should apply them in a manner appropriate to its distinct needs: minimizing harm, maximizing benefit, and being accountable and responsive to stakeholders.

- Discussion of corporate citizenship also often has political undertones, with corporations acting instead of governments that cannot – or will not – act to deal effectively with problems. (Government failure)

- Commentators have also pointed to liberalisation, deregulation and privatisation placing more power in the hands of corporations and less in the hands of the state.

- Right & obligation

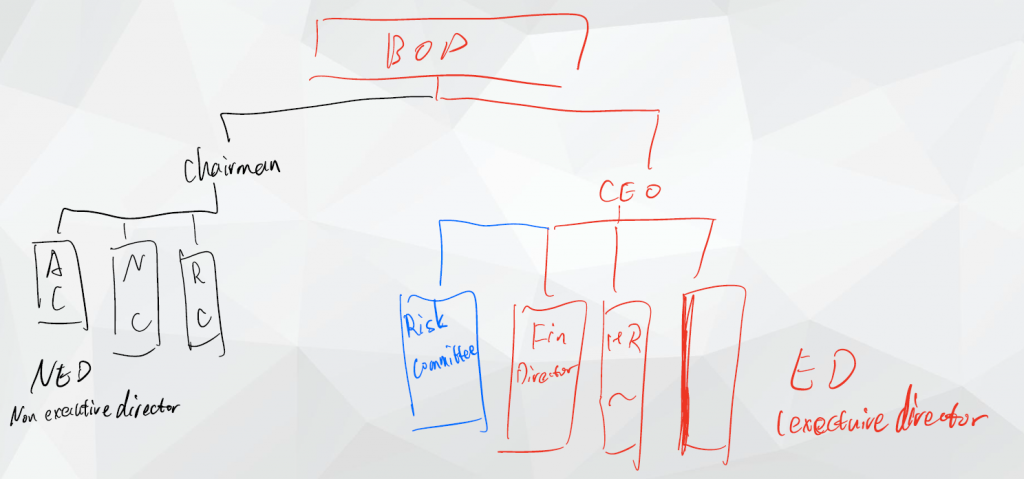

09 Board of director

Board membership and roles

- Size – the balance needs to be struck between the benefits of having varied views and opinions, alongside the need for coherence of decision-making.

- Inside/outside mix – the split between executive decision-making directors and non-executive directors. Independent non-executive directors have a key role in governance. Their number and status should mean that their views carry significant weight.

- Diversity mix in terms of gender, ethnicity, backgrounds, experience, etc.

Roles of a nominations committee 3

- Mix

The first role is to establish the appropriate balance between executive and non-executive directors (NEDs). In some countries, this is influenced by regulation. In the UK, the UK corporate governance code specifies that a half of the whole board should be NEDs. - 确保 skill knowledge

The second role is to ensure that the board contains the requisite skills, knowledge and experience to effectively lead the company and provide leadership. Any identified gaps in these requirements should be filled by new appointments. - 继承计划 succession

Third, the nominations committee is concerned with the continuity of required skills, the retention of directors and succession planning. - Size

Fourth, it is responsible for determining the most desirable board size given the skill needs, cost constraints and strategies of the company. - Diversity

Finally, the committee is likely to be concerned with issues of diversity and to ensure that the company’s board is adequately representative of the society in which it operates.

How to recruit a director

- personal recommendations, network of people with similar interests, 关系网络

- search companies and consultancies, human hunter

- advertise for suitable persons, 打广告

Advantages of diversity

- Wider pool of talent: wider range of skills, abilities and competences are

available. - A wider range of views and opinions to be expressed: contrary and challenging voices available

- (NFP) More representative of the community, increase its social legitimacy and enjoy a stronger social contract with its community

- (NFP) Meet the local government requirements

Director’s induction programme

- 了解企业 culture

To convey to the new starter, the organisation’s norms, values and culture. This is especially important when the new employee is from a different type of culture. - 公司 policy structure

Company policies: place in the structure, reporting line - 公司究竟做啥

To convey an understanding of the nature of the company, its operations, strategy, key stakeholders and external relationships. - 发展新同事关系

To establish and develop the new director’s relationships with colleagues, especially those with whom he or she will interact on a regular basis.

Continuing Professional Development CPD

- The first advantage of CPD for Sonja Tan is to maintain and update the currency of her skills and knowledge.

- CPD can also broaden Sonja’s skills. By learning about more general management and management control issues, such as internal controls, she is developing skills alongside her accounting expertise.

- Profession

Criteria for individual performance measurement

- Independence – free thinking, avoids conflicts of interest

- Preparedness – knows key staff, organisation and industry

- Committee work – understands process of committee work, exhibits ideas and enthusiasm

- Development of the organisation – makes suggestions on innovation, strategic direction and planning, helps win the support of outside stakeholders

Leaving office

Retirement by rotation

be limited to a specific period (typically three years)

It reduces the cost of contract termination and encourages directors’ performance.

Other means

- Resigning

- Not offering himself/herself for re-election Death in service

- Death in service

- Death in service

- An ‘agreed departure’

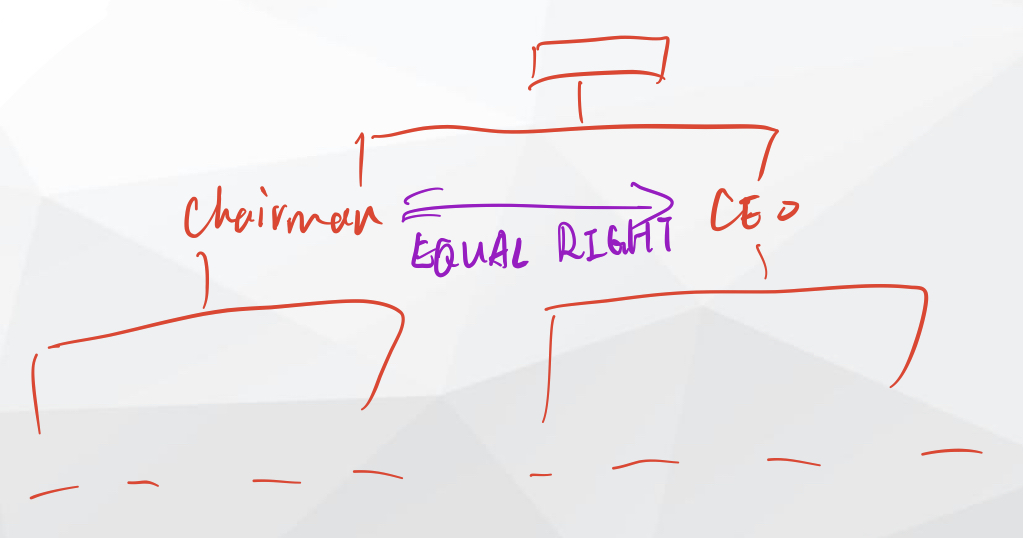

Chairman and CEO

Roles of the chairman

Leader of the board of directors

- Ensuring the board’s effectiveness as a unit: setting the board’s agenda and ensuring that board meetings take place on a regular basis

- Represents the company to investors: communication with shareholders, eg AGM

- Ensure that directors receive relevant information

- Co-ordinating the contributions of NEDs

Division of responsibilities

- Frees up the chief executive to fully concentrate on the management of the organization

- Represent shareholders’ interests

- Reduces the risk of a conflict of interest: performance reporting

- Unfettered powers: excessive secrecy or lack of transparency and accountability

Role of CEO

- Lead the company and to protect shareholder interests above all others

- Develop and implement policies and strategies capable of delivering superior shareholder value

- Manage the financial and physical resources of the company, monitor results, and ensure that effective operational and risk controls are in place

- Oversee the management team, co-ordinate the interface between the board and the other employees in the company

Importance of the chairman’s statement

Convey important messages to shareholders

Offers the chairman the opportunity to inform shareholders

This independent communication is an important part of the separation of the roles of CEO and chairman.

NED

- Non-executive directors have no executive (managerial) responsibilities.

- Non-executive directors should provide a balancing influence, and play a key role in reducing conflicts of interest between management (including executive directors) and shareholders. They should provide reassurance to shareholders, particularly institutional shareholders, that management is acting in the interests of the organisation.

Roles of non-executive directors

NED 4个职责

战略,监督,风险,people

- In the strategy role, NEDs may challenge any aspect of strategy they see fit and offer advice or input to help to develop successful strategy.

- The scrutinising or performance role is where the NEDs’ independence is perhaps the most important. NEDs are required to hold executive colleagues to account for decisions taken and company performance. In this respect, they are required to represent the shareholders’ interests against any vested interests or short-term executive pressures.

- The risk role involves NEDs ensuring the company has an adequate system of internal controls and systems of risk management in place.

- Finally, in the people role, NEDs oversee a range of responsibilities with regard to the management of the executive members of the board. This typically involves issues concerning appointments and remuneration, but might also involve contractual or disciplinary issues, and succession planning.

Number of non–executive directors

Majority, more than half the board

Cross-directorships

This is where an executive director of Company A is a non-executive director of Company B, and an executive director of Company B is a nonexecutive director of Company A.

Independence of NED

Definition of independence

- Independence is a quality possessed by individuals and refers to the avoidance of being unduly influenced by a vested interest. This freedom enables a more objective position to be taken on issues compared to those who consider vested interests or other loyalties.

- Independence can be threatened by over-familiarity with the executive board, which is why many corporate governance codes have measures in place to prevent this. These include restrictions on share option schemes for NEDs, time-limited appointments and bans on cross-directorships.

NED source / background

- Outside the industry: more independent

- Other companies within the same sector: provide industry knowledge

- Succession to an NED from ED: threaten independence

Benefits of greater independence

- Less likely to have prior vested interests

- Fewer prejudices for or against certain policies or individuals

- More likely to challenge the established beliefs, scrutinising

Disadvantages of greater independence

- Strategic advice

- Retired executive directors: their experience of that industry and company to bear on committee discussions

Directors’ remuneration

Components of rewards

- The basic salary is not linked to performance. meet market rate

- A number of benefits in kind

- Pension contributions

- Performance-related component: short-term or long-term (share option)

Purposes of directors’ remuneration

- Clearly adequate remuneration has to be paid to directors in order to attract and retain individuals of sufficient calibre.

- Remuneration packages should be structured to ensure that individuals are motivated to achieve performance levels that are in the company and shareholders’ best interests as well as their own personal interests.

Remuneration policy

- Directors’ remuneration should be set by independent members of the board.

- Any form of bonus should be related to measurable performance or enhanced shareholder value. 【Align their interests with those of shareholders】

- There should be full transparency of directors’ remuneration, including pension rights, in the annual accounts.

- The pay scales applied to each director’s package.

- The proportion of the different types of reward within each package.

- The period within which performance related elements become payable.

Roles of a remunerations committee

- Determine remuneration policy: scale, proportion, period

- Ensure fairly but responsibly rewarded

- Report to shareholders.

NED’s remuneration

- The main reason why NEDs are usually not allowed to receive share options or other performance-related elements as part of their reward packages (as Sam South asked) is because it could threaten their independence and hence their usefulness to the company’s shareholders.

- In order to be effective in their roles, NEDs need to be motivated in different ways to their executive colleagues and too much similarity can mean that the scrutiny role is weakened.

- Because non-executives comprise the remuneration committee, it would be inappropriate for them to decide on their own rewards. It would be an abuse of the responsibility. It is usual for NEDs to be paid a fair rate based on external comparison figures.

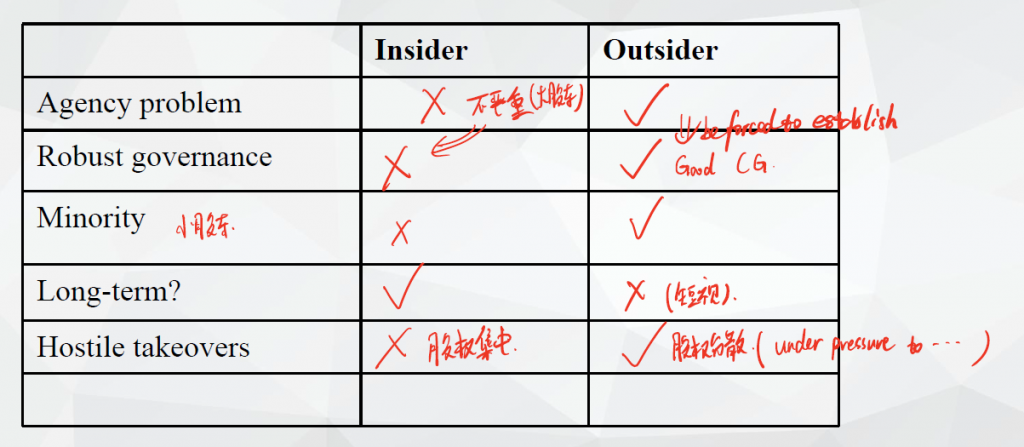

Influence of ownership

Insider or Outsider

- Insider: Company is owned and controlled by a small number of major shareholders. Agency is not really an issue.

- Outsider: Shareholding is more widely dispersed, and there is the manager-ownership separation.

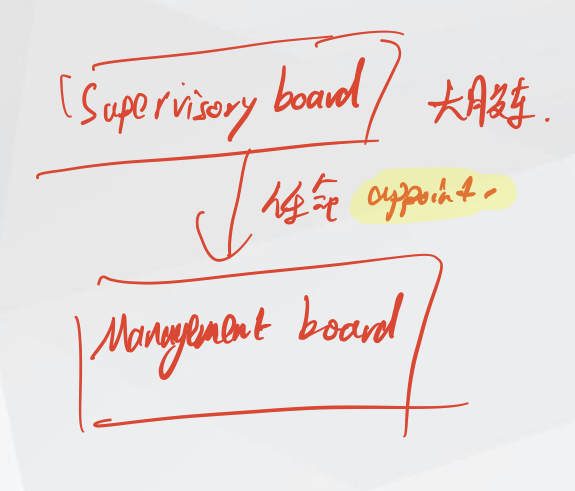

Unitary & Multi-tier

Unitary: All directors are of equal ‘rank’, share the collective responsibility

Multi-tire: The supervisory board appoints the management board.

Family v.s. Listed

- Formal governance

- Agency issues

- Highly regulated, eg committee structure, ensure transparency, stronger accountability, additional reporting requirements.

10 Risk

Internal control system

Purposes of control systems

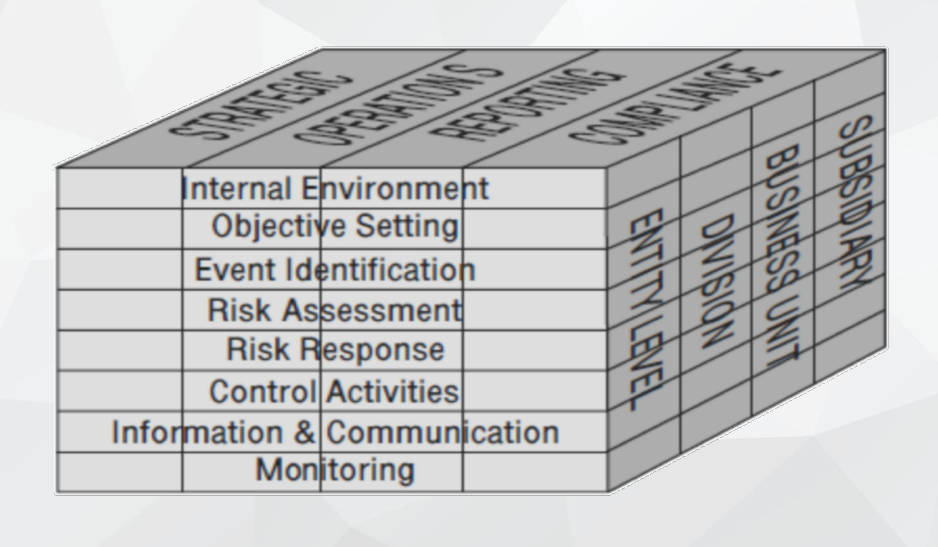

经营,报告,合规。

- Facilitate its effective and efficient operation by enabling it to respond appropriately to significant business, operational, financial, compliance and other risks to achieving the company’s objectives.

This includes the safeguarding of assets from inappropriate use or from loss and fraud and ensuring that liabilities are identified and managed. - Help ensure the quality of internal and external reporting. This requires the maintenance of proper records and processes that generate a flow of timely, relevant and reliable information from within and without the organisation.

- Help ensure compliance with applicable laws and regulations, and also with internal policies with respect to the conduct of businesses.

Characteristics of internal control systems

好的内控3个特点

- 嵌入经营中,形成文化一部分。

- 迅速应对演化风险。

- Reporting channel, 保护 whistleblower

- Be embedded in the operations of the company any form part of its culture.

- Be capable of responding quickly to evolving risks within the business.

- Include procedures for reporting immediately to management significant control failings and weaknesses together with control action being taken (whistleblower provision).

Typical reasons – Ineffective internal controls

5个内控失效原因

- Costs outweighing benefits. This is when an IC system provides more assurance than is needed (i.e. the control is over-specified). In such a situation, the control will not be supported or trusted by those working alongside or within the control, and this will reduce its effectiveness.

- Failures in human judgement when assessing a control, or fraud in measuring or reporting a control. Where a control relies upon human measurement, error is always a possibility either through lack of training, incompetence, wilful negligence or having a vested interest in control failure.

- Collusion between employees, perhaps with a vested interest in misapplying or circumventing a control. The risk of this is greater when two or more people believe they may gain by it.

- Non-routine or unforeseen events can render controls ineffective if they are intended to monitor a specific process only. Most internal controls are unable to cope with extraordinary events and so need to be adapted or circumvented when such events occur.

- Previous or existing controls can become obsolete because they are not updated to meet changed conditions. Changes to key risks, for example, need to modified if they are to continue to remain effective in controlling the risk.

Mix of controls

Strategic internal controls

- Internal controls can be at the strategic or operational level. At the strategic level, controls are aimed at ensuring that the organisation ‘does the right things’; at the operational level, controls are aimed at ensuring that the organisation ‘does things right’.

Internal control deficiencies

- Policy: prevent or detect

- Less scrutiny

- Reporting channel / requirement

- Opportunity

- Separation of duty

- Collusion / complicity

Motive / Opportunity / Dishonesty

Risk concept

Risk is a condition in which there exists a quantifiable dispersion in the possible results of any activity.

- Fundamental risks: beyond the control of any one individual

- Particular risks: an individual may have some measure of control

- Speculative risks: either good or harm 投机风险

- Pure risks: only possible outcome is harmful

Strategic and operational risks

Strategic risks: These arise from the overall strategic positioning of the company in its environment. Strategic issues typically affect the whole of an organisation and not just one or more of its parts. They are managed at board level in an organisation.

Operational risks: Operational risks refer to potential losses arising from the normal business operations. Accordingly, they affect the day-to-day running of operations and business systems. Operational risks are managed at management level (not necessarily board level).

Related and correlated risks

- Related risks are risks that vary because of the presence of another risk or where two risks have a common cause. This means when one risk increases, it has an effect on another risk and it is said that the two are related.

- Risk correlation is a particular example of related risk. Risks are positively correlated if the two risks are positively related in that one will fall with the reduction of the other, and increase with the rise of the other. They would be negatively correlated if one rose as the other fell.

Risk appetite

Risk appetite describes the willingness of an entity to become exposed to an unrealised loss (risk). Two preferences: risk aversion and risk seeking.

Both preferences are associated with different levels of returns: those that are risk-seeking favour higher risks and higher returns with the converse being true for the risk averse.

COSO’s framework

Organisational culture

Organisational culture has been defined as “a pattern of shared basic assumptions…considered valid and transmitted to new members” (Schein). It has also been described as “the way we do things round here”.

An organisation’s culture may be influenced by:

- The culture of the nation or area in which it operates

- The founder or founders

- Its history

- Style of leadership and management

- Structure

Successful organisations generally align their culture with their critical success factors and core competencies as closely as possible.

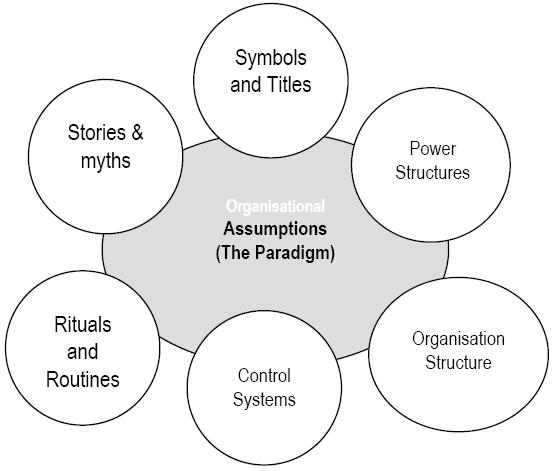

The cultural web

Definition Sources Impacts

Stories are told by employees in an organisation. These often concern events from the history of the organisation and highlight significant issues and personalities.

Symbols include logos, offices, cars, titles and the type of language and terminology commonly used within the organisation.

Routines and rituals concern the ‘way we do things around here’.

The control systems of the organisation include measurement and reward systems.

Organisation structure – this will determine formal and informal relationships and what is important, for example a hierarchical structure suggest a ‘top down’ approach.

Power structures – people holding power in the organisation. This may not just be based on seniority, e.g. in professional firms technical experts may hold significant power.

Paradigm – the shared assumptions of the organisation

Control environment

The internal or control environment is influenced by management’s attitude towards control (tone at the top), the organisational structure and the values and abilities of employees.

Factors:

- Style of the directors and management

- Entity’s culture

- Organisational structure

Risk culture

Culture is ‘the pattern of basic assumptions that a given group has invented, discovered, or developed, in learning to cope with its problems of external adaptation and internal integration, and that have worked well enough to be considered valid and, therefore, to be taught to new members as the correct way to perceive, think and feel in relation to these problems.’

Embedding risk awareness

- Risk awareness is a capability of an organisation to be able to recognise risks when they arise, from whatever source they may come.

- A culture of risk awareness suggests that this capability (or competence) is present throughout the organisation and is woven into the normal routines, ways of thinking and is embedded in all parts of the company and in all employees.

Methods to embed

- 目标要一致,通过 training 实现。

- Job description 要规定好。

- 奖励制度而不是责备的文化。

- Indicator Feedback Suggestion

- 交流

- Aligning individual goals with those of the organisation and building these in as part of the culture. The need for alignment is important because risk awareness needs to be a part of the norms and unquestioned assumptions of the organisation.

- Communicating risk awareness and risk management messages to staff and publishing success stories. Internal communications is important in developing culture and continually reminding staff of risk messages. Training of staff at all levels is essential to ensure risk is embedded throughout the organisation.

- Including risk responsibilities with job descriptions. This means that employees at all levels have their risk responsibilities clearly and unambiguously defined.

- Establishing reward systems that recognise that risks have to be taken (thus avoiding a ‘blame culture’).

- Establishing performance indicators that monitor and feedback information on risks to management. This would ensure that accurate information is always available to the risk committee and/or board, and that there is no incentive to hide relevant information or fail to disclose risky behaviour or poor practice. A ‘suggestion box‘ is one way of providing feedback to management.

Event identification

Entrepreneurial risk

- Entrepreneurial risk is the necessary risk associated with any new business venture or opportunity.

- Any new product, new market development or new activity is a potential source of entrepreneurial risk but these are also the sources of future revenue streams and hence growth in company value.

Business risks

- These are risks which can threaten the survival of the business as a whole and they can arise from many sources.

- This is when the continuation of a business in its present form is uncertain because of external threats to the business at a strategic level, or a failure of the business’s strategy.

Financial risks

杠杆 or 营运资本管理 gearing or management of working capital

- These are the risks which arise from the way a business is financially structured, its management of working capital and its management of short and long-term debt financing.

- Cash flow can be strongly influenced by how much debt to equity a business has, its need to service that debt and the rate at which it is borrowed.

- Likewise, the ability of a business to operate on a day-to-day basis depends upon how it manages its working capital and its ability to control payables, receivables, cash and inventories.

- Any change which makes its cash flow situation worse, such as poor collection of receivables, excessive borrowing, increased borrowing rates, etc, could represent an increased financial risk for the business.

Liquidity risk

Inability to meet its short-term financing needs

Credit risk

- Credit risk is the risk to a company from the failure of its debtors to meet their obligations on time.

- The most common type of credit risk is when customers fail to pay for goods that they have been supplied on credit.

Currency risk/ Exchange rate risk

- loss or gain due to future changes in exchange rates

- The final amount payable/receivable in the home currency will be uncertain at the time of entering into the transaction .

Interest rate risk

As with foreign exchange rates, future interest rates cannot be easily predicted. If a firm has a significant amount of variable (floating) rate debt, interest rate movements will give rise to uncertainty about the cost of servicing this debt. Conversely, if a company uses a lot of fixed rate debt, it will lose out if interest rates begin to fall.

Product risk

会有怎样恶果:赔钱,召回,损害名誉

Product risks will include the risks of financial loss due to producing a poor quality product. These include the need to compensate dissatisfied customers, possible loss of sales if the product has to be withdrawn from the market or because of loss of reputation and the need for expenditure on improved quality control procedures.

Market risk

Market risk is a risk arising from any of the markets in which a company operates, including resource markets (inputs), product markets (outputs) or capital markets (finance).

Legal risks

Cause & impact

- Legal risks may therefore be strongly correlated with other risks if a business is potentially affected by legislation that relates to those other risks, for example health and safety or environmental legislation.

- Financial or other penalties, loss of reputation

Political risk

- Country risk

- election of a government 会产生影响

- If a company suffers a collapse in its reputation as a result of a public outcry, this may force politicians to take action against it.(keep informed 说服 keep satisfied)

Technological risks

- Strategic level: A technology-focus industry

- Operation risk: The risk arise from a specific operation

Health and safety risks

Sources:

- A lack of a health and safety policy

- A lack of emergency procedures

- A poor health and safety culture

Environmental risk

An environmental risk is an loss or liability arising from the effects on an organisation from the natural environment or the actions of that organisation upon the natural environment.

Reputation risk

- Reputation risk is the risk that is most strongly correlated to other risks.

- Stakeholders react

- The loss of reputation may have serious consequences, depending on the strength of stakeholders’ reaction and the influence they have on what happens to the organisation.

- Causes:

- Poor customer service

- Failure to innovate

- Poor ethics

- Poor corporate governance

Knowledge management risk

knowledge resources, unauthorised use or abuse of intellectual property

Fraud risk

Probity risk

How risks vary by sector

- Different environments

Some exist in relatively simple and stable environments whilst others are in more turbulent and changeable environments. Thus, in more unstable and complex environments, perhaps with greater levels of regulation, changing consumer patterns and higher technology, companies will be subject to greater risks than those in more stable and simple environments. - Different business model

This means that the ways in which value is added will differ substantially among companies in different sector. - Different financial structures and cost bases

Financial gearing, different cost structure (operation gearing)

Why environmental risks are strategic

- The way the company is viewed will have an impact on the company, eg withdrawal of support, inability to attract a key resource provider (labor).

- Industry specific factors: chemical

Industry (Chemical) –> High environmental risk –> Reputation risk –> Power of key stakeholders

Explore correlation between legal risk and reputation risk

Positively correlated, independent variable, dependent variable

Risk assessment and response

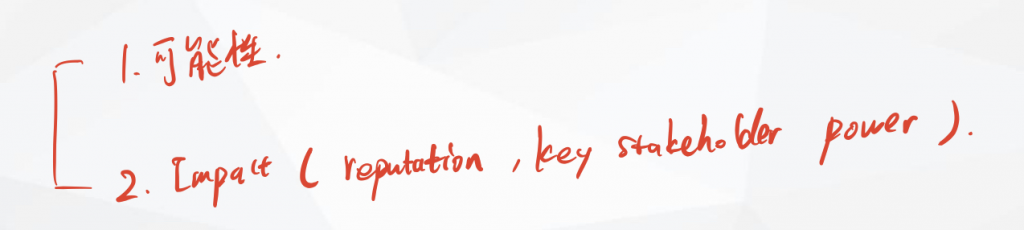

Importance of risk: the probability (likelihood) of the risk event being realised, the impact (value of loss) that the risk would have if it were realised

Different risk management strategies can be assigned depending on the importance of risks.

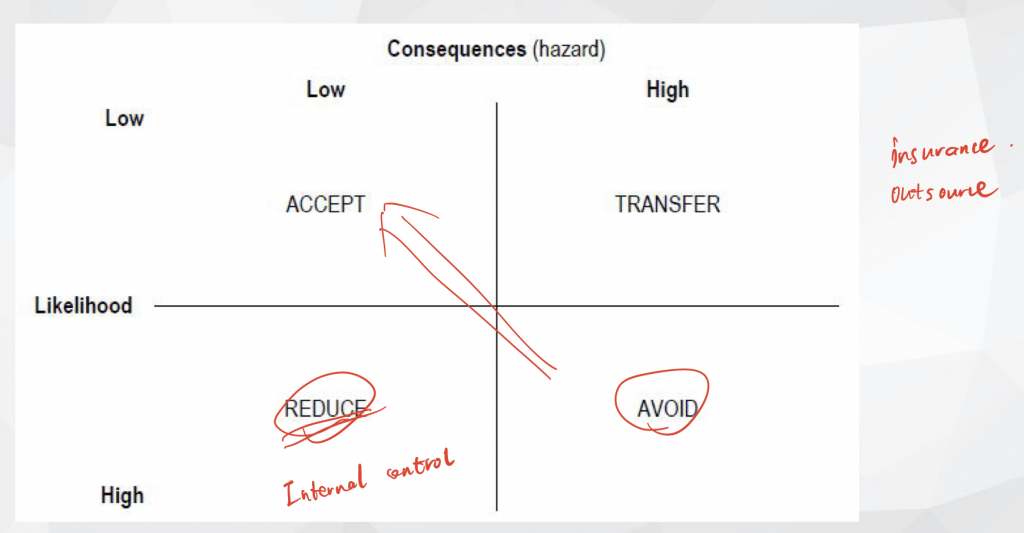

TARA model

Accept: Even if the risk materialised, it would not have a high severity.

Avoid: changing behaviour or discontinuing a certain activity

There is no reason to bear the risk unless the potential return is very large and the company has a high risk appetite.

Transfer: share it with another party, insure against losses or outsource or licence the activity

Reduce: Carrying out the activity in a different way, doing less of the opportunity

The ALARP principle

These risks cannot be avoided completely. However they have to be reduced to an acceptable level by incurring the costs of risk mitigation.

As low as reasonably practicable

Continuous and onging

- Strategic importance & dynamic nature

(Changing environment –> Risk movement –> not ‘once and for all’) - The need to adjust risk management strategies

Why risk assessment is dynamic

Changing environment (PESTEL) –> Risk movement –> dynamic / not ‘once and for all’

Objective and subjective risk perception

- Objective: high degree of certainty

- Subjective: quantifiable accuracy is not possible (knowledge and skills, information available)

Importance of accurate risk assessment

- Underestimates –> inadequate procedures

- Exaggerated –> excessive measures

Risk consolidation

Be aggregated

Controllable and uncontrollable

Stop and go

Control activities

- Segregation of duties

- Physical: safety

- Authorisation: sign

- Management

- Supervision

- Organisation: reporting lines, ensures everyone is aware of their control (and other) responsibilities

- Arithmetical

- Personnel: training

Information & communication

The qualities of good information

- Accurate

- Complete: include everything that it needs to include

- Cost-beneficial

- Relevant

- User-targeted: strategic info or details

- Authoritative

- Timely

- Easy to use

Communication –> Embed risk awareness

Monitoring

Monitoring should help ensure that internal controls continue to operate effectively and that systems produce accurate and reliable information.

Aims of monitoring

- Correction of root causes (why staff have made errors) –> Training / discipline / control redesign

- Ongoing monitoring: Routing reviews in smaller companies

- Separate evaluation: Audit committee and internal audit, annual reviews of control procedures

Communication structure for monitoring

The results of monitoring need to be reported to the right people and corrective action taken. Deficiencies in internal controls should be reported to the person responsible for the control’s operation and to at least one level higher.

The deficiencies need to be assessed in the same terms as risks, the likelihood that a control will fail to detect or prevent a risk’s occurrence and the significance of the potential impact of the risk.

Audit committee

Compulsory

Audit committee should consist entirely of independent non-executive directors, and should include at least one member with significant and recent financial experience.

Benefits of audit committee

- Create a climate of discipline and control which will reduce the opportunity for fraud.

- Strengthen the position of the external auditor, by providing a channel of communication and forum for issues of concern.

- Strengthen the position of the internal audit function, by providing a greater degree of independence from management.

Internal audit

The need for internal audit

- The scale, diversity and complexity of the company’s activities. The larger, the more diverse and the more complex a range of activities is, the more there is a need to monitor.

- The number of employees. As a proxy for size, the number of employees signifies that larger organisations are more likely to need internal audit to underpin investor confidence than smaller concerns.

- Cost-benefit considerations. Management must be certain of the benefits that will result from establishing internal audit and it must obviously been seen to outweigh the costs of doing so.

- Changes in the organisational structures, reporting processes or underlying information systems. Any internal change is capable of changing the complexity of operations and, accordingly, the risk.

- Changes in key risks could be internal or external in nature. The introduction of a new product, entering a new market, a change in any of the PESTEL factors might trigger the need for internal audit.

- Problems with existing internal control systems. Any problems with existing systems clearly signify the need for a tightening of systems and increased monitoring.

- An increased number of unexpected events

Risk auditing

Auditors will attempt to confirm that these risk management processes and controls operate to mitigate risks and ensure that management receives accurate information about risks, particularly high consequences-likelihood risks, risks outside the organisation’s risk appetite or risks that have materialised due to serious deficiencies in internal control.

The stages in a risk audit

- The first stage in a risk audit is risk identification.

- Once identified, each risk must then be assessed.

- The review of controls is the third stage of the audit.

- The final stage is to issue a report to management for future planning and decision-making.

Internal and external risk audit

- Internal risk audit is one undertaken by employees of the company being audited and is usually carried out by the internal audit function.

- Externally, consultants provide this service to clients. In some cases, this is a non-audit service offered by accounting practices and other consultancies specialise more specifically on risk including the provision of risk audit services.

Advantages of external risk audit

- An external risk audit will avoid familiarity threats by the auditor.

- An external risk audit will be neutral and independent in its approach.

- An external risk audit, assuming it is accompanied by a report to shareholders, will enhance investor confidence in the process and in XX’s risk management.

- We believe that current thinking and best practice can be more effectively transferred when the audit is undertaken by external parties.

Audit committee overseeing internal audit

- Scope

- Authority

- Independence

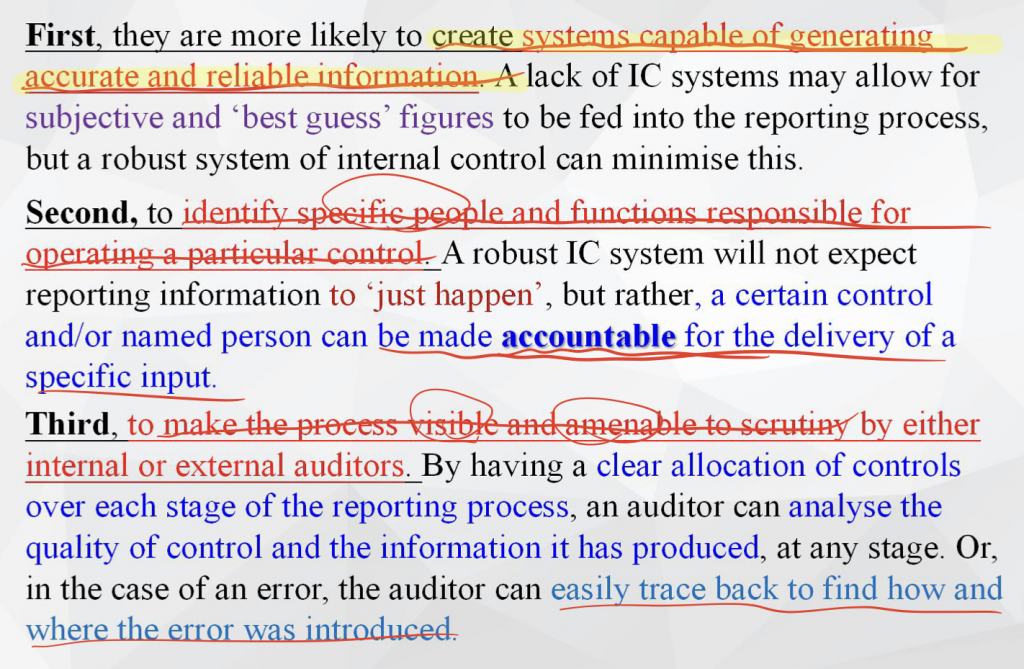

Effective internal controls in assuring the integrity of financial reporting

Responsibility

Board’s responsibilities for internal control

- Establishing a control environment

- Conducting risk assessment to establish which risks need to be controlled

- Introduction of relevant control activities

- Providing information and maintain relevant communications

- Monitoring controls

CEO’s responsibilities for internal control

- Assume final responsibility

- Set the tone from the top

Risk committee

Role and function of risk committee

- Approving the organisation’s risk management strategy and risk management policy

- Reviewing reports on key risks prepared by business operating units, management and the board

- Monitoring overall exposure to risk and ensuring it remains within limits set by the board

- Assessing the effectiveness of the organisation’s risk management systems

- Providing early warning to the board on emerging risk issues and significant changes in the company’s exposure to risks

- In conjunction with the audit committee, reviewing the company’s statement on internal control with reference to risk management, prior to endorsement by the board.

Disadvantages of non-executive membership

- Direct input and relevant information

- Specialist knowledge of products, systems and procedures

- Report their findings to the executive board

Risk manager

Reporting

Institutional investors

Shareholder activism

- making positive use of voting rights

- engagement and dialogue with the directors of investee companies

- paying attention to board composition/governance of investee companies

- presenting resolutions for voting on at the AGM (rarely used in UK)

- requesting an EGM and presenting resolutions

Intervention by institutional shareholders

- Fundamental concerns about the strategy being pursued in terms of products, markets and investments.

- Poor operational performance, particularly if one or more key segments has persistently underperformed.

- Management being dominated by a small group of executive directors, with the non-executive directors failing to hold management to account.

- Major failures in internal controls, particularly in sensitive areas such as health and safety, pollution or quality.

- Failure to comply with laws and regulations or governance codes.

- Excessive levels of directors’ remuneration.

- Poor attitudes towards corporate social responsibility.

AGMs and EGMs

- Annual general meetings (AGMs) are a part of the normal financial calendar.

- Extraordinary general meetings are called to discuss strategic and other issues with shareholders outside the normal financial calendar.

They typically involve presentations by the board (typically the chairman and/or CEO) and a chance for shareholders to question the board.

AGMs – purpose

Present the year’s results, discuss the outlook for the coming year

EGMs – purpose

Mandate for a particular strategic move, issues that might threaten shareholder value –> cannot wait until the next AGM

Proxy votes

Representative of the views of the shareholder body as a whole

Mandatory disclosures

Compulsory: main financial statements, directors’ shareholdings and emoluments, directors’ contracts

Voluntary disclosures

Not required: chairman’s statement, social and environmental disclosure, risk reporting

Advantages:

- Redressing the information asymmetry

- More information helps investors decide.

- Forward looking

- Transparency

Pros of compulsory reporting

- Improved confidence of shareholders

- Stimulus to directors

- Valuable information to hold directors accountable

13 Reporting to stakeholders

Sustainability

Present v.s. Future generations

Extension of sustainability

People, Planet & Profit

Environmental footprint

Environmental footprint is the impact that a business’s activities have upon the environment including its resource environment (impact of inputs) and pollution emissions (impact of outputs).

Direct and indirect impacts

- Direct –> narrowly

- Indirect –> broadly

Social footprint

Impact on people, society and the wellbeing of communities

Environmental report

Voluntary

The purpose is to report the details of the company’s environmental impact.

Contents: Direct impacts, indirect impacts / Consumption, production

Environmental audit

- Quantify an organisation’s environmental performance

- Stages:

- Agreeing suitable metrics

- Measure actual performance against the agreed metrics

- Compile a report:

- Levels of compliance

- Any significant breaches

- Recommended improvements

Pros of an environmental audit

Improved decision making: enable the board to understand their specific environmental risks

Resource consumption: Understanding how the company interacts with its natural environment allows it to more efficiently use its resource.

Compliance: Meeting its specific statutory requirements.

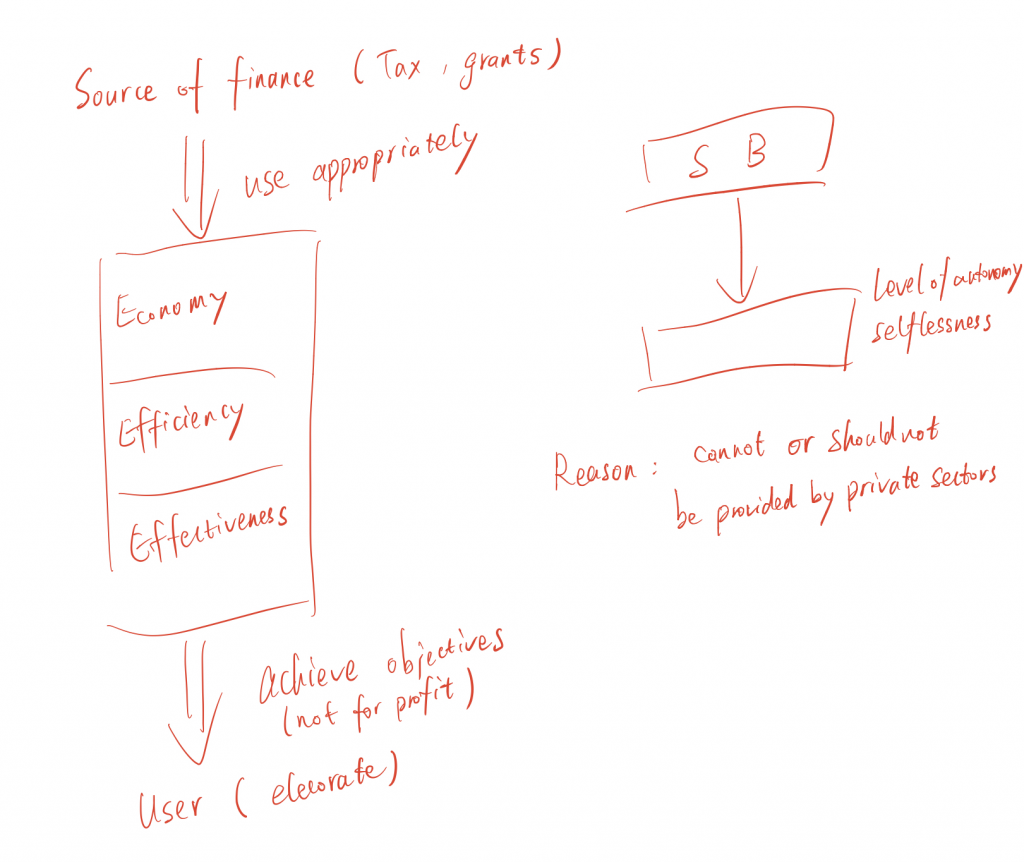

14 Public sector

Differences: Aims & purposes, not for profit, Sources of funding -> taxation, grants

Public sector: cannot or should not be provided by private sector

Level of autonomy, selflessness

Public money is being used appropriately to achieving objectives.

electorate 选民

15 Ethics

Corporate code of ethics – Purposes

Meet external expectations and react to public pressure

- Communicating the organisation’s values

- Identify the key stakeholders and promote stakeholder rights and responsibilities

- Means of conveying values to stakeholders

- Influence and control individuals’ behaviour

- An important part of an organisation’s strategic positioning, having an influence on organisation’s reputation.

Fundamental principles

- Integrity

- Members should be straightforward and honest in all business and professional relationships.

- Objectivity

- Members should not allow bias, conflicts of interest or undue influence of others to override professional or business judgements.

- Professional competence and due care

- Members have a continuing duty to maintain professional knowledge and skill at a level required to ensure that a client or employer receives competent professional service based on current developments in practice, legislation and techniques.

- Members should act diligently and in accordance with applicable technical and professional standards when providing professional services.

- Confidentiality

- Members should respect the confidentiality of information acquired as a result of professional and business relationships and should not disclose any such information to third parties without proper or specific authority or unless there is a legal or professional right or duty to disclose. Confidential information acquired as a result of professional and business relationships should not be used for the personal advantage of members or third parties.

- Professional behaviour

- Members should comply with relevant laws and regulations and should avoid any action that discredits the profession.

Ethical threats

- Self-interest

- Financial or other interests of a professional accountant or of an immediate family member inappropriately influence judgement or behaviour.

- Familiarity

- A close relationship resulting in excessive trust in, or sympathy for, others.

- Self-review

- Evaluation of a judgement by the accountant who made the judgement, or a member of the same organisation.

- Advocacy

- Accountant promoting a position or opinion to the point where objectivity may be compromised.

- Intimidation 威胁

- Accountant not acting objectively because of actual or perceived pressures.

Bribery and corruption

Bribery is the offering, giving, receiving or soliciting of any item of value to influence the actions of an official or other person in charge of a public or legal duty.

Why bribery and corruption are problems

- Lack of honesty and good faith

- Conflicts of interest

- Economic issues: Bribery and corruption results in a misallocation of resources. Contracts do not go to the most efficient producer, but the producer that pays the highest bribes.

- Reputation

Combat bribery and corruption 反腐败措施

- Top-level commitment: A culture that bribery is never acceptable

- Proportionate procedures: Procedures are proportionate to the bribery risks.

- Risk assessment: Audit

- Due diligence procedures: Personnel

- Communication: Embed culture

- Monitoring and review

Public interest

Ann Koo owes a duty to the public interest both as an accountant and as a company director.

This means that it is her duty to behave in such a way as to maximise the public good and not act in terms of pursuing personal interests only.

Accounting and other professionals are bound to recognise this duty and to comply with it regardless of the temptation or inducement to act otherwise

American Accounting Association

- What are the facts of the case?(抄)

- What are the ethical issues in the case?(纠结点)

- What are the norms, principles and values related to the case?(原则/ Transparency)

- What are the alternative courses of action?(备择方案)

- What is the best course of action that is consistent with the norms, principles and values identified?(最好的情况)

- What are the consequences of each course of action?

- What is the decision?

Tucker’s 5-question model ★

- Profitable?

- Legal?

- Fair and equitable?

- Right, which is prone to subjective judgement?

- Sustainable or environmentally sound?

Criticise bribery

- Not allow equal competition

- Offer poor value to stakeholders

- Expose to ethical threats that may result in more unethical behaviour in the future

- This belief or expectation may apply to most qualified professionals but acceptance of additional rewards in this manner is totally unacceptable.

Insider dealing/trading

- Short-term effect

- Damage to the reputation of the capital markets

16 Structure and process

Organisational structure

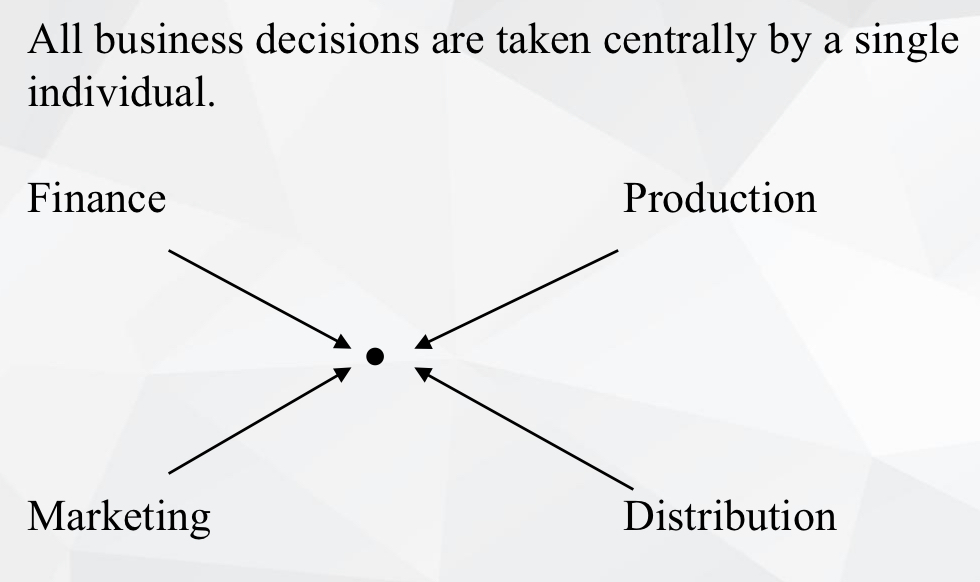

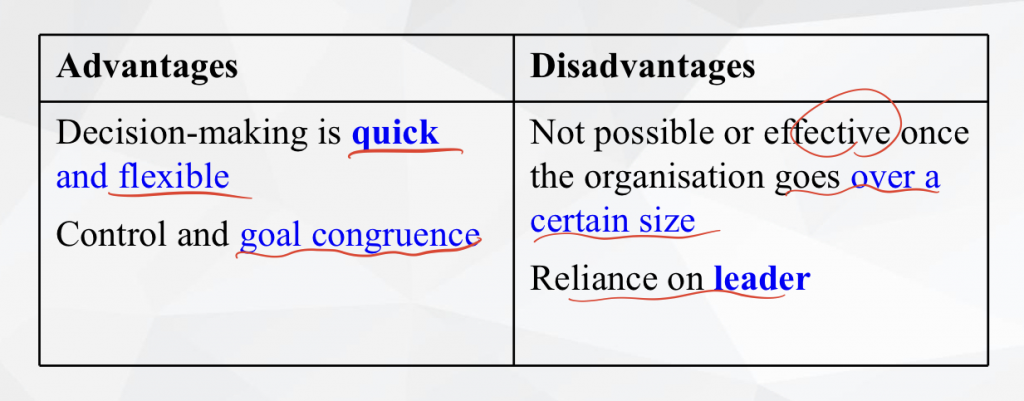

Simple

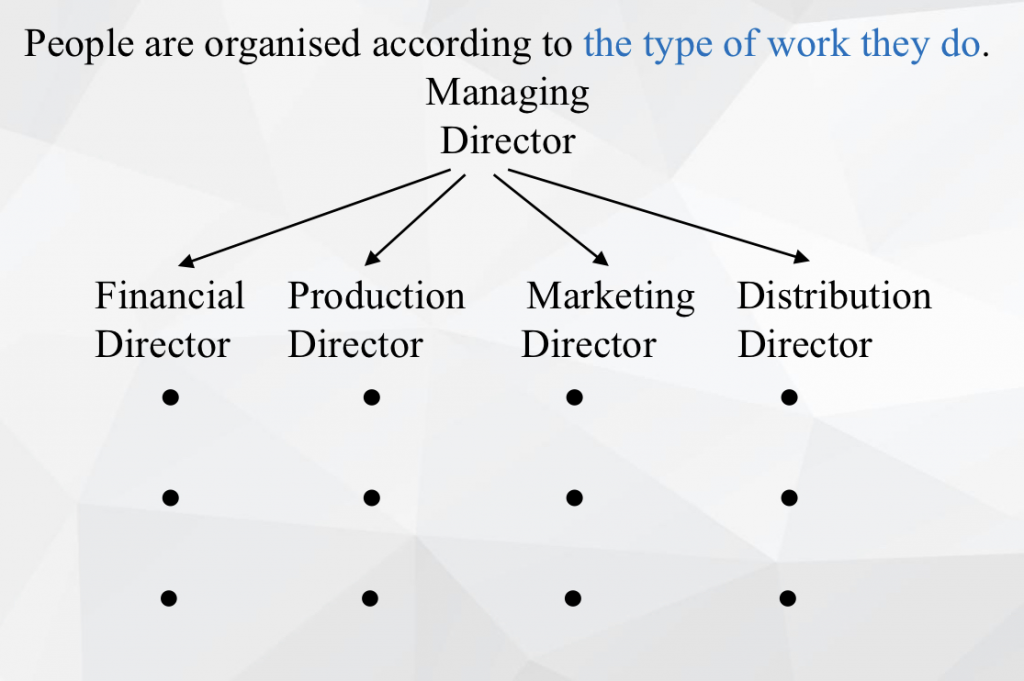

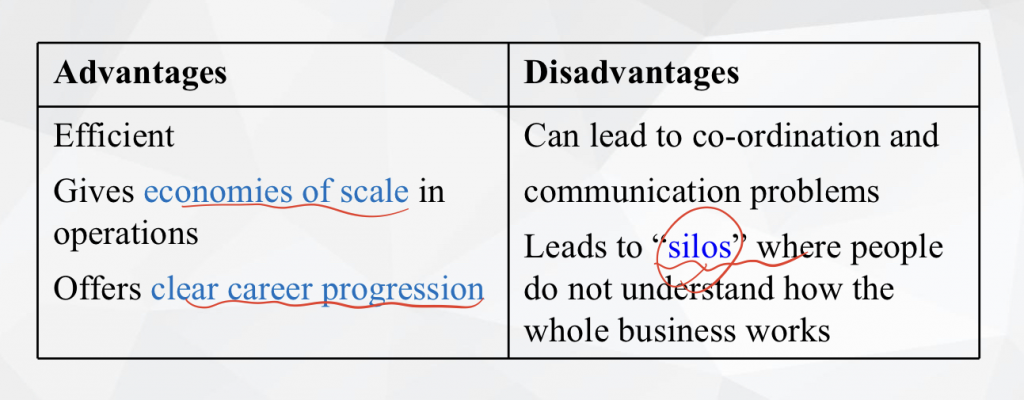

Functional

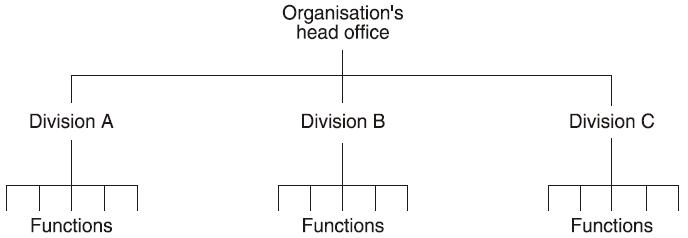

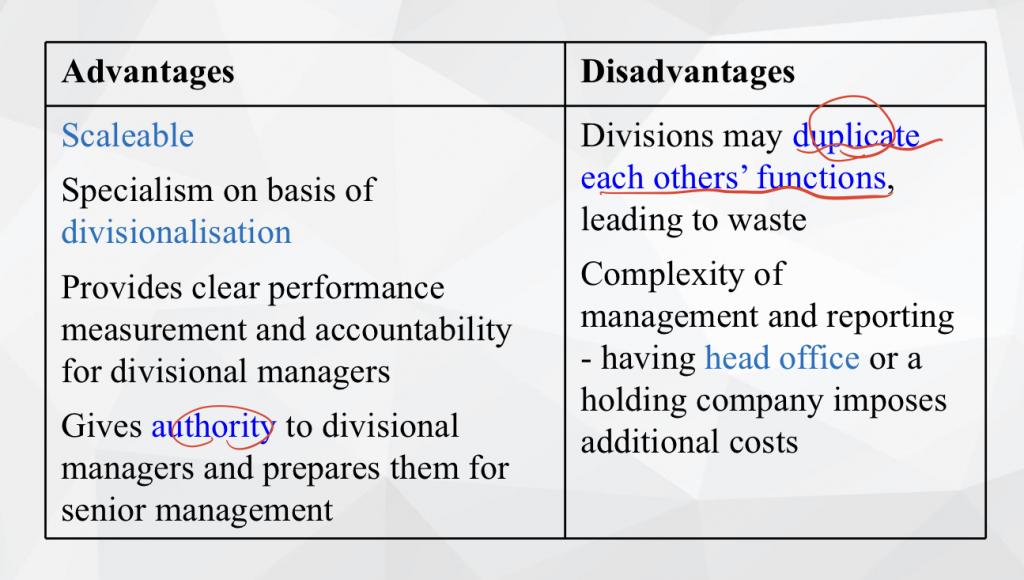

Divisional/holding company

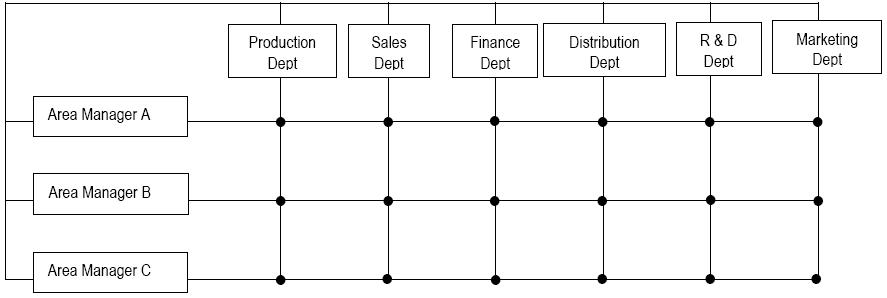

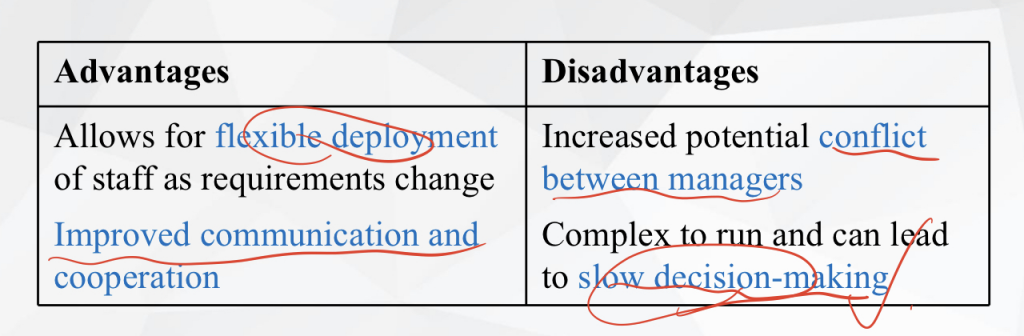

Matrix