Week 1 Lecture

Testing the usefulness of accounting and financial reporting

Whether accounting information is useful.

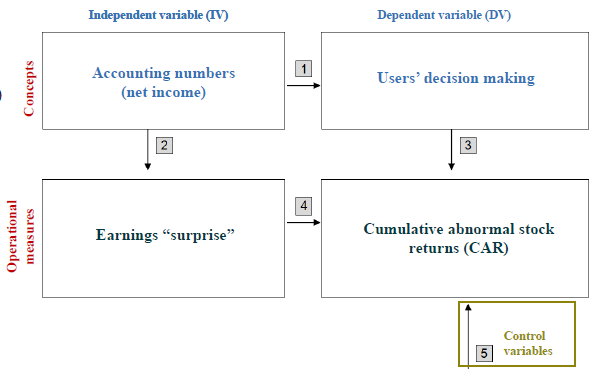

Paper 01 Nichols and Wahlen, (2004)

How Do Earnings Numbers Relate to Stock Returns? A Review of Classic Accounting Research with Updated Evidence

Earnings are value-relevant.

Earnings –> Stock returns

Earnings == Net income

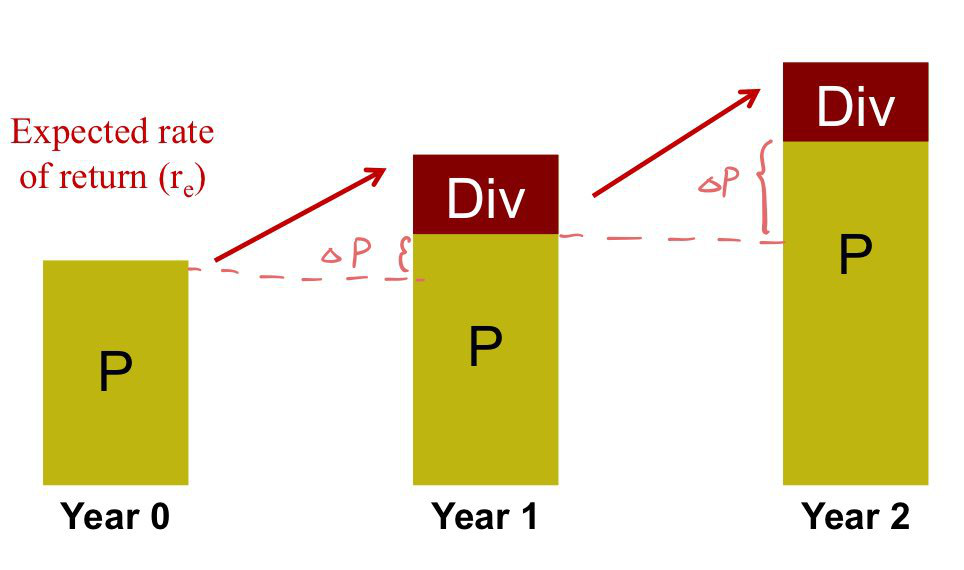

Stock returns == Relative change in stock price (DIV + ΔPrice)

Event study: How an event impacts something else.

Ball and Brown, (1968)

Evaluation role: Whether accounting information reflects the value the company created for the shareholders?

Research question: Do earnings capture information that investors consider useful and “value relevant” for decision making?

At that time, accounting information was considered useless.

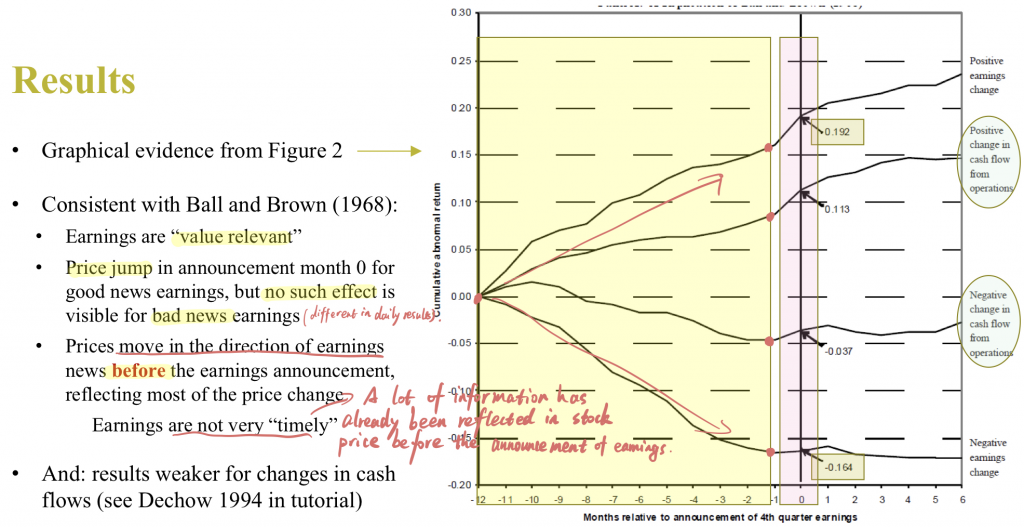

- Changes in earnings are related with stock returns.

- Accounting earnings information is not particularly timely.

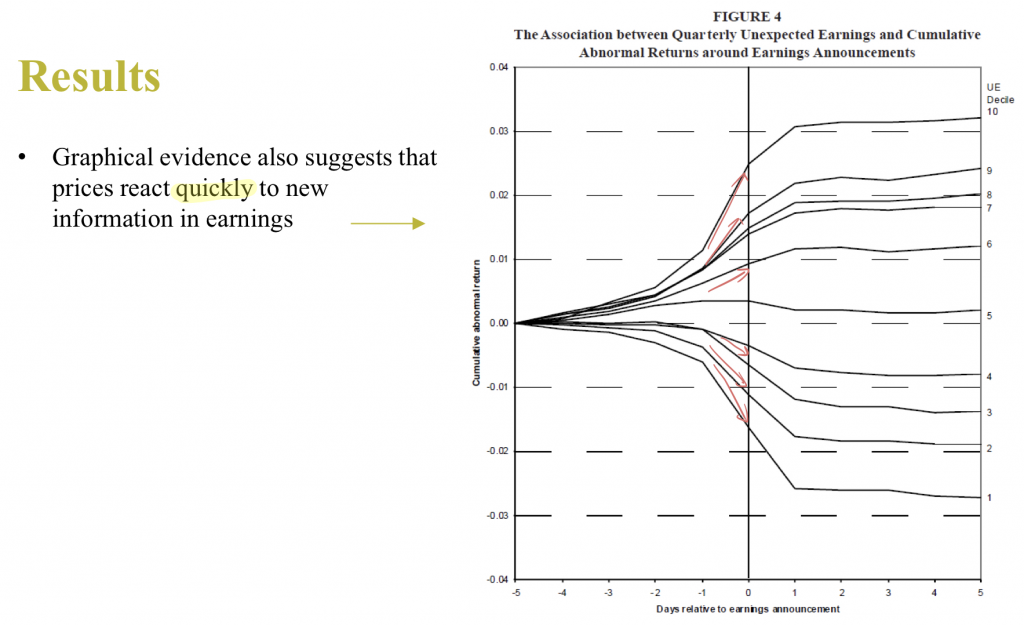

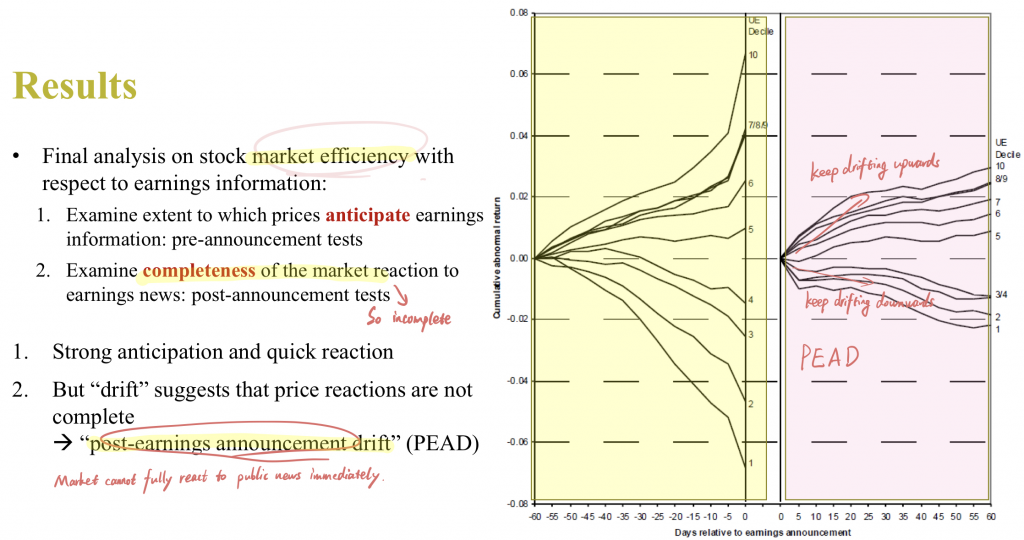

- Investors react rapidly to new information in earnings, their reaction is not complete. Post-earnings announcement drift (PEAD)

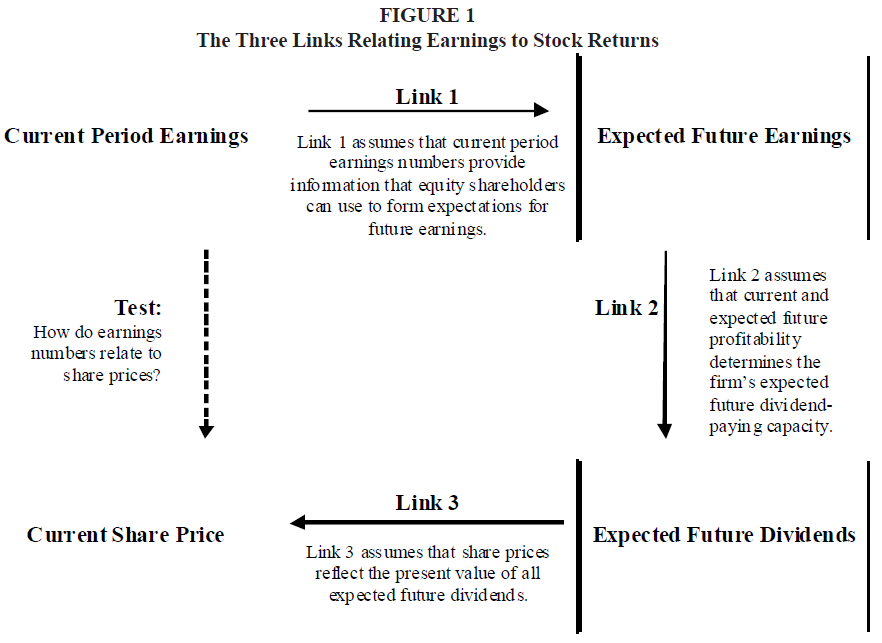

The framework

Current earnings –> Future periods’ earnings –> Future dividends –> Share value (Discounted future dividends)

- Link 1: Forward-looking information

- Link 2: Practically and academically valid (Even if firms do not pay dividends)

- Link 3: Valuation

The value of an equity share can be seen as the present value of expected future dividends.

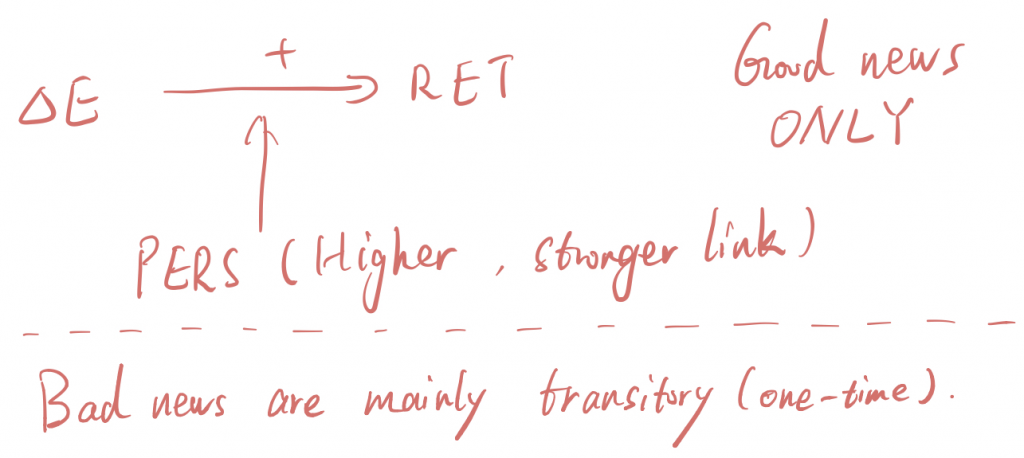

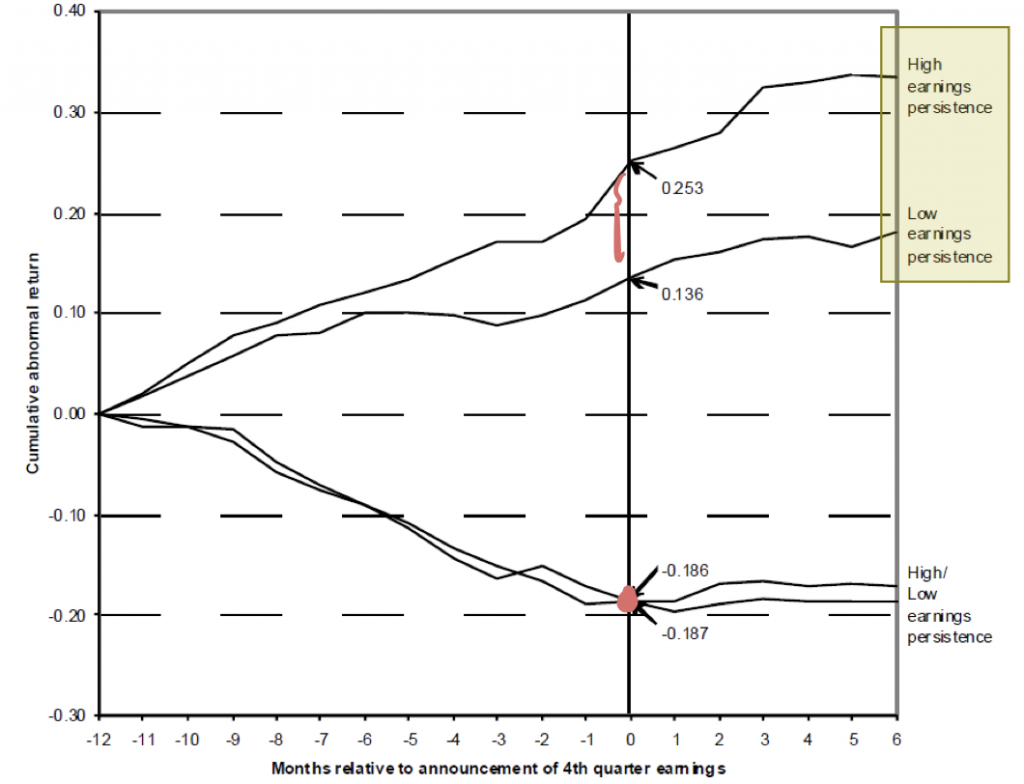

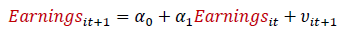

Earnings persistence

The likelihood a firm’s earnings level will recur in future periods. (Link 1)

Transitory (One-time)(Especially losses) event (Gain/Loss) –> No effect on future dividends –> Little impact on stock value

Results (Monthly data)

Results (Daily data)

Summaries

- Earnings are value relevant.

- Earnings reflect new information (three links), but are not very timely.

- Post-earnings announcement drift

Information is not fully transparent. Drift can tell regulators more about how company should provide information. The better the quality of the financial reporting, the weaker the drift. ++

Regression

Earnings Response Coefficient (ERC)

Every 1 euro of earning surprise leads to ERC euro increase in stock price.

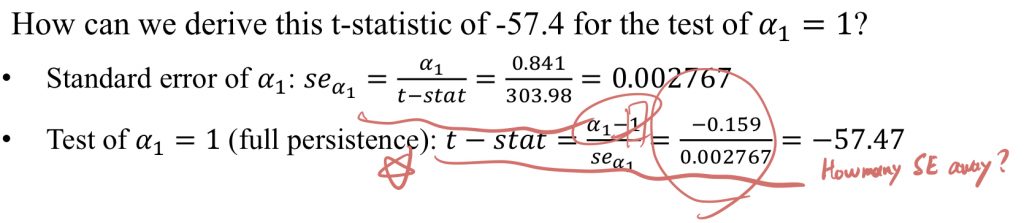

The impact of current earnings change to future earnings (persistence)

R-squared

R-squared (?2) provides information on the proportion of the total variation in dependent variable Y that is explained by the independent variable(s) X in the model

See more knowledge about regression here, including standard error, t-value, etc.

s.e. * t = x

Week 1 Tutorial

Paper 02 Dechow (1994)

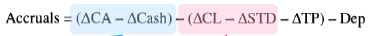

Accruals

- Receivables

- Payables

- Deferred revenue

- Deferred taxes

- Provisions (warranty)

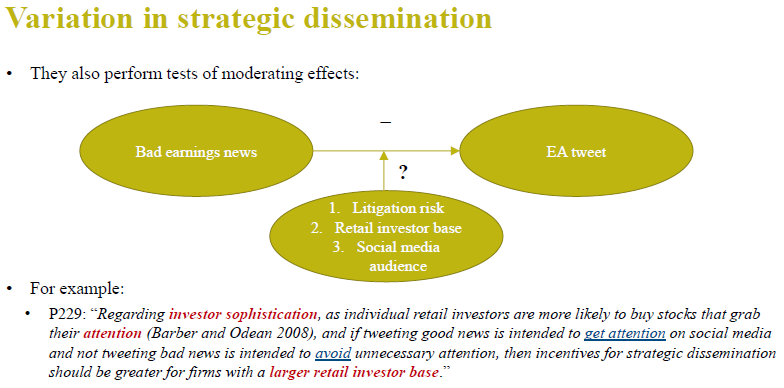

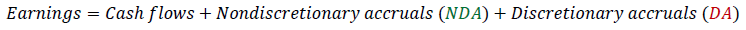

Accruals == Earnings – Cash flows

Timing Principle

Revenue is recognized when performance obligation is met, not necessarily when cash is received.

Matching Principle

We want to match the expenses to the period which value is created in.

By fixing matching issues, we also fix timing issues.

Operating Cycle

Time differences between first spending cash on the project until get money.

Longer operating cycle,

Trade-off

Discretion: More information (relevance) or Earnings management (reliability)

Predictions

H1: There is a stronger contemporaneous association between stock returns and earnings than between stock returns and realized cash flows over short measurement intervals.

H2: The contemporaneous association of stock returns with realized cash flows improves relative to the contemporaneous association of stock returns with earnings as the measurement interval is increased.

H3: The larger the absolute magnitude of aggregate accruals made by a firm, the lower the contemporaneous association between stock returns and realized cash flow relative to the association between stock returns and earnings. (More volatile environments)

H4: The longer a firm’s operating cycle, the more variable the firm’s working capital requirements and the lower the contemporaneous association between stock returns and realized cash flows. (Larger and more volatile working capital needs)

Research design

Y

Stock price as benchmark (performance)

Assumption: Markets are efficient.

Prices respond rapidly to new information, but reactions are not always complete.

X

Performance measures: Earnings, CFO, CF

R-squared is used as the measure of the association.

Results

- Changes in CF <—> Accruals (Interval ↑ Relation↓)

- CF <—> Accruals (Interval ↑ Relation↓)

H1

Earnings explain more of the variation in stock returns than the cash flow measures.

H2

The ability of cash flow to measure firm performance improves when the measurement interval increases.

H3

CF of smaller accrual companies better measures performance.

When the magnitude of accruals increases, cash flows suffer more severely from timing and matching problems.

H4

The longer the operating cycle of an industry, the weaker the ability of cash flows to measure firm performance.

This effect does not exist for earnings.

Different types of accruals

Short-term accruals (Working capital, TR, TP) mitigate the problems of timing and matching.

Week 2 Lecture

Accounting conservatism

Asymmetry in recognition

- Good news don’t lead to recognition.

- Bad news lead to recognition.

Impairments are outcome of accounting conservatism.

There are multiple indicators that exist that can lead to recognition of impairments. There are different types of bad news.

Paper 03 Basu (1997)

- To identify the accounting conservatism.

- How can we identify conservative accounting?

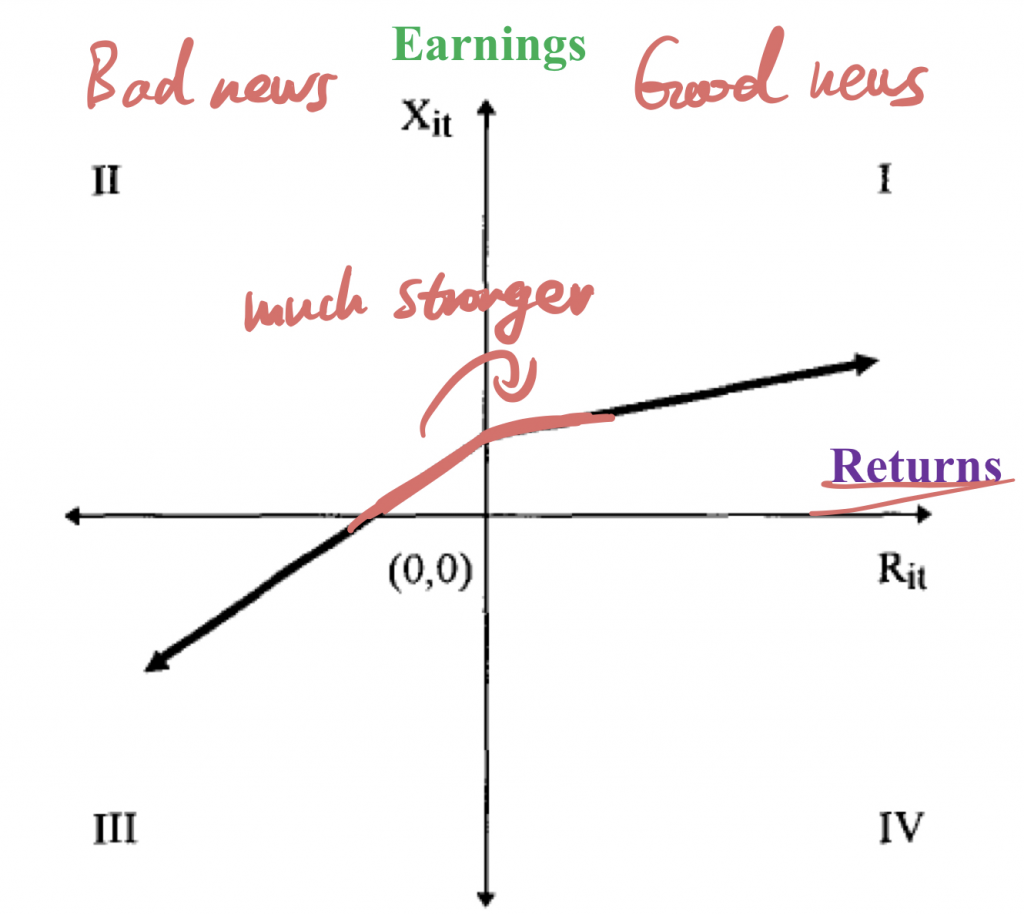

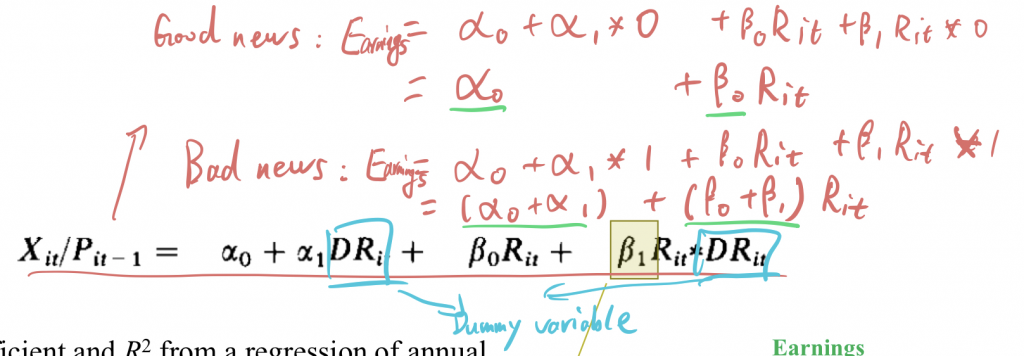

Earnings reflects bad news more quickly than good news.

Accountants’ tendency to require a higher degree of verification to recognize good news as gains than to recognize bad news as losses” in financial statements.

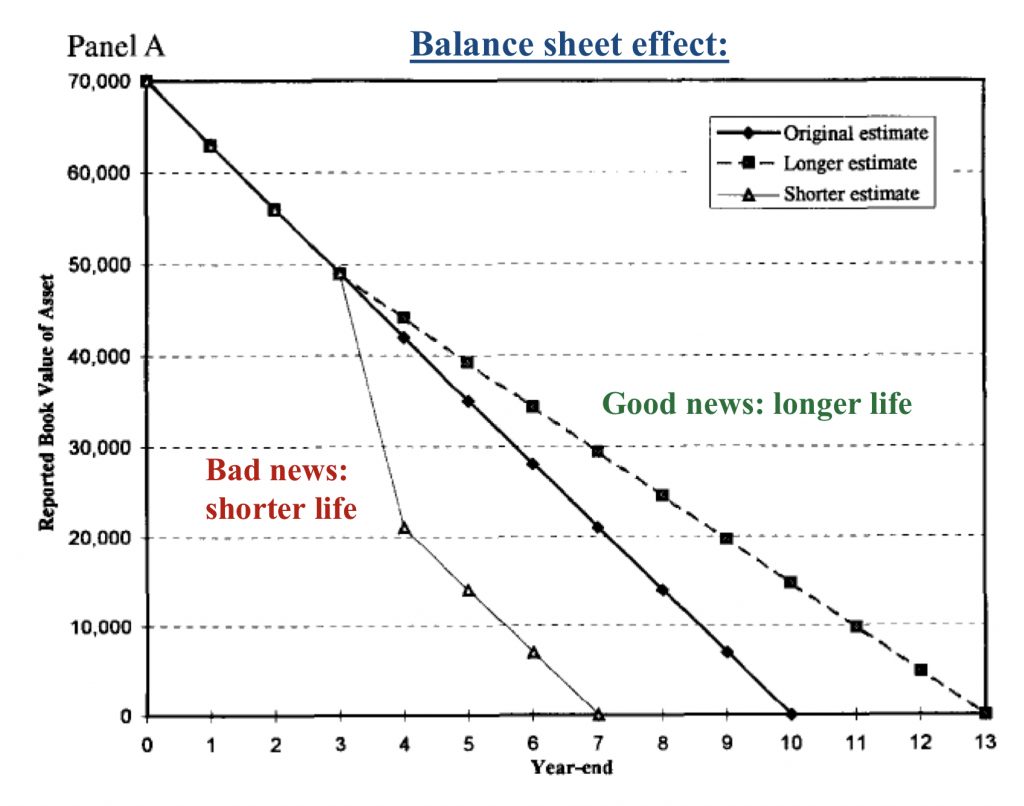

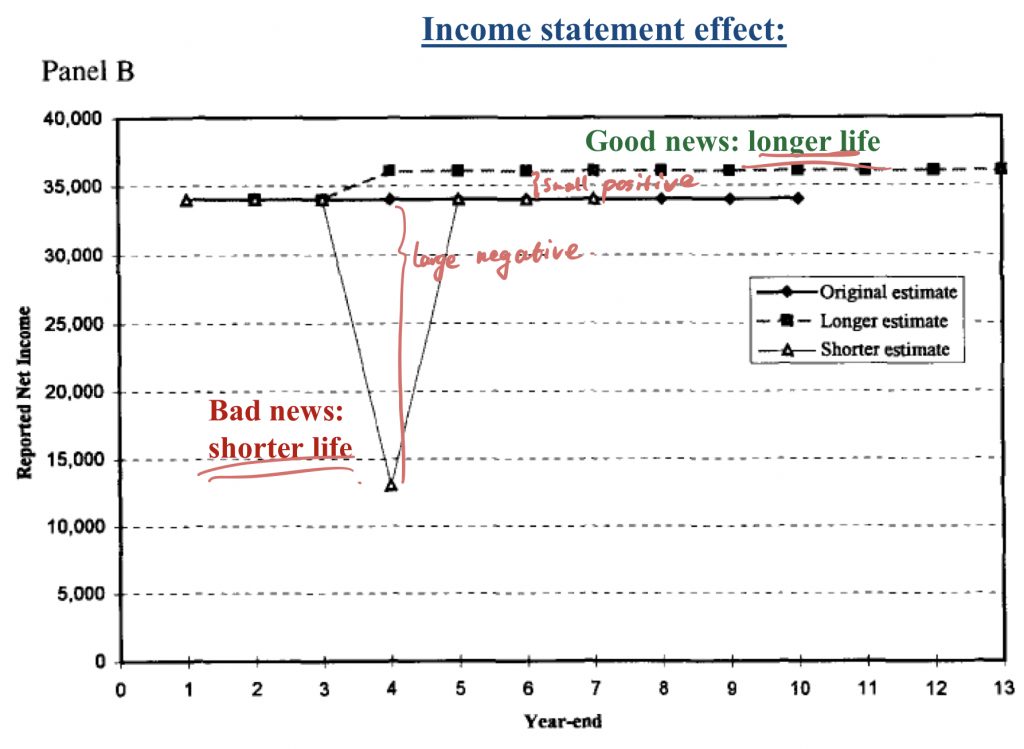

Modules

- Good news: Longer life, No gain recognized. (Small profit but more persistent)

- Bad news: Shorter life, Impairment recognized. (Large loss but transitory)

Managers’ view

More valuable private information.

- Conditional conservatism: news-dependent

- Unconditional conservatism: news-independent

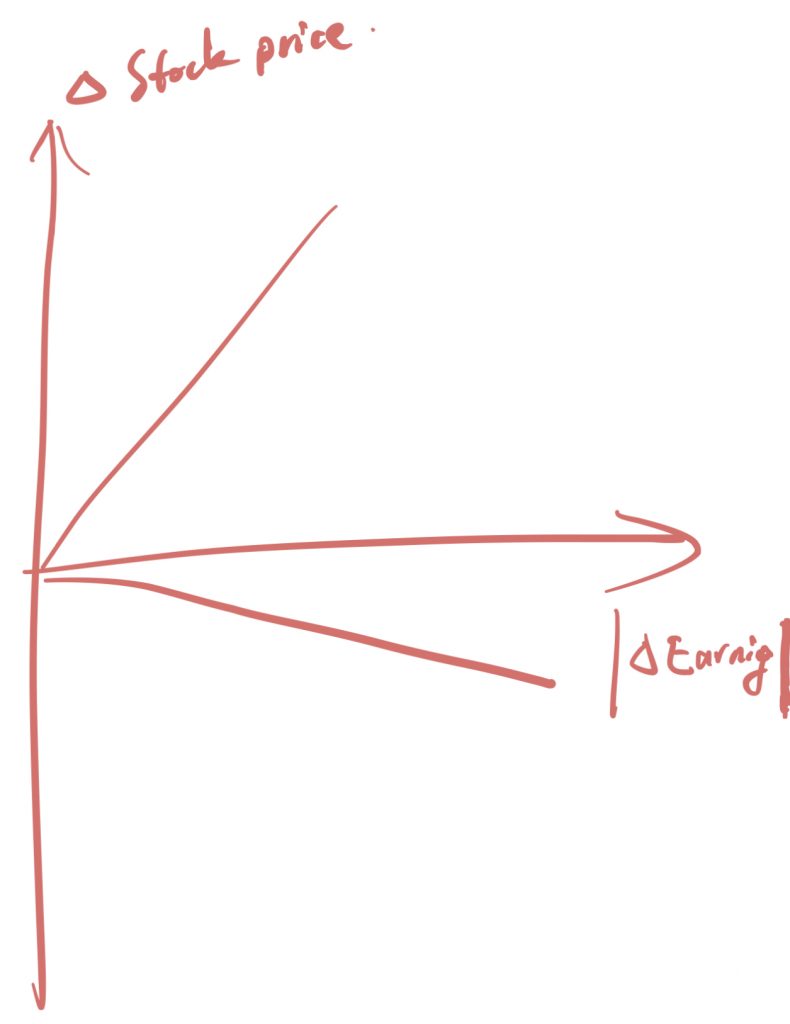

H1

The slope coefficient and ?2 from a regression of annual earnings on annual unexpected returns are higher for negative unexpected returns than for positive unexpected returns.

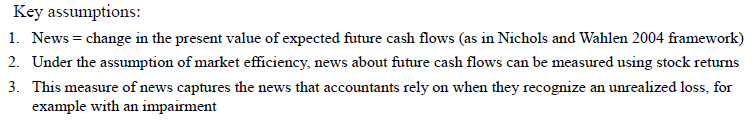

- ??????? = ? + ? ???????? + ? (N&W)

- ???????? = ?+ ? ??????? + ? (Basu)

Whether earnings summarize information in a timely manner.

Unexpected returns (News) —> Earnings

Results

?0 > 0, ?2

H2

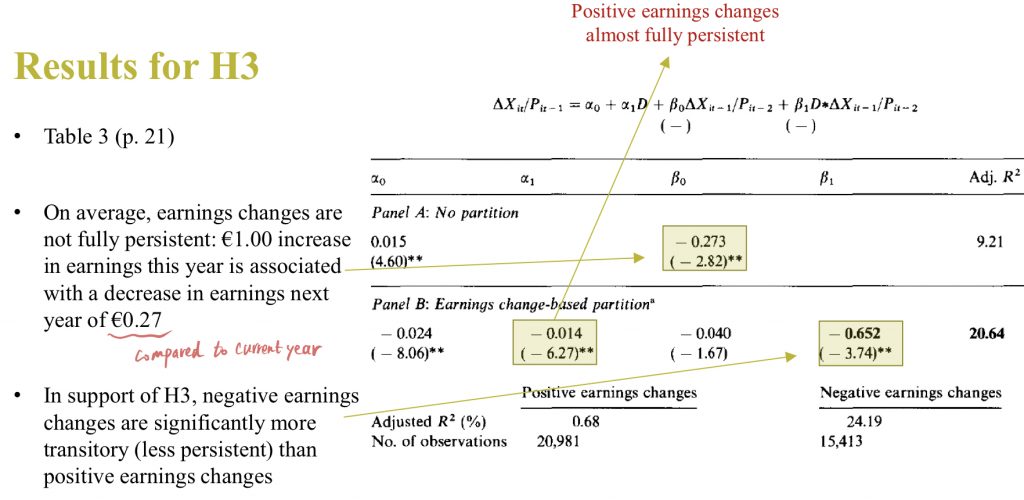

The increase in the timeliness of earnings over cash flow is greater for negative unexpected returns than positive unexpected returns.

Earnings are more conservative than cash flow.

And earnings are more value relevant than CF.

H3

Negative earnings changes have a greater tendency to reverse in the following period than positive earnings changes. (persistence)

H4

In a regression of announcement period abnormal returns on earnings changes, the slope on positive earnings changes is higher than on negative earnings changes.

Examines how conservatism affects the market’s reaction.

Week 2 Tutorial

Paper 04 Banker (2017)

- Different assets —> Different useful life —> Different impairment indicators

- So multiple indicators

Ex.

Stock price ↑ REV(Sales) ↓ —> Impairment in inventory but not the whole firm

- Current assets: Short-term CF

- Long-term assets: Long-term CF as well as short-term

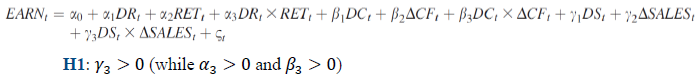

H1

Earnings <— Impairment <— Forecasts of CF <— Sales forecasts <— Recent sales trends

After controlling for the asymmetric effects of both stock return and operating cash flow change, earnings exhibits asymmetric association with sales change.

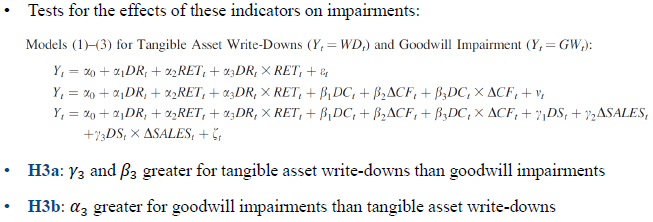

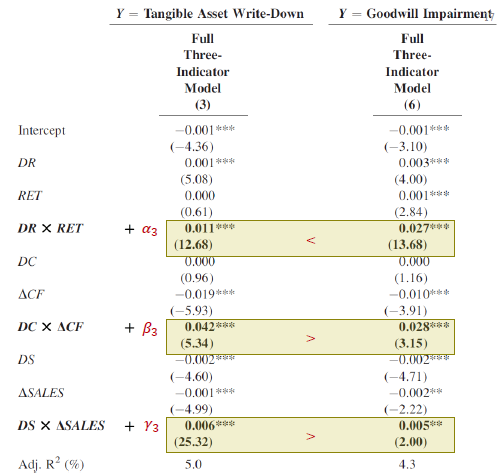

H3

Changing dependent variable from earnings to tangible assets / GW impairment.

H3a: The relative impact of short-term indicators, such as sales change or operating cash flow change, is greater for tangible asset write downs than for goodwill impairments.

H3b: The relative impact of stock return is greater for goodwill impairments than for tangible asset write downs.

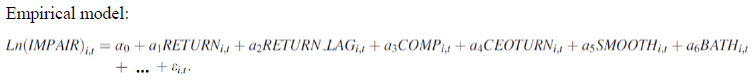

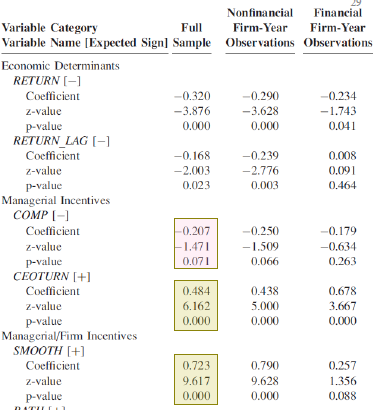

Research design

Results

H1

?3>0

Earnings has a stronger relation with negative changes in sales than with positive changes in sales. (Earnings also explains conservatism accounting. )

H3

- G/W (long-term) <— Stock return

- Inventory (short-term) <— Changes in CF/Sales

Paper 05 Glaum (2018)

s.e. * t = x

What variables (managers’ incentives, enforcement) are more strongly related to impairment decision?

Background

Managers have much more discretion to decide whether to impair G/W or not. Managers decide the fair value of G/W. Managers know best in the company.

Managers may delay recognition or recognize smaller impairments.

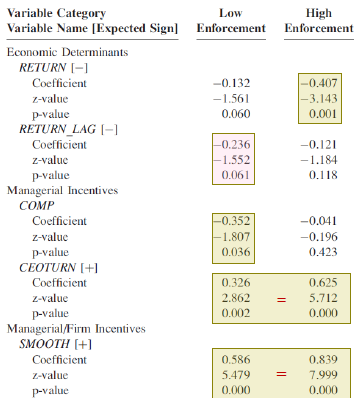

Research Design

Use of Return as independent variable. If there is news, does that lead to an impairment? But, returns are not split into positive and negative, and the study does not look into asymmetry.

- COMP: Negative relation with impairment decision. Higher compensation, less likely to impair G/W.

- CEOTURN: New CEO more likely to impair G/W.

- SMOOTH: Intention to smooth earnings. The earnings is already high.

- BATH: Big loss already.

Doing regression separately for countries with high and low enforcement.

Results

Standard error —> Variability

0 —> No variation

Negative relation between return and impairment.

But there is also negative relation between lag_return and impairment. It shows companies delay recognition of impairments.

Companies in low enforcement countries are more likely to delay the recognition of G/W.

SMOOTH/CEOTURN has the same influence. Compensation only influence companies in low enforcement countries.

Key insight: Conservative accounting, as reflected in goodwill impairments, varies predictably across countries and companies, despite one common set of accounting standards.

Week 3 Lecture

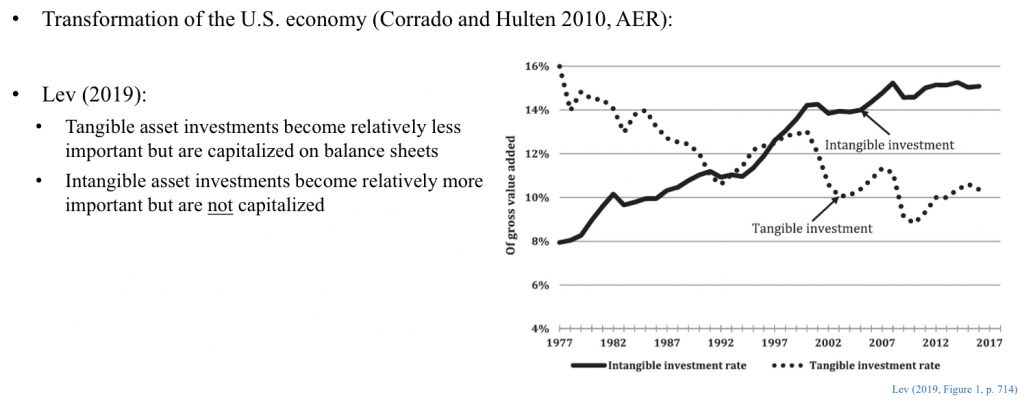

Intangible assets: a form of unconditional accounting conservatism.

- Very similar (intangible) assets (internally generated or externally acquired) are treated very differently in the accounting.

- Recognizing fair values based on market prices, and uncertain future cash flow expectations, can lead to large fluctuations.

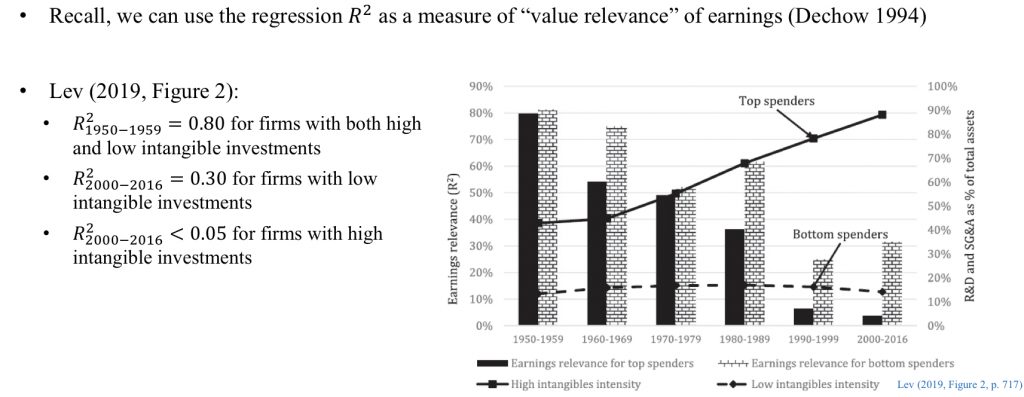

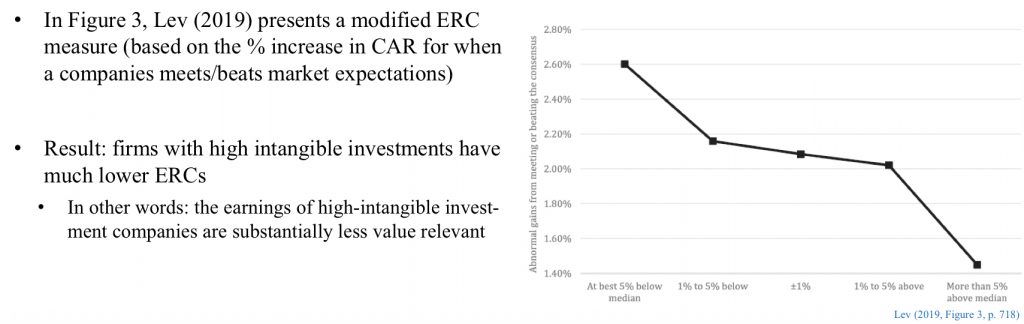

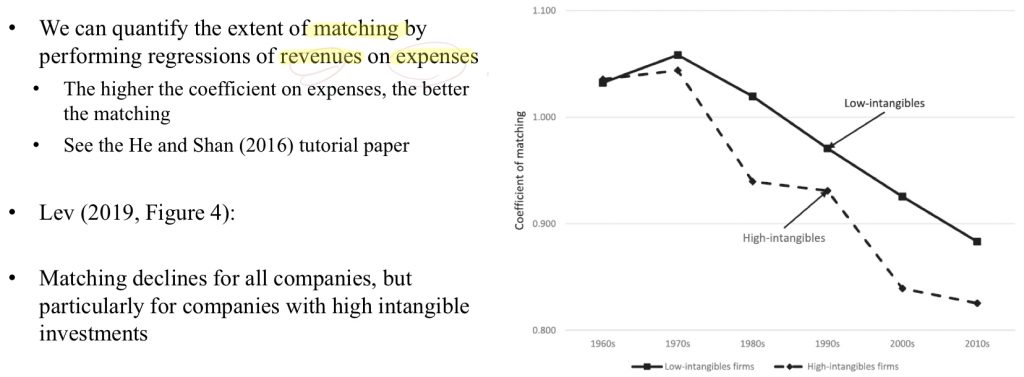

Paper 06 Lev (2019)

SG&A (Selling, general and administrative expenses) contributes to the mismatch between revenue and expenses.

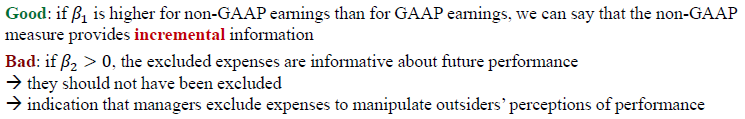

Non GAAP: performance measures that are not calculated following GAAP (or IFRS) rules.

The adjustment elements for Non-GAAP include both recurring and transitory items.

Week 3 Tutorial

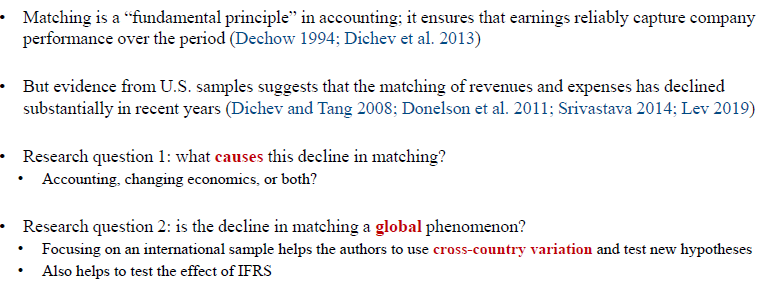

Paper 07 He and Shan (2016)

Poor matching

- Economic/business factors

- Accounting standards: R&D

- Earnings management

Hypothesis

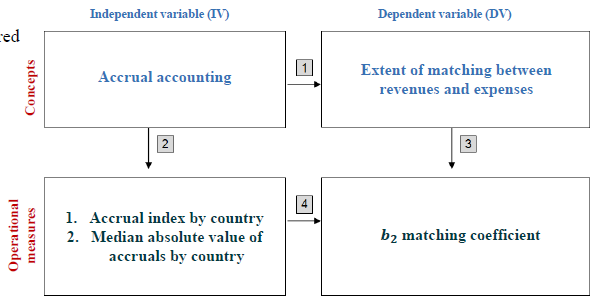

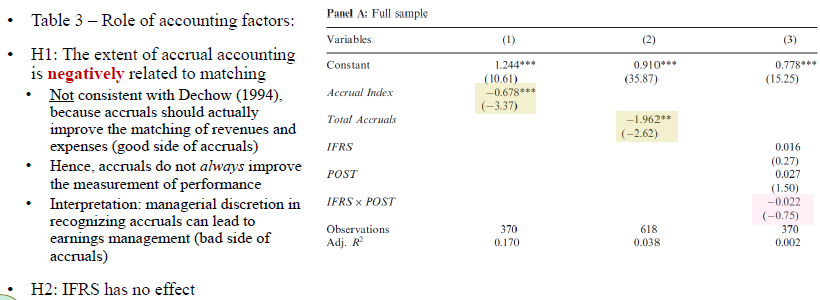

H1 (Accounting factors)

H1(null): The degree of accrual accounting used in a country’s accounting standards is not associated with the extent of matching between revenues and expenses.

Prediction 1: Accrual accounting improves matching because the key advantage of accrual accounting over cash accounting is better matching of revenues and expenses regardless of payments or receipts of cash. (Dechow (1994))

Prediction 2: Accruals rely on estimates and forecasts – managers might use the discretion they have in the financial reporting to shift expenses (firstly understate expense and then recognize in one period) across accounting periods.

H2 (Accounting factors)

H2: The adoption of IFRS does not affect the extent of matching between revenues and expenses.

H3 ~ H5 (Economic factors)

- Variable costs (Higher economic growth) can enhance matching.

- More writedowns in economic downturns.

- More restructuring expenses in economic downturns.

H3: Economic growth is not associated with the extent of matching between revenues and expenses.

H4: R&D spending is not associated with the extent of matching between revenues and expenses.

H5: The weight of the service sector in an economy is not associated with the extent of matching between revenues and expenses.

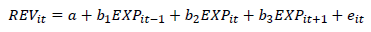

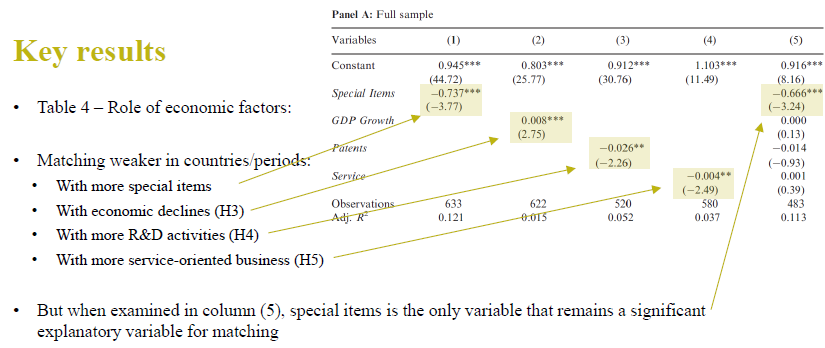

Research design

?2 –> Matching (The better the matching, the higher the coefficient ?2.)

?1 –> Conservatism (the extent to which expenses are recognized earlier than revenues are recognized)

Special items is the most important determinant.

Conclusion

Both accounting and economic factors are important for the decline in matching internationally.

Accounting can reflect the changes in the company’s business models and strategies.

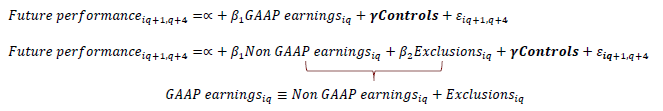

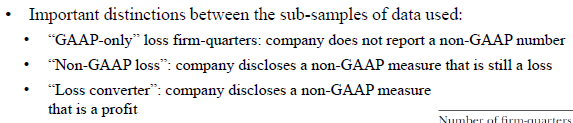

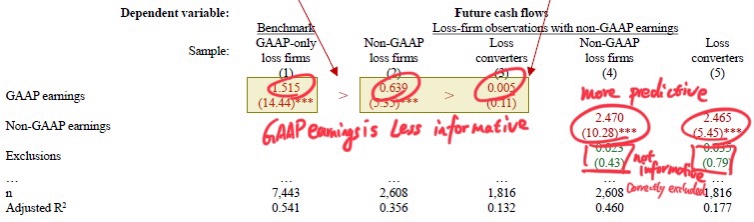

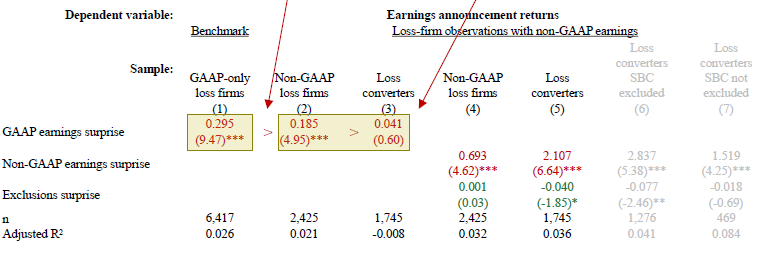

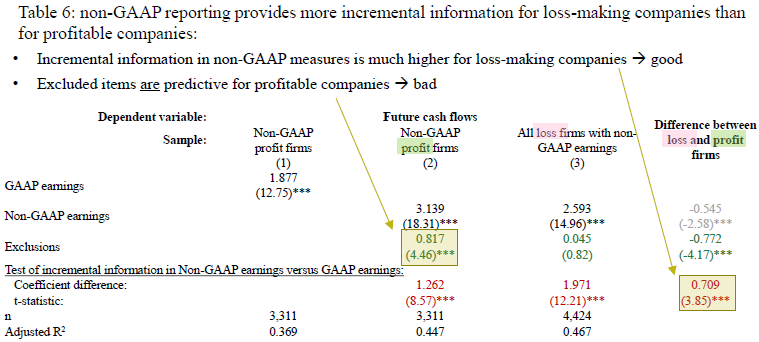

Paper 08 Leung and Veenman (2018)

Why non-GAAP reporting?

- GAAP earnings are perceived to have become less useful in evaluating company performance.

- Financial statement users demand additional information needed to evaluate company performance.

Research design

Future performance —> Future cash flows and ERC

Less persistent earnings (GAAP earnings) should trigger weaker stock market reactions to earnings announcements.

Certain accruals cannot enhance the informativeness of the earnings. Those accruals include stock-based compensation and amortizations.

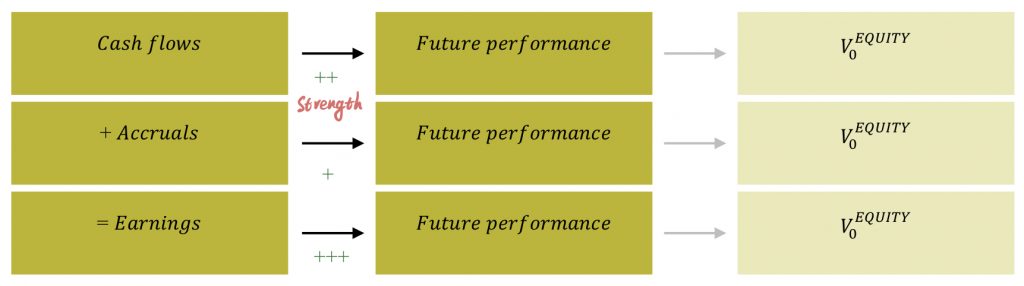

Week 4 Lecture

The IASB objective is that financial reporting provides information that is useful to users, but this assumes that these users fully understand how to interpret the accounting information. (transitory or persistent)

Regulators and commentators think that investors are imperfect processors of publicly available information.

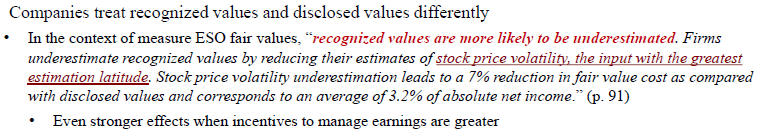

Recognize (much more visible) or disclose (hidden)

The same information is reported, but in different locations.

Aims:

- Whether the location decision makes a difference?

- Why it makes a difference?

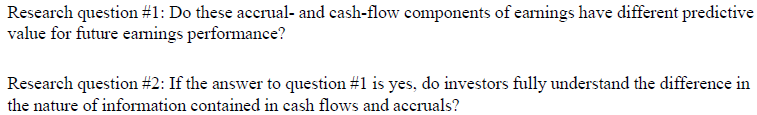

Paper 09 Sloan (1996)

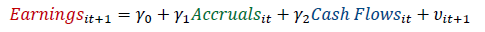

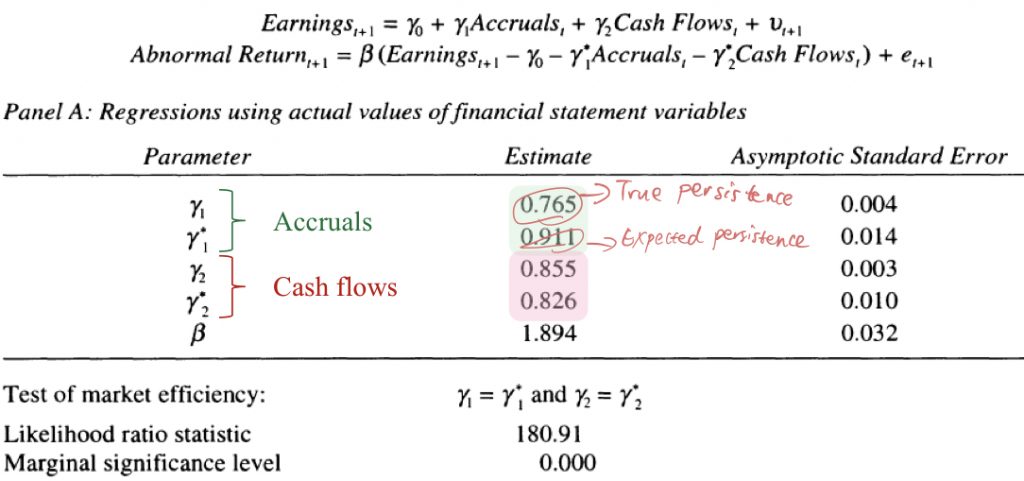

Do stock prices fully reflect information in accruals and cash flows about future earnings?

—> Do investors fully understand the differential information reflected in the accruals about future earnings?

- Dechow (1994): Cash flows v.s. earnings as performance measure (Stock returns)

- Sloan (1996): Cash flows v.s. accruals to predict future performance

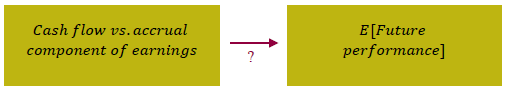

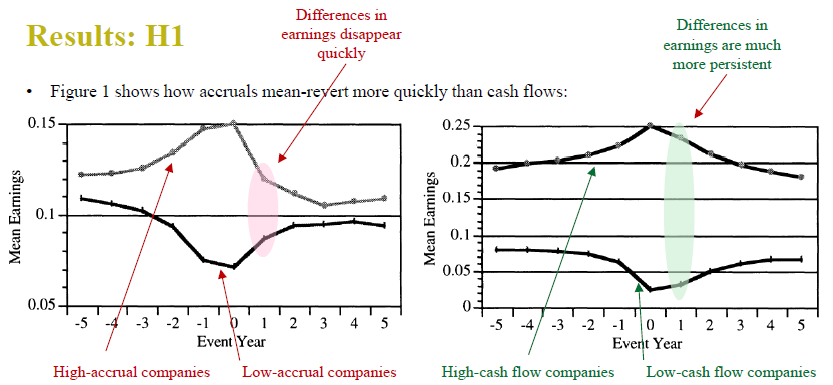

Accruals are not persistent because:

- Subjectivity

- Impairments are transitory.

Accruals have incremental information making earnings a better performance measure.

Hypothesis

High earnings performance that is attributable to the cash flow component of earnings is more likely to persist than high earnings performance that is attributable to the accrual component of earnings.

H1: The persistence of current earnings performance is decreasing in the magnitude of the accrual component of earnings and increasing in the magnitude of the cash flow component of earnings.

Investors should look at information from both income statements and cash flow statements to understand where the earnings come from.

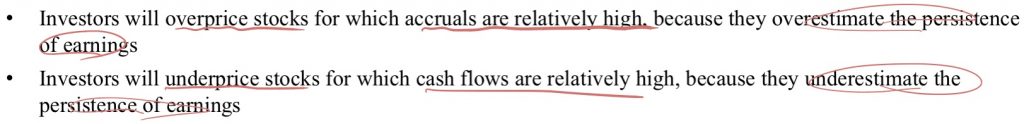

Investors are always unsophisticated and fail to unscramble the true cash flow implications of accounting data.

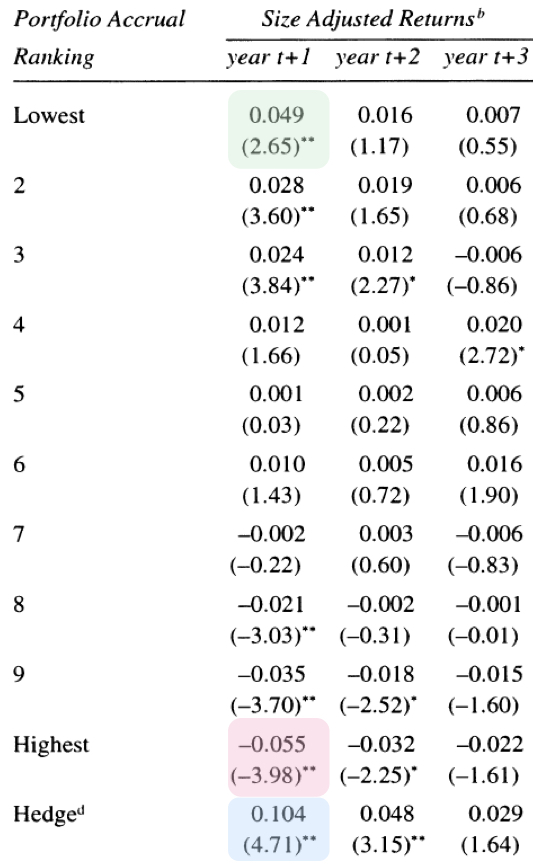

H2(i): The earnings expectations embedded in stock prices fail to reflect fully the higher earnings persistence attributable to the cash flow component of earnings and the lower earnings persistence attributable to the accrual component of earnings.

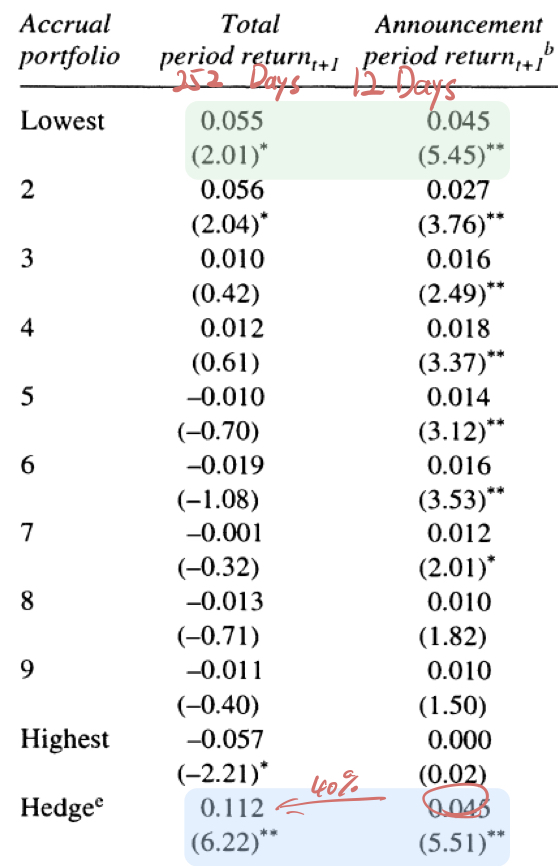

H2(ii): A trading strategy taking a long position in the stock of firms reporting relatively low levels of accruals and a short position in the stock of firms reporting relatively high levels of accruals generates positive abnormal stock returns.

H2(iii): The abnormal stock returns predicted in H2(ii) are clustered around future earnings announcement dates.

Research design

- Earnings —> EBIT

- CF == Earnings – accruals

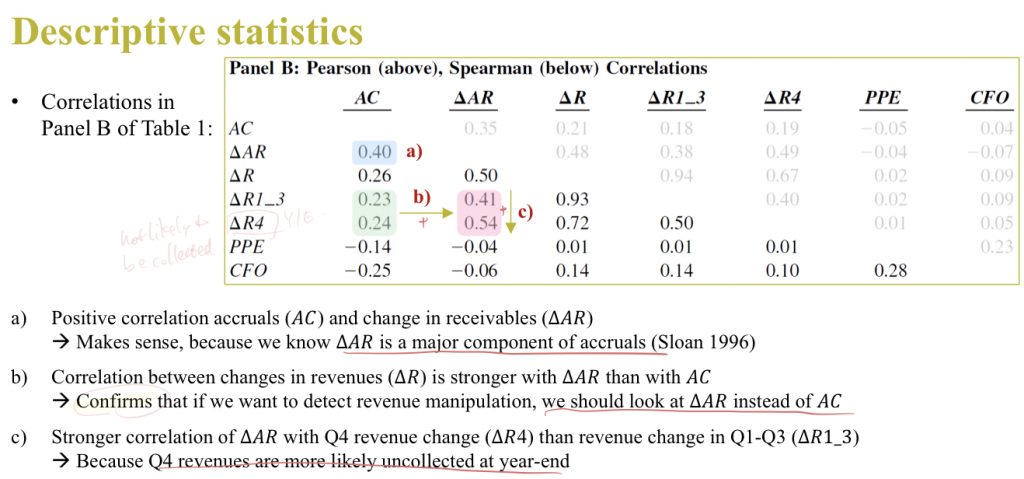

Descriptive statistics

Most changes in accruals come from changes in current assets. (Receivables and inventory)

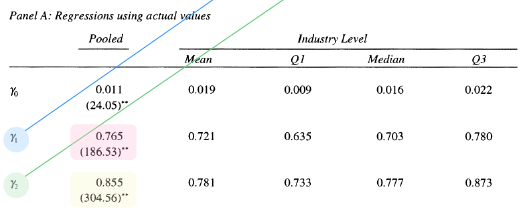

Results

H1: ?1 < ?2

Accruals are less persistent than cash flows.

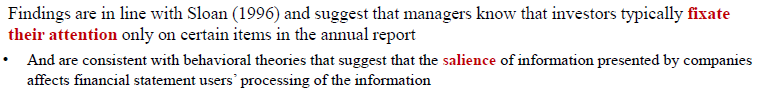

- Investors do not fully understand the difference in persistence.

- Investors fixate on earnings and do not look at accruals and cash flows components.

- Investors over-estimate the persistence of accruals.

H2(ii)

H2(iii)

Theories on users’ information processing

- Decision makers typically have “limited attention” and are not able to completely process all of the information that is presented to them.

- A decision can be informed by multiple pieces of information; in practice, however, attention should typically be directed only to a subset of the information. It is not possible to process all information.

Investors will neglect some pieces of information. This leads to mispricing.

What matters is how salient the information is presented to investors.

Week 04 Tutorial

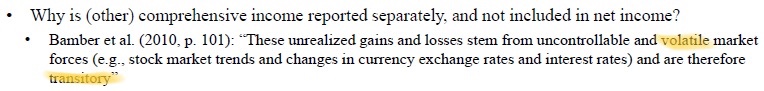

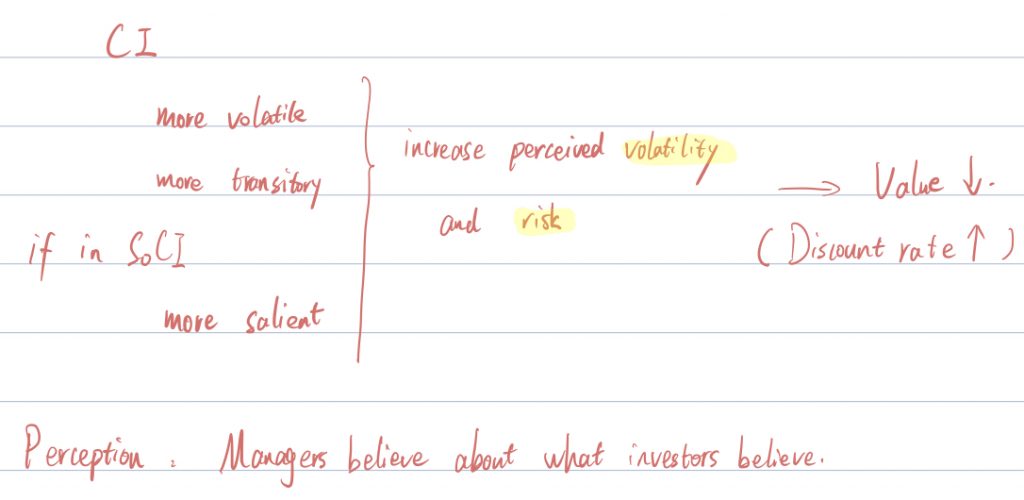

Paper 10 Bamber et al. (2010)

CI == Total change in shareholders’ equity (net of dividends, buybacks and share issuances)

NI + OCI = CI

OCI impacts equity but is not recognized in net income.

Issues

Firms can report CI either in the income-statement (performance reporting) or in the statement of changes in shareholders’ equity.

Managers believe the location matters, and they say investors will process these information differently when reported in performance statement v.s. changes in equity.

OCI makes CI more volatile.

Investors should focus on the volatility of the company’s core operations, but by presenting CI in this way, it’s likely that investors will limit their attention to focus too much on CI number.

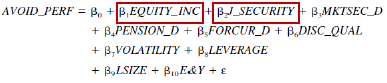

Hypothesis

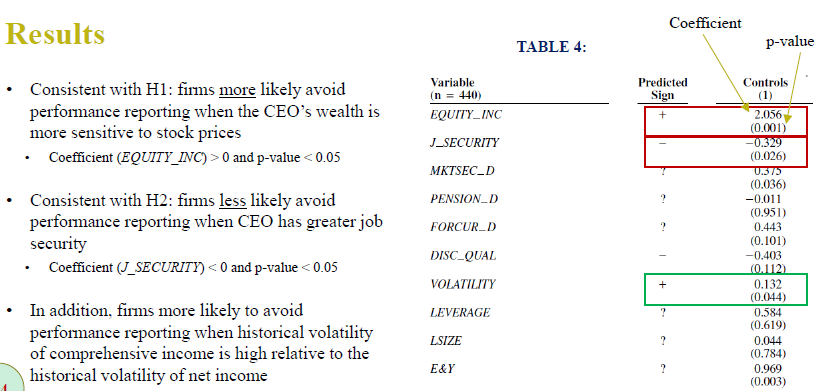

H1: The likelihood that a firm avoids reporting comprehensive income in a performance statement increases in the power of the CEO’s equity based incentives.

H2: The likelihood that a firm avoids reporting comprehensive income in a performance statement decreases as the CEO’s job security increases.

Research design

Measuring equity based incentives: the sensitivity of a CEO’s wealth that results from a hypothetical one percent change in the stock price.

Measuring CEO job security using corporate governance variables:

- CEO-Chair duality (+)

- Percentage of outsiders on the board of directors (-)

Results

Summary

Paper 11 Jung et al. (2018)

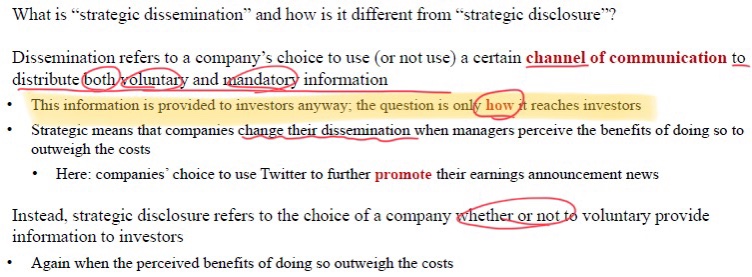

Strategic Dissemination

How firms communicate information with investors. Information is already out there.

The Twitter users who browsing financial information are less-sophisticated investors. They suffer from limited attention and information processing constraints. If the information is shown less saliently, it is more likely to be ignored by those investors.

- Broader dissemination increases public awareness of company disclosures and increases investors’ recognition of the firm.

- Firms can use Twitter to broaden dissemination and overcome a lack of investor attention.

Hypothesis

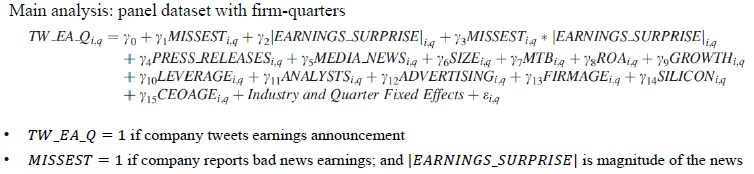

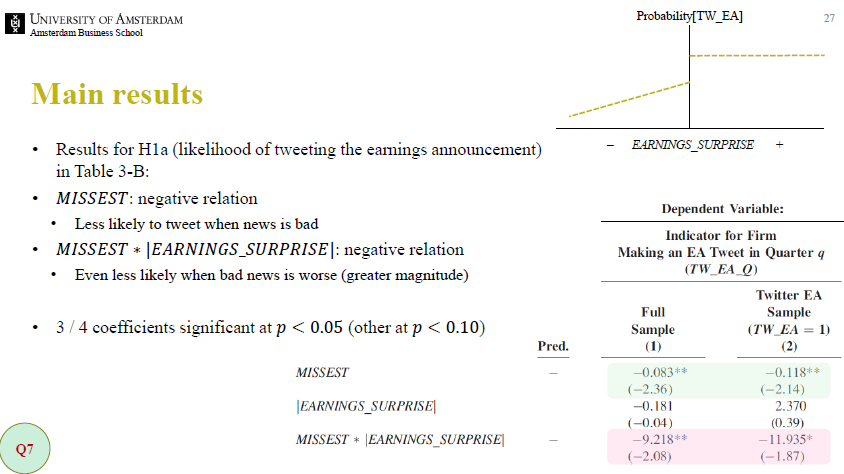

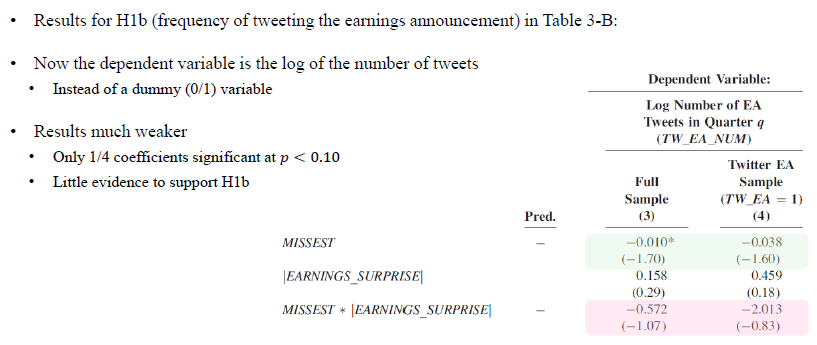

H1a: Strategic dissemination is associated with the direction of the news; firms are more (less) likely to disseminate good (bad) news over social media.

H1b: The extent of strategic dissemination is associated with the direction of the news; within the same quarter, firms tend to send more good news (fewer bad news) tweets over social media.

Results

Most important insights: firms are less likely to tweet bad earnings news when they have more retail (less sophisticated) investors, and when they have more followers.

Week 05 Lecture

Earnings management

Managers’ intentional over- or understatement of earnings to achieve a particular objective and thereby influence users’ perception of company performance.

- Managing accruals: aggressive recognition of revenues, deferring costs, understatements of liabilities

- Managing real activities: cutting R&D, using discounts

Earnings == CF + accruals

So, we can examine accruals to identify the possibility of earnings management.

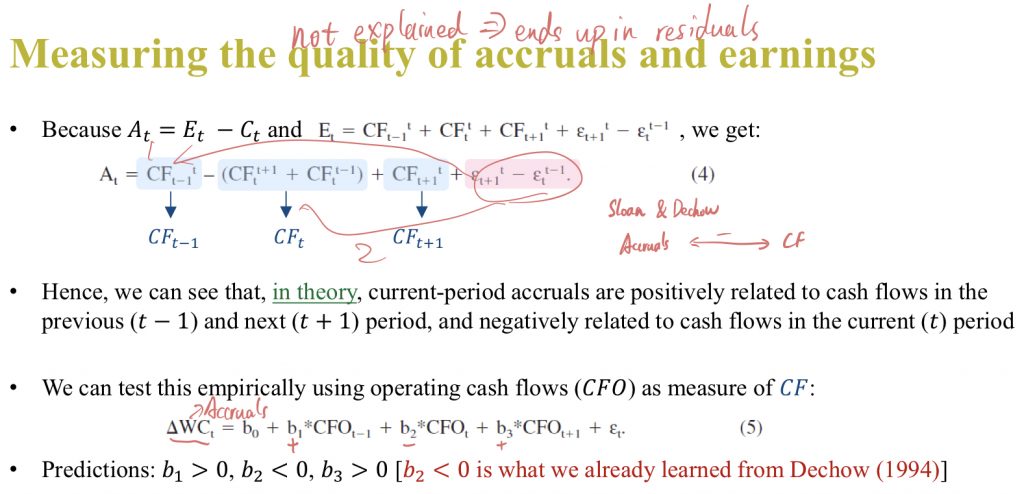

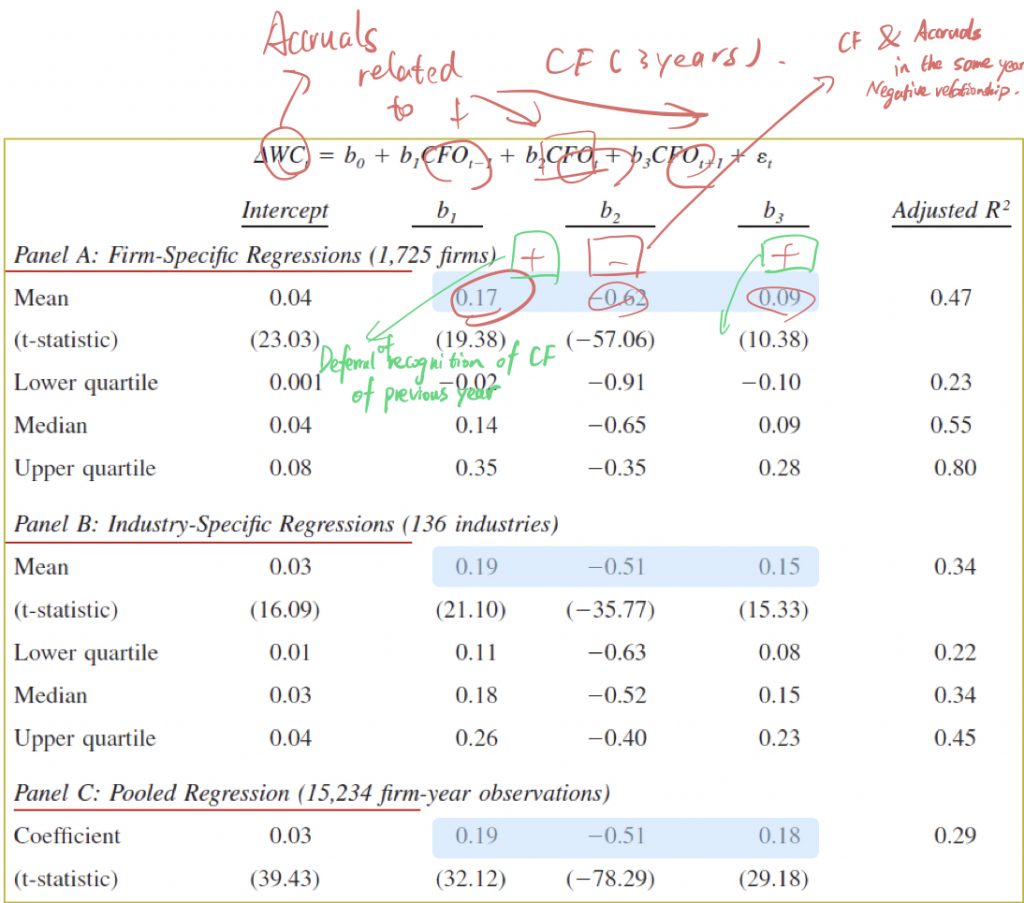

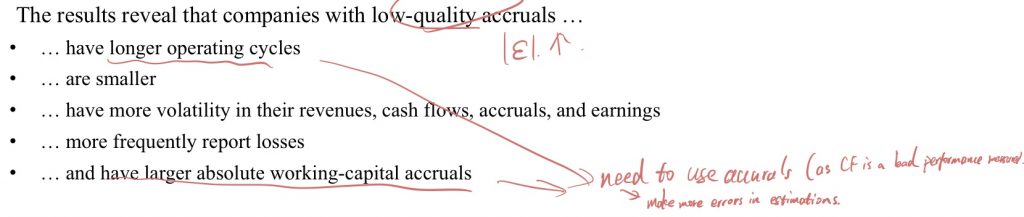

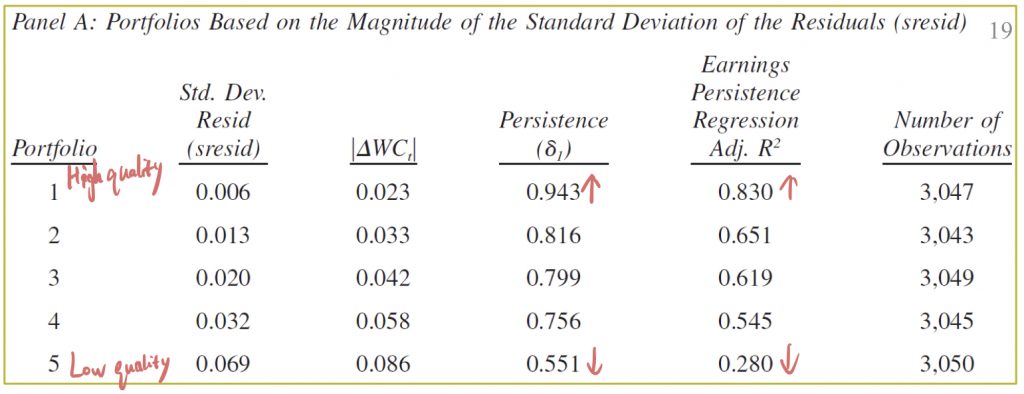

Paper 12 Dechow and Dichev (2002)

Focus on errors in accruals driven by unintentional errors.

The quality of accruals is lower if there are bigger prediction errors in accruals.

The quality of accruals and earnings is decreasing in the magnitude of estimation error in accruals.

If there is error in prediction, there will be an entry recording the correction of the estimation error.

Why there are errors?

- Future is uncertain.

- Management intent.

Regression residuals ↑, Quality of accruals ↓

Results

It’s expected that firms with low accrual quality will also have low earnings persistence.

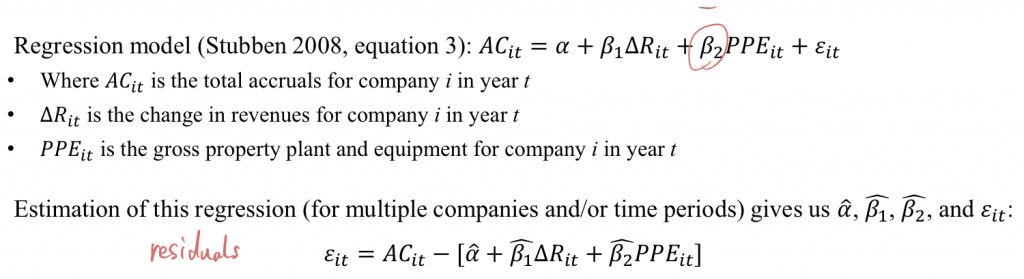

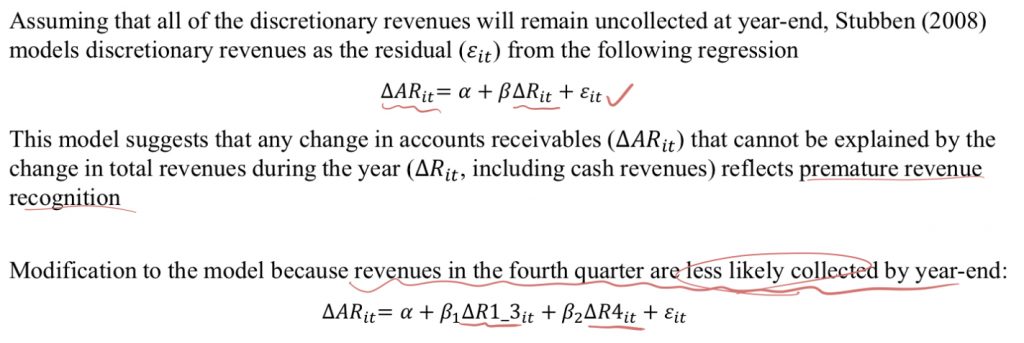

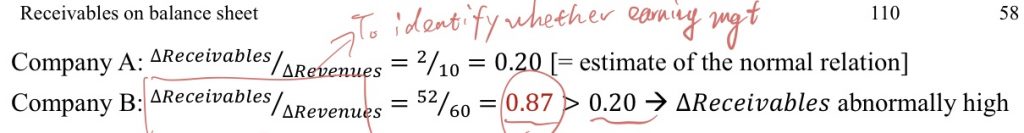

Paper 13 Stubben (2010)

This paper focuses on identifying when companies engaging in managing revenues as earnings management.

- True accruals: result from the company’s ongoing business. (nondiscretionary accruals)

- Managed accruals: result from earnings management. (discretionary accruals)

We can make an estimate of a company’s NDA for the year.

DA estimation is noisy and biased due to complex real-world processes that leads to NDA, e.g. depreciation rate changes.

Instead of focusing on aggregate accruals, it is better to examine specific accruals, like revenues.

Nondiscretionary revenues v.s. discretionary revenues

- Type 1 errors: Incorrectly classify a company as manipulator.

- Type 2 errors: Failing to classify a company as manipulator.

Revenue model is less biased and better specified than accrual models in identifying earnings managements.

Week 05 Tutorial

Paper 14 McVay (2006)

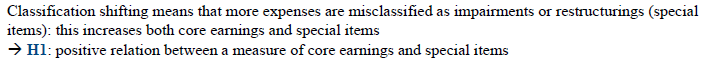

Classification Shifting

The deliberate misclassification of items within the income statement.

This involves shifting expenses down, or revenues up.

This does not change bottom-line net income.

Core earnings = revenues COGS SG&A

Company can manage core earnings number. It can lead to a misrepresentation of an earnings subtotal.

Analysts and investors typically place more attention on measures of “core earnings” that exclude transitory expenses like impairments and restructuring charges.

Investors fixate more on the core earnings measure.

Managers have incentives to exploit this fixation to inflate the company’s core earnings.

Link with non-GAAP earnings

Non-GAAP earnings ignore expenses that are not predictive of future performance. Similarly, core earnings exclude transitory expenses such as impairments. Those items tend to be excluded from core earnings by both managers and analysts.

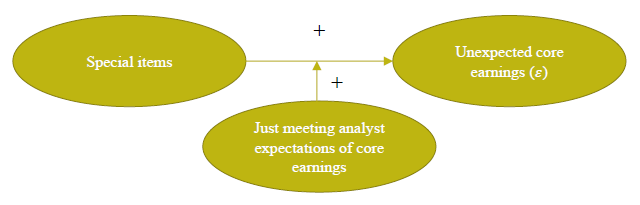

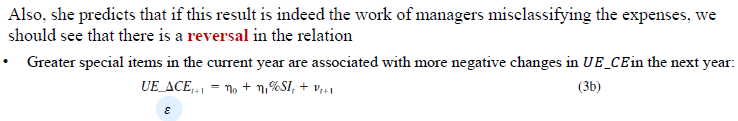

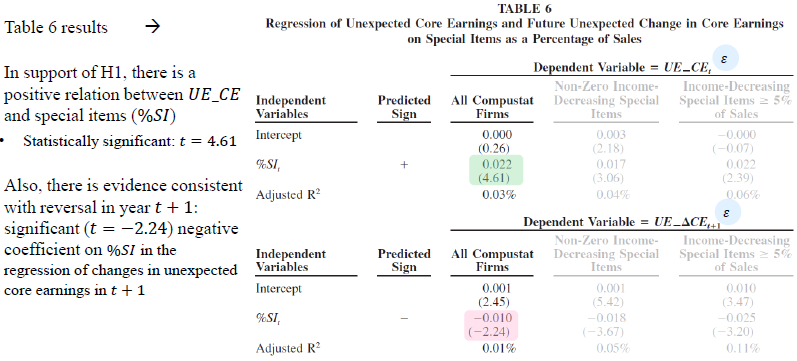

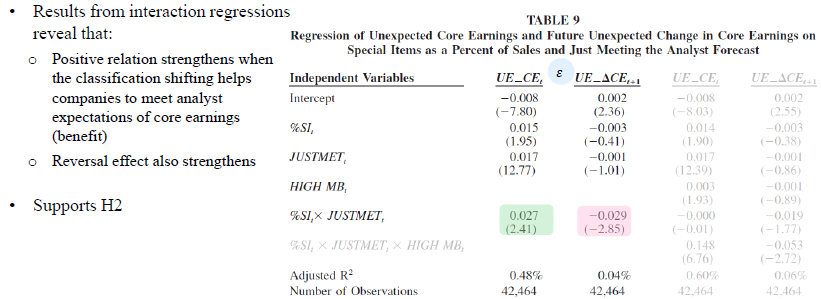

Hypothesis

The higher the line is, the more persistent this item is.

Because net income does not change, the shifting of expenses in the income statement is less likely to receive critical inspections by auditors and regulators.

H1: Managers classify core expenses as special.

H2: Managers classify more expenses as special in periods when the net benefits to classification shifting are expected to be greater.

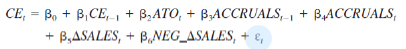

Research design

Residual is unexpected core earnings. Then there is a positive relation between UN_CE and SI.

Paper 15 Amiram et al. (2015)

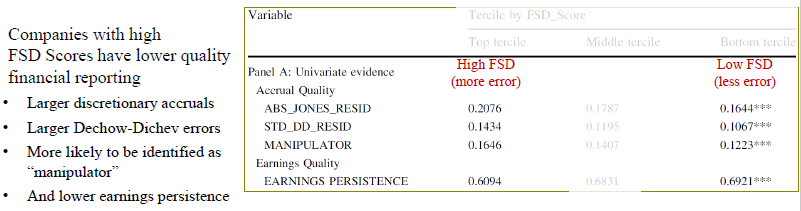

Create and evaluate a new measure of the level of error in financial statements.

Benford’s Law

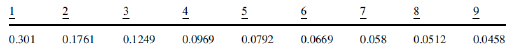

The first digits of all numbers in a dataset containing numbers of varying magnitude will follow a particular theoretical and mathematically derived distribution where the leading digits 1 through 9 appear with decreasing frequency.

Financial statements numbers is the mixture of different cash flows, so they should follow Benford’s Law.

When there is a manipulation, there will be deviation from the law.

The results of FSD correlate well with other measures.

The likelihood that these data may contain errors.

Week 06 Lecture

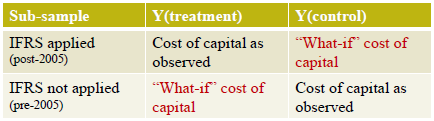

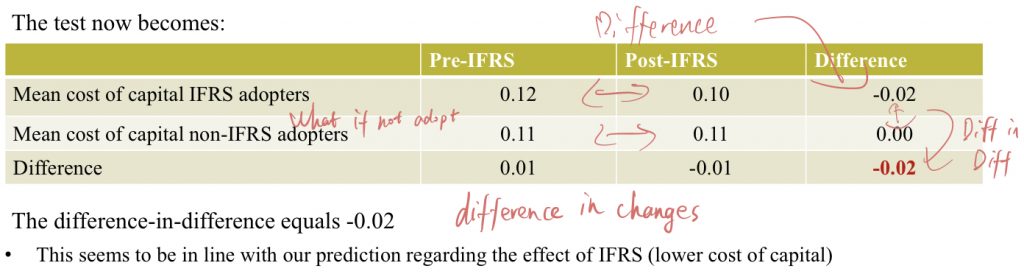

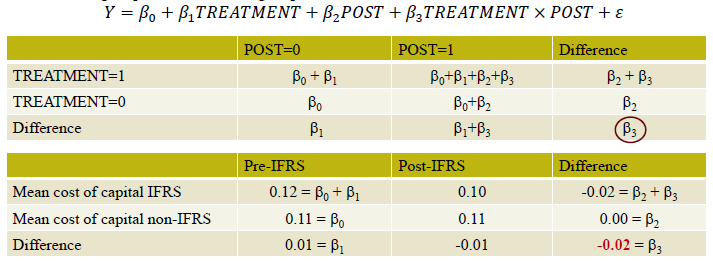

We cannot rule out other explanations, so difference-in-difference analysis is needed.

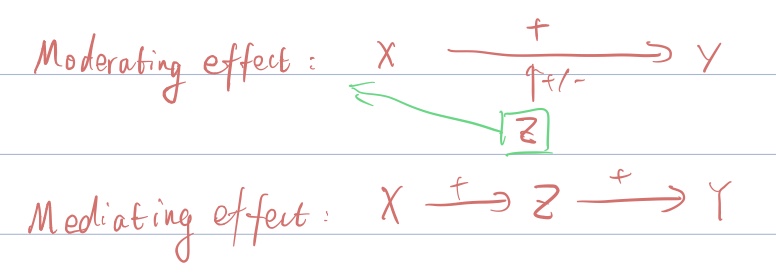

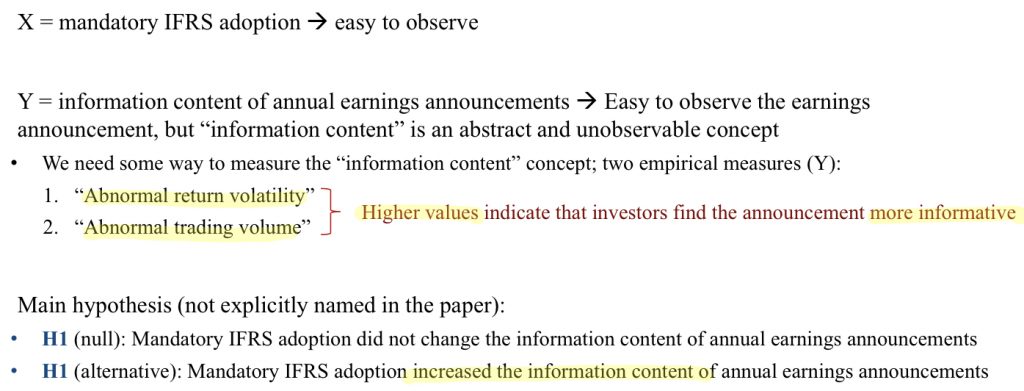

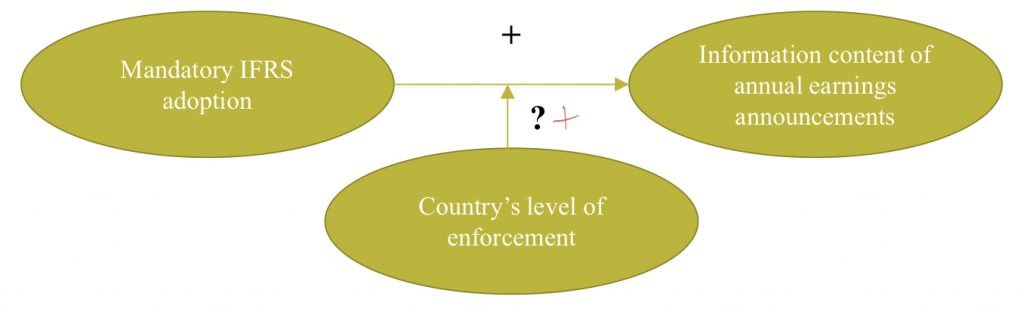

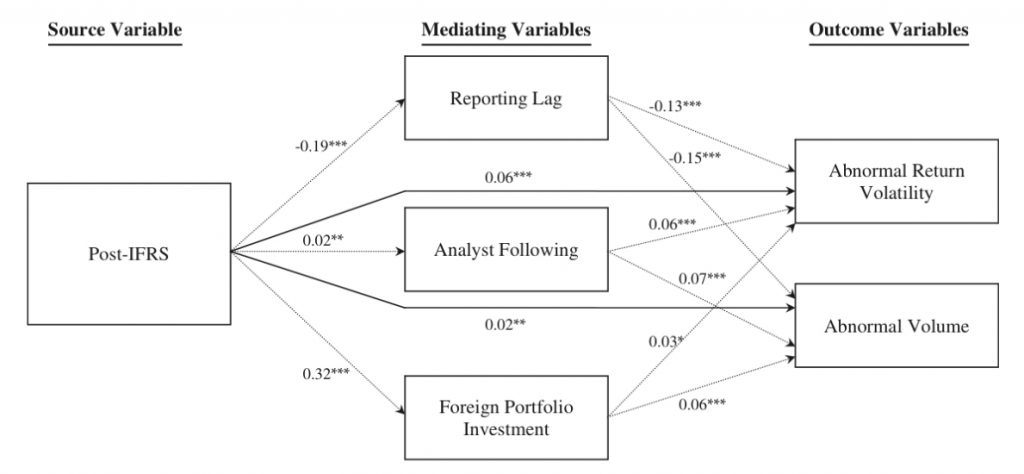

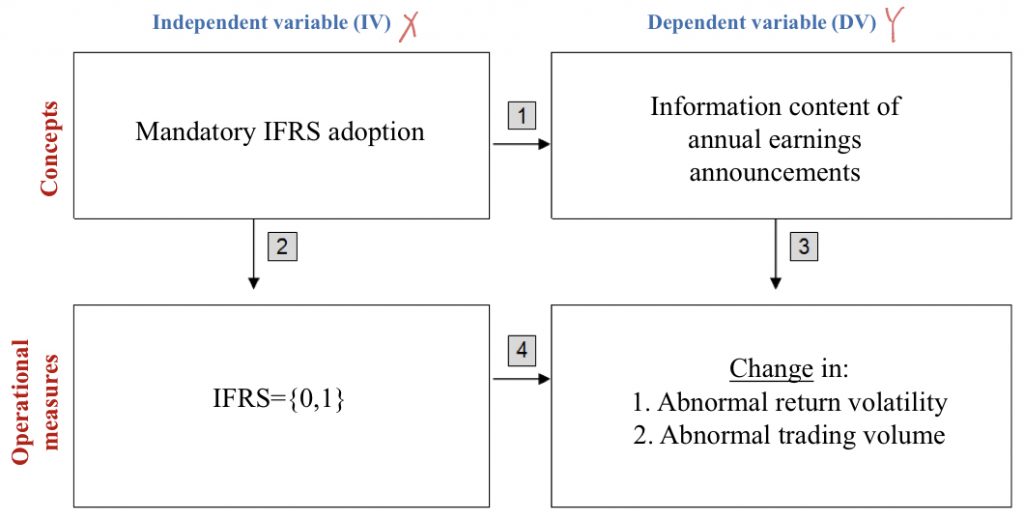

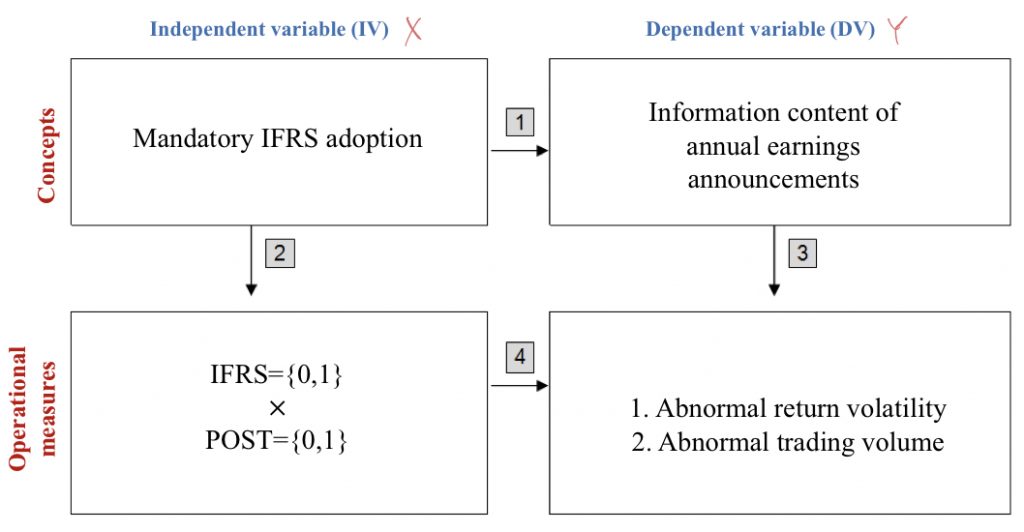

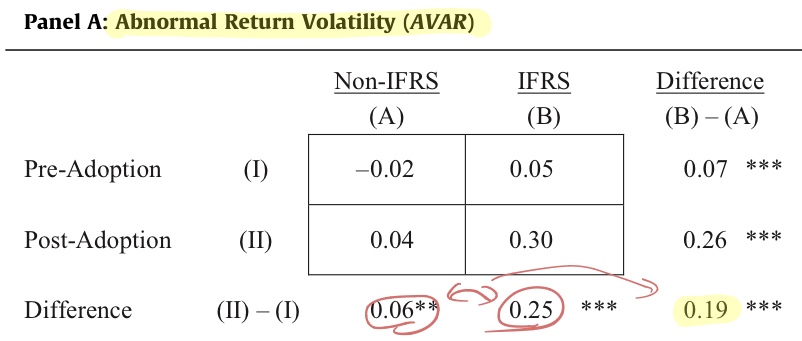

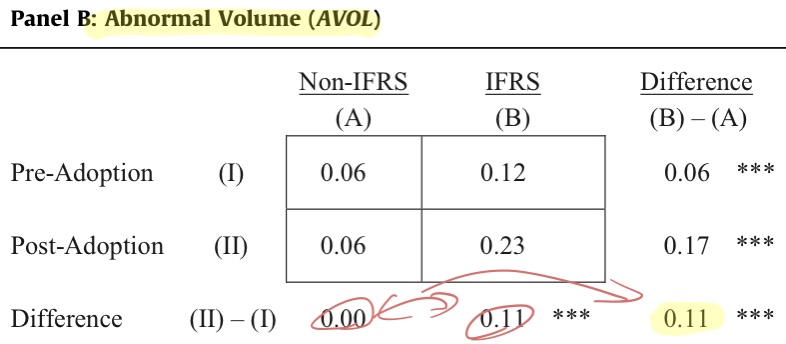

Paper 16 Landsman et al. (2012)

The economic consequences of adopting IFRS

Main research question: Does mandatory adoption of IFRS increase the “information content” of annual earnings announcements?

Do investors perceive earnings announcement of the company as more informative to company value after adopting IFRS?

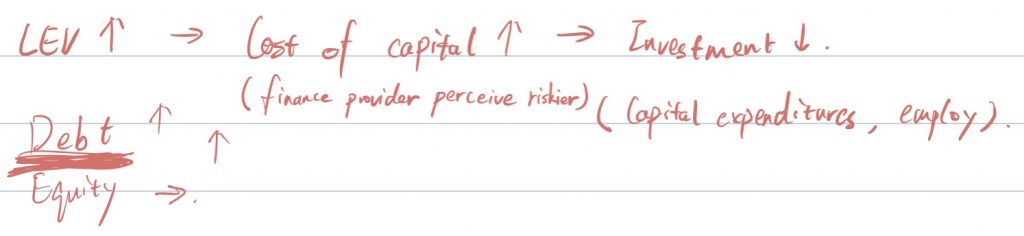

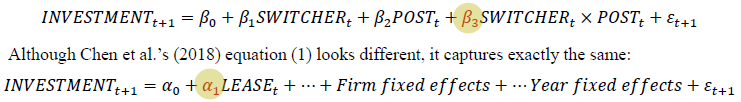

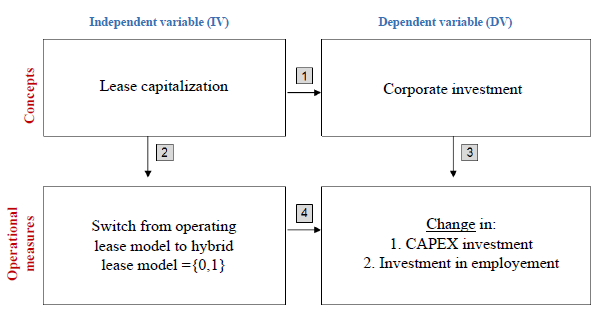

Paper 17 Chen et al. (2018)

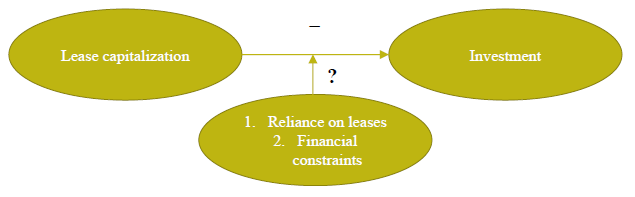

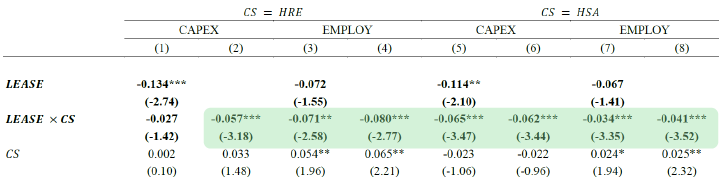

Real effects of changes in lease capitalization rules.

The economic consequences of changes in accounting rules.

Do changes in accounting rules change the operating, investing, or financing decisions that managers make for the company?

Decision making (Change the way they do business)

- Operating lease model —> Hybrid lease model

- Hybrid lease model —> Capital lease model

Move from partial capitalization to full capitalization.

Companies should disclose details that should help financial statement users to calculate the present value of lease obligations.

Finance provider may suffer from limited attention that they may react to information disclosed differently from those recognized.

Research design

- Companies in 6 countries switching from the operating model to the hybrid model in 2003 or 2005.

- Companies from countries using the hybrid model in all years 1995 2010

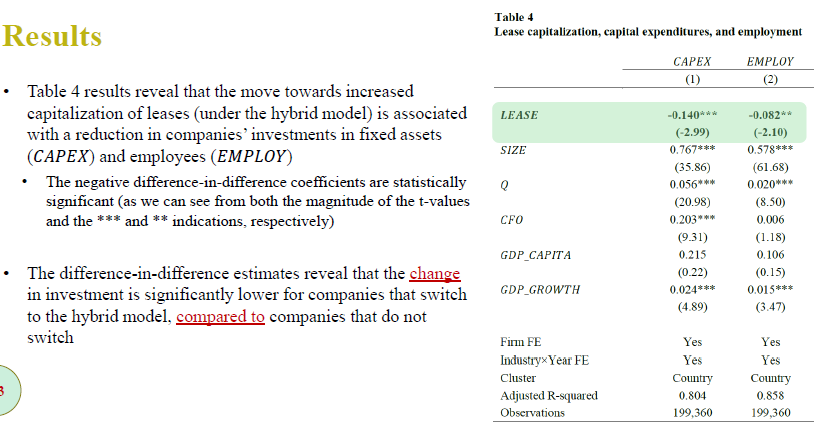

Results

Summary

Users rely more on salient information.

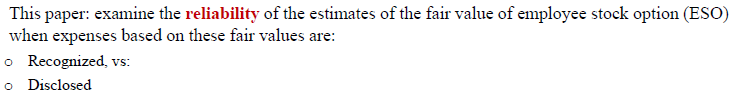

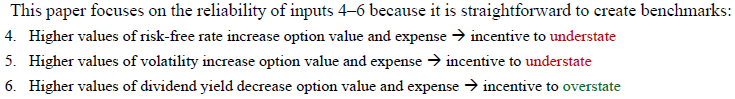

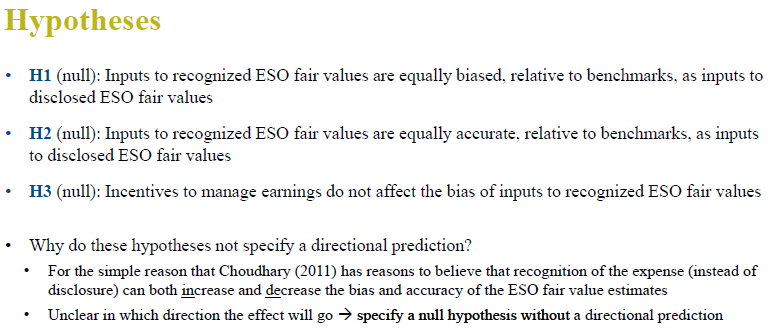

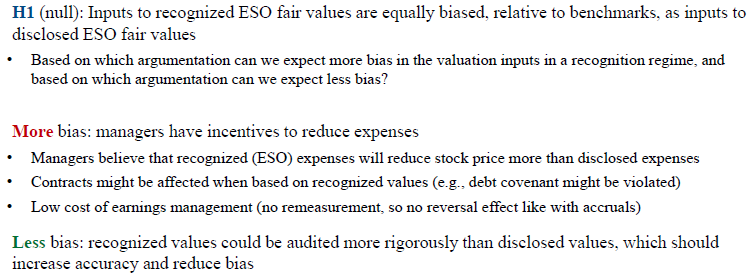

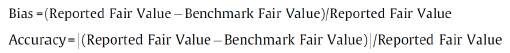

Paper 18 Choudhary (2012)

Investors tend to attach more weight to information that is more salient or visible to them, given their limited attention and information processing constraints.

Research design

Results

发表评论