Week 1 Lecture

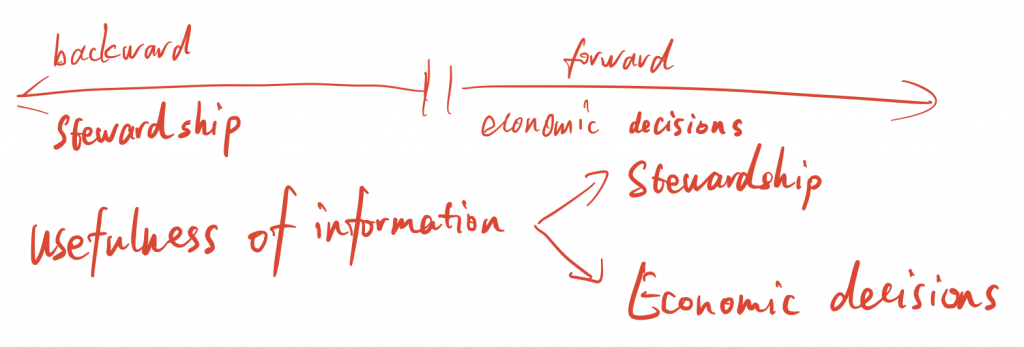

Two objectives of financial statements

- stewardship (backward)

- economic decisions (forward)

Principles v.s. Rules

- Principles: Guide / Substance

- Rules: Clear / Form

Pros and cons of rule-based system

- Pros: reflect economic status

- Cons: tool to manipulate

Relevance

Information is relevant if it is capable of making a difference to the decisions made by users.

Steps

- Definition

- Recognition

- Measurement

- Disclosure

Definitions

Asset

A present economic resource controlled by the entity as a result of past events.

An economic resource is a right that has the potential to produce economic benefits.

Liability

A present obligation of the entity to transfer an economic resource as a result of past events.

An obligation is a duty or responsibility that the entity has no practical ability to avoid.

Equity

The residual interest in the assets of the entity after deducting all its liabilities.

Week 1 Tutorial

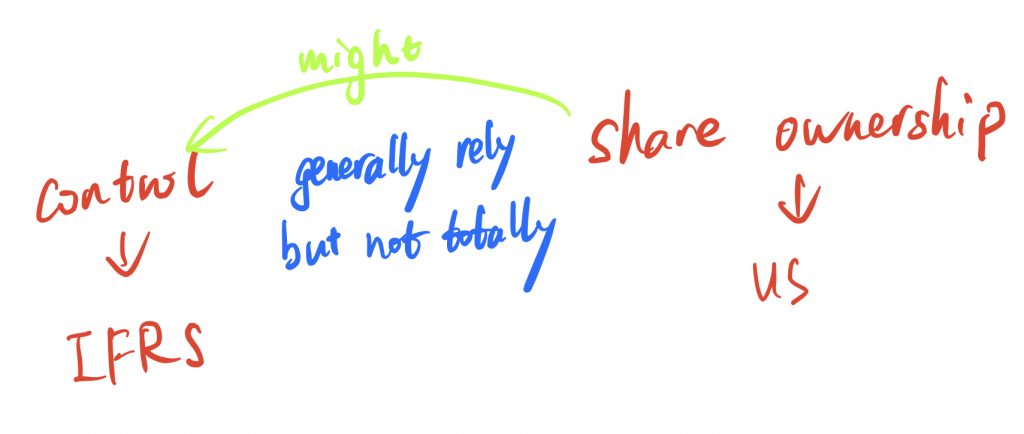

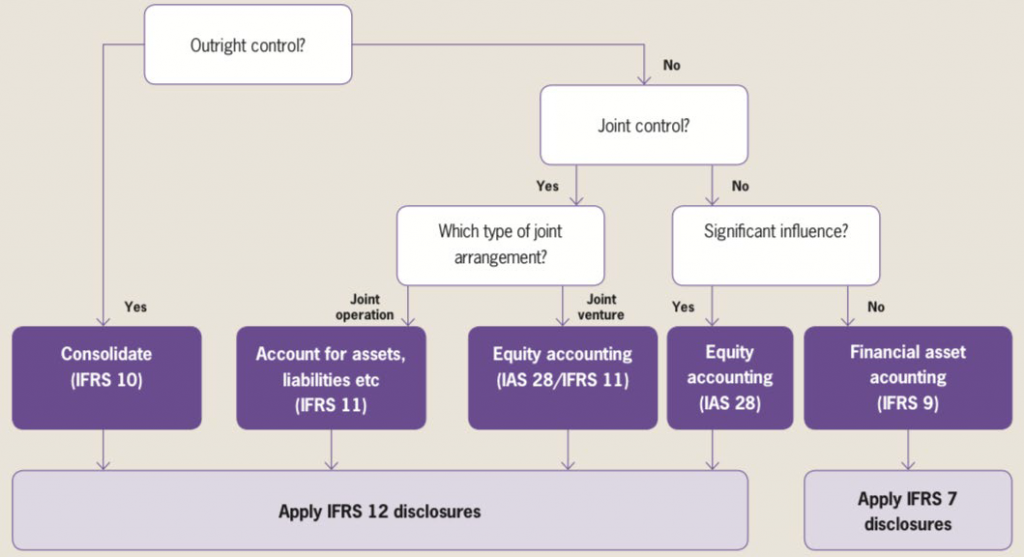

Whether to fully consolidate?

Segmental disclosure

- Geographical regions

- Operations

- End customers

- Pros: have a more detailed understanding of the company

- Cons: not always comparable

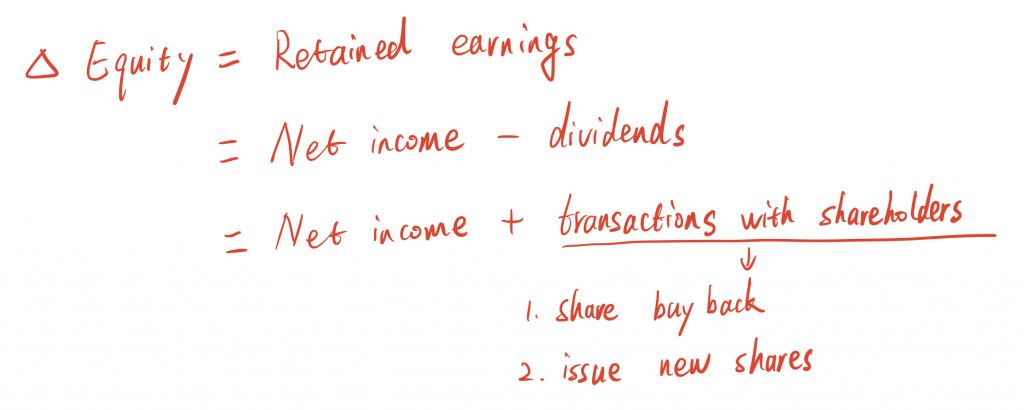

Changes in shareholders’ equity

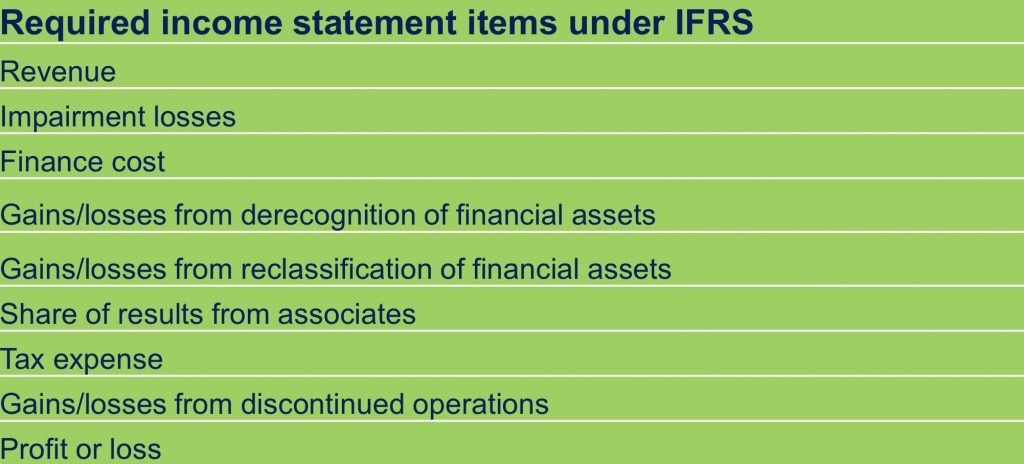

Income statements

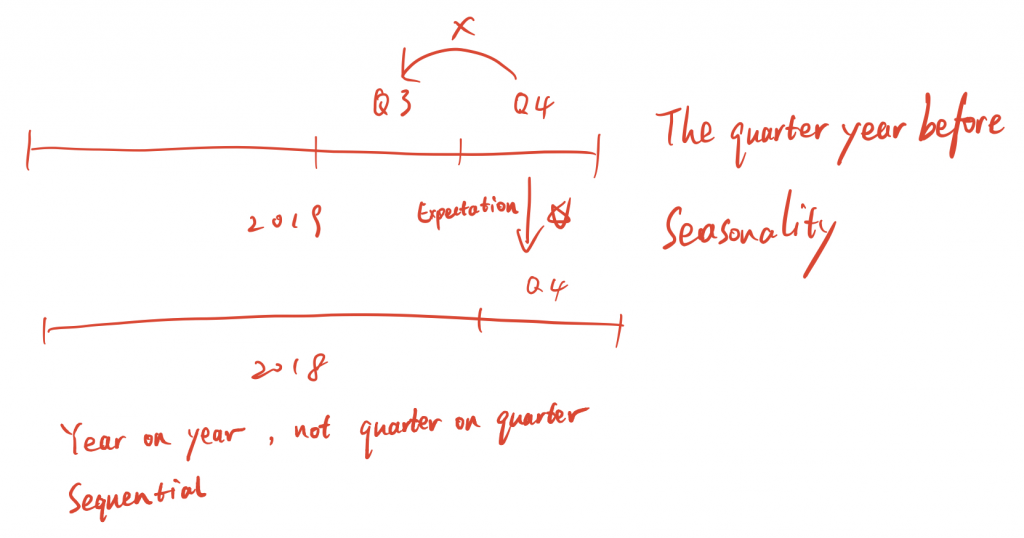

Role of income statements

- Evaluate the past performance of the company

- Provide a basis for predicting future performance

- Help assess the risk and uncertainty of achieving future cash flows

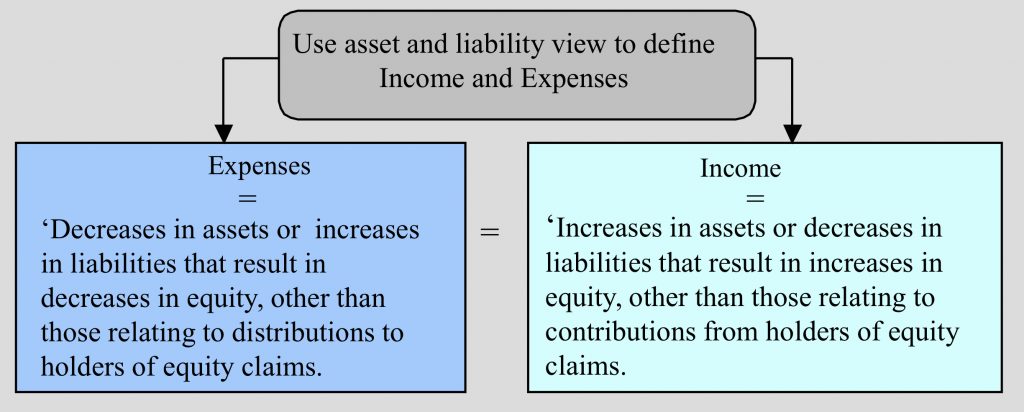

ASSET AND LIABILITY VIEW

资产负债表观

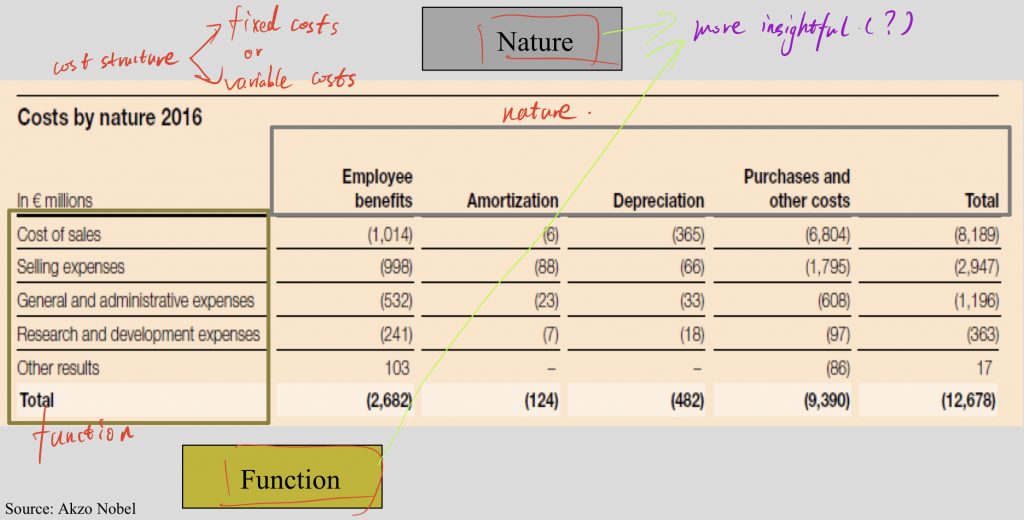

Income statement presentation

- Costs by function: Cost of sales, Selling, General & Administrative Expenses

- Costs by nature: Personnel, depreciation and amortization

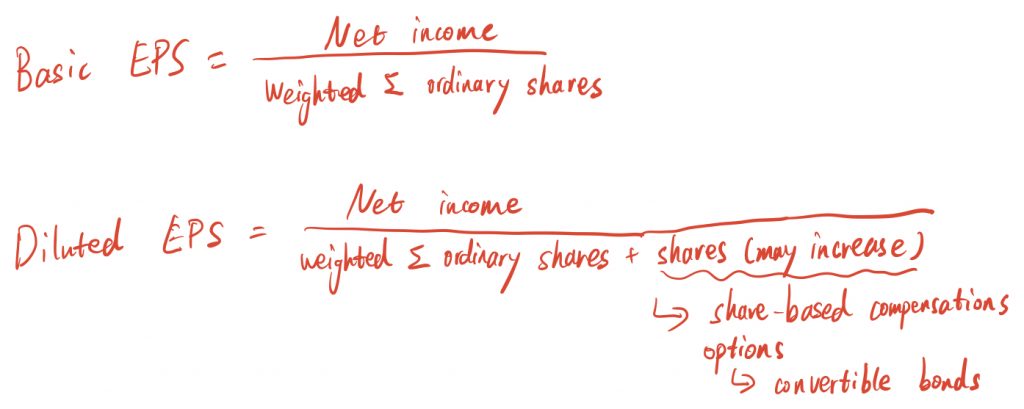

EPS

Why start-ups choose share-based compensations?

- not have money to pay salaries

- ensure employees on board

OCI

There is no clear definition for OCI. Whether an income is recognized in net income or OCI is decided on a case-by-case basis.

The existence of OCI is for a better statements understanding.

Cash flow statements

Components

- Cash from operating activities CFO

- Cash from investing activities CFI

- Cash from financing activities CFF

Presenting

- Direct cash flow statement: Starts with cash received from customers

- Indirect cash flow statement: Starts with profit and reverses non-cash items in earnings

Week 2 Lecture

PPE

Definition

- Tangible items

- With a specific use within the entity

- That are expected to be used during more than one period

PPE are tangible assets that are held by an entity for:

- use in the production or supply of goods or services

- for rental to others

- for administrative purposes

Initial recognition

Subsequent expenditure

Cost recognised as an asset if:

• it is probable that economic benefits will flow to the entity, and;

• the cost can be reliably measured

Pros of lease

- lower cash out flow

- flexibility

Initial measurement

PPE is initially measured at cost, which includes:

• Purchase price (at fair value);

• Directly attributable costs required to bring the asset to the location and

condition necessary for it to operate; and,

• Initial estimate of costs of dismantling, removing the item or restoring

the site. (Nuclear plant)

Borrowing costs

Subsequent measurement

Cost model or Revaluation model (×)

Repair and maintenance costs are expensed as incurred, not capitalised.

Maintenance costs are expensed as incurred. However, maintenance cost that extend the useful life of an asset or increase its value are capitalized.

Depreciation

Match revenues to expenses.

Component approach (E.g. engines) capitalized or expensed

Derecognition

Disposal

Proceeds are recorded in profit or loss as gains or losses, not revenue.

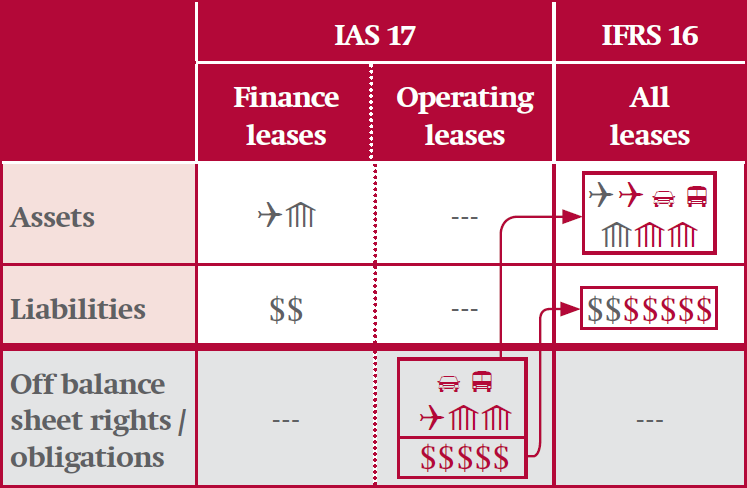

Leasing

Old classification

- Operating lease: off balance sheet

- Finance lease: on balance sheet

Classification as a finance lease may have the following adverse impacts on a lessee’s financial statements:

- Increases non-current assets – thus reducing return on asset ratios

- Increases non-current liabilities – adversely affecting debt/equity ratios

- Depreciation and interest charges may exceed lease payment in early years of lease – resulting in lower profits

Lease v.s. service

- Lease: Customer has the right to control

- Service: Supplier has the right to control

Recognition

IFRS 16 requires a lessee to recognise assets and liabilities except for short term leases and leases for low-value assets.

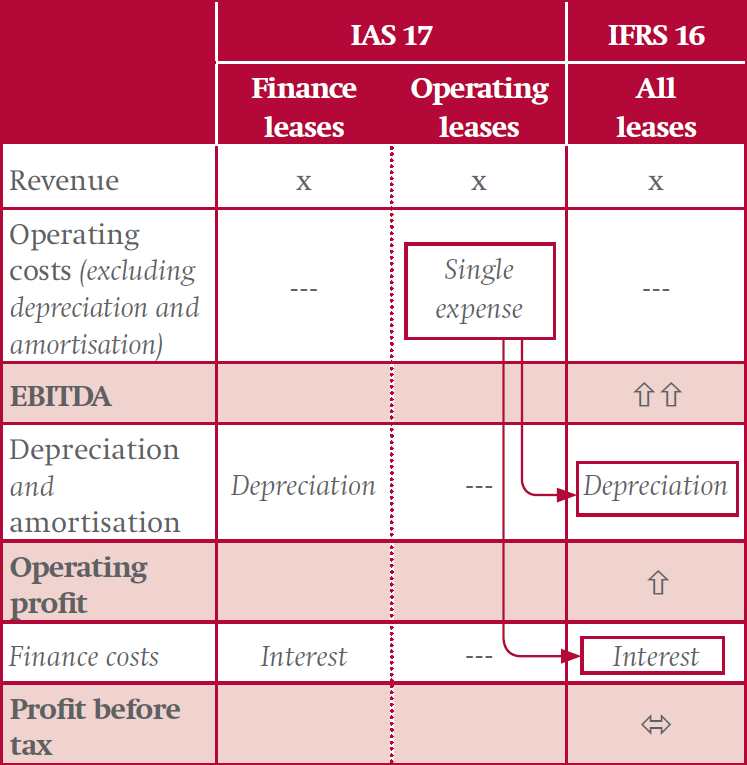

Impacts to cash flows

Changes in accounting requirements do not change amount of cash transferred between the parties to a lease.

Consequently, IFRS 16 will not have any effect on the total amount of cash flows reported. However, IFRS 16 is expected to have an effect on the presentation of cash flows related to former off balance sheet leases.

IFRS 16 is expected to reduce operating cash outflows, with a corresponding increase in financing cash outflows, compared to the amounts reported applying IAS 17. This is because, applying IAS 17, companies presented cash outflows on former off balance sheet leases as operating activities. In contrast, applying IFRS 16, principal repayments on all lease liabilities are included within financing activities. Interest payments can also be included within financing activities applying IFRS.

Week 2 Tutorial

Intangibles

Definition

- Non-monetary

- Identifiable (Separable)

- No physical substance

Tangible assets are more difficult to be separated from company.

Separable is capable of being separated or divided from the entity and sold, transferred, licenced, rented or exchanged.

Recognition

- Internally generated: Expensed

- Externally acquired: Capitalized

Whether externally acquired intangible assets can be reliably measured?

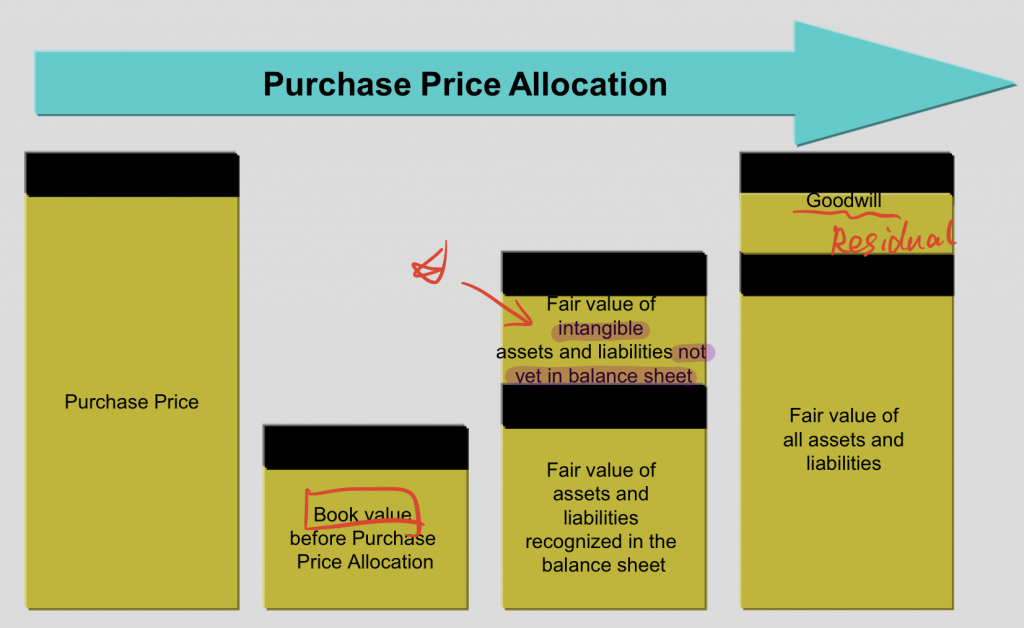

Proceeds for company as a whole v.s. tangible assets (purchase price allocation)

The conflict arisen by measurement

Historical cost v.s. Current value

Subsequent measurement

| Goodwill | Impairment only | / |

| Intangibles – Finite life | Amortisation & impairment | E.g. licences, patents |

| Intangibles – Indefinite life | Impairment only | E.g. brands |

Assets are underestimated due to the expensed cost for organic generated intangible assets, raising the difference between book value of equity and market capitalization at some companies. Another reason is the expectation of future cash flow.

R&D

Criteria

- The technical feasibility of completing the intangible so that it will be available for sale or use.

- Its intention to complete the intangible asset and use or sell it.

- Its ability to use or sell the intangible asset.

- How the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset.

- The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset.

- The ability to measure reliably the expenditure attributable to the intangible asset during its development.

In some sections, the window for capitalization is very short.

Firms with larger amounts of intangibles have higher cost of capital.

Disclosure might be the solution.

Week 3 Lecture

Source of control:

- voting rights

- rights to receive dividends

- rights to liquidation

If fully consolidated, the amount of revenue should increase, but the auditor should get a confirmation of control from NCI.

Net income allocated to NCI can be negative, meaning that the subsidiary is loss making.

The impact of NCI is shown in the statements of cash flow as dividends.

If NCI has a put option for their stake in the subsidiary, the non-current liability should be recognised. Then fair value module should be adopted instead of historical cost model.

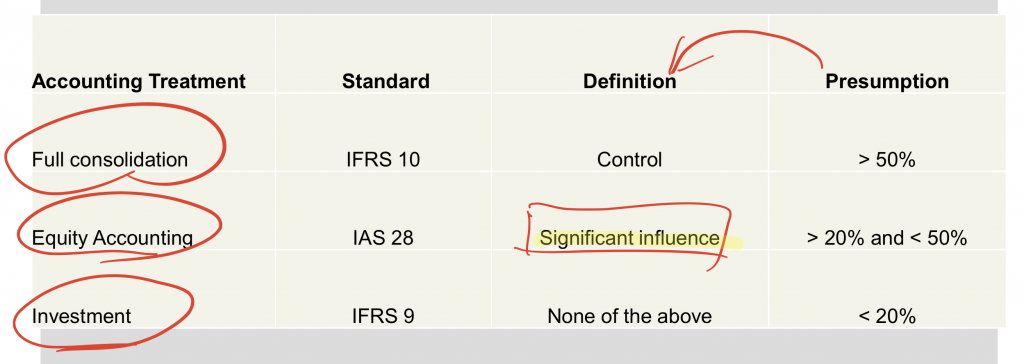

Equity method

Balance sheet

Historical cost model, adjusting the historical purchase cost against profits and losses.

Initially, the investment is accounted for at historical cost, and over the course of the investment horizon, gains and losses as well as contributions incurred by investee adjusts the recorded investment total.

Income statement

The net income share of investee that corresponds to the parent company is reported in the income statement. Dividends received are not treated as income, but as a reduction of the investment’s carrying value.

Cash flow statement

The net income corresponding to the investor is subtracted from net income before taxes to calculate cash flow from operations. Dividends received are considered as positive cash flow.

Financial instruments

If there is control or significant influence, historical cost accounting is applied. If non of the above (available for sale), the equity investment is recognised at fair values. (IFRS 9)

The value change in asset available for sale is recognised in OCI.

Week 3 Tutorial

No merger accounting

Acquisition accounting:

Bidder – purchase price – target

Purchase Price Allocation

PPA -> FV NAV (Net asset value)

G/W = Purchase price – FV NAV

FV is different from the number on the balance sheet.

Goodwill

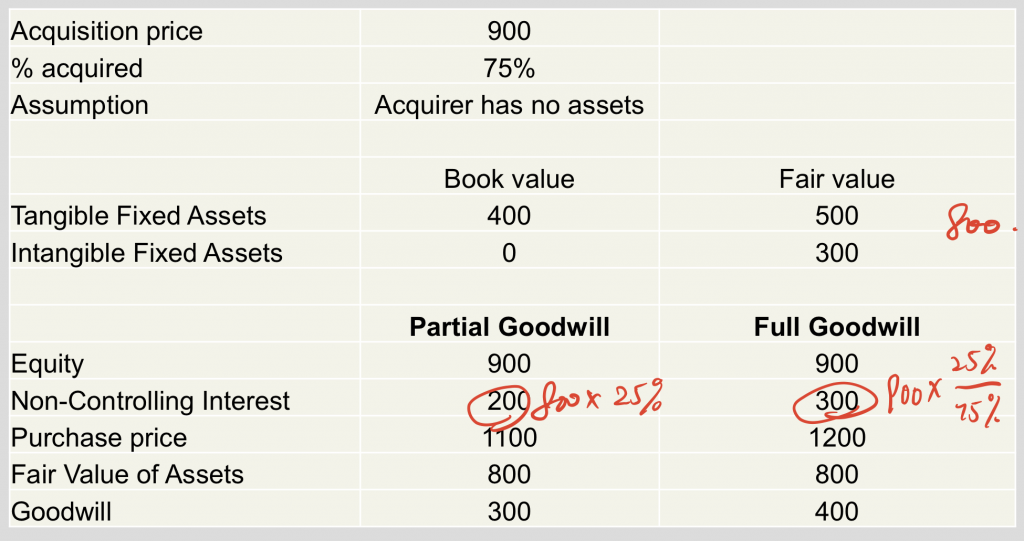

Partial / Full goodwill

- If 100% acquired, no matter which method to adopt.

- If not, company can make a choice on a case-by-case basis.

Negative G/W

Gain on purchase -> Profit in I/S

What does goodwill represent?

- Excess of the fair values over the book values of the acquiree’s recognised assets

- Fair values of other net assets not recognised by the acquiree

- Fair value of the “going concern” element of acquiree’s existing business

- Fair value from combining the acquirer’s and acquiree’s business and net assets

- Overvaluation of the consideration paid by the acquirer

- Overpayment (or underpayment) by the acquirer

CGU Impairment

The impairment loss should be firstly allocated to goodwill and then to other assets on a pro-rata basis based on carrying amount.

To be revalued to the higher of FVLCS and VIU.

Week 4 Lecture

IAS 32

A convertible bond:

- Loan (liability)

- Option (equity)

Financial asset / Financial liability / Equity instrument

Financial liability:

- Timing factor: Something you should repay at some point of time

- Amount factor: Unrelated to performance (No matter whether you have money

Preference share is a liability.

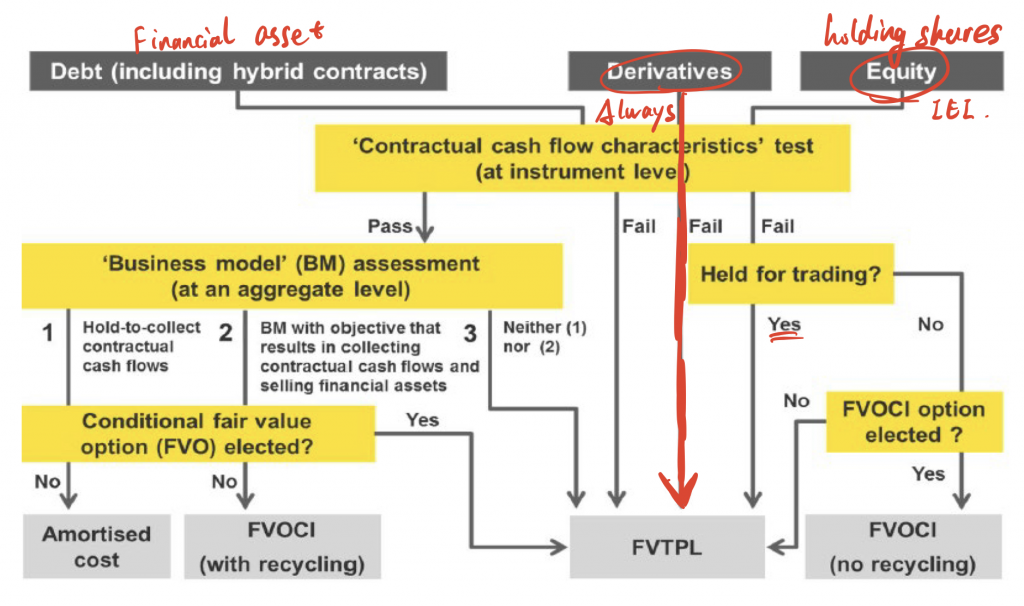

IFRS 9

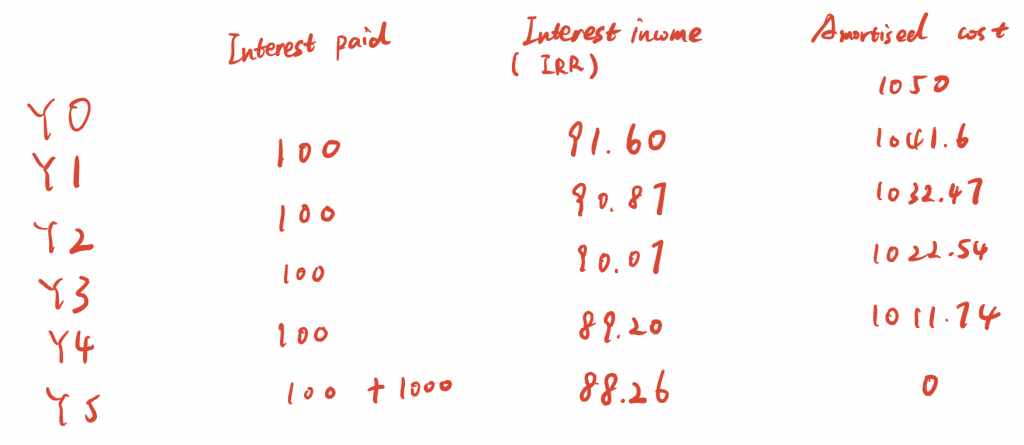

Amortised cost

Risks are embedded in FV (

Impairments

Week 4 Tutorial

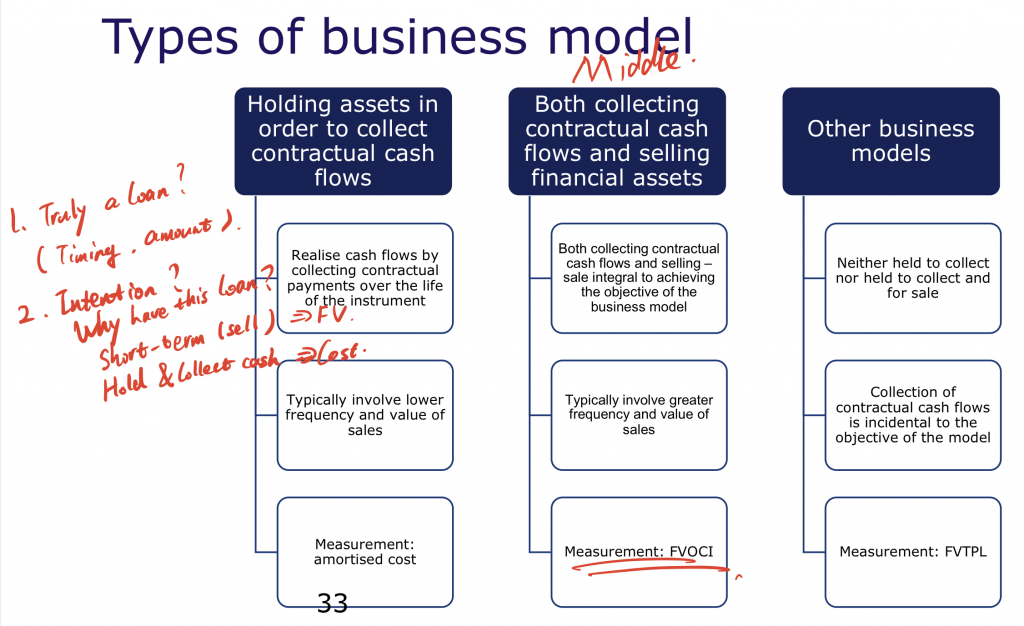

Default option: Fair value, Gain or loss through P/L

Historical cost doesn’t tell us relevant information.

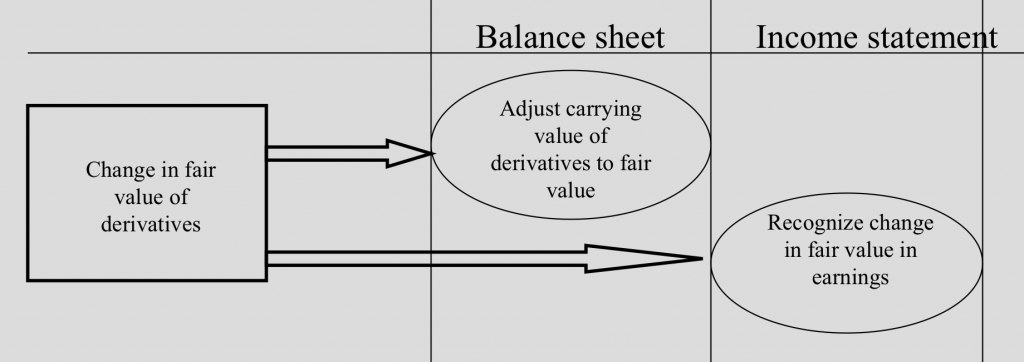

Default treatment for derivatives

Fair value, Gain or loss through P/L

Issues: Mismatch between gain (Eg. 2 years) and revenue (1 year).

Gain or loss on derivatives – Operation gain or loss

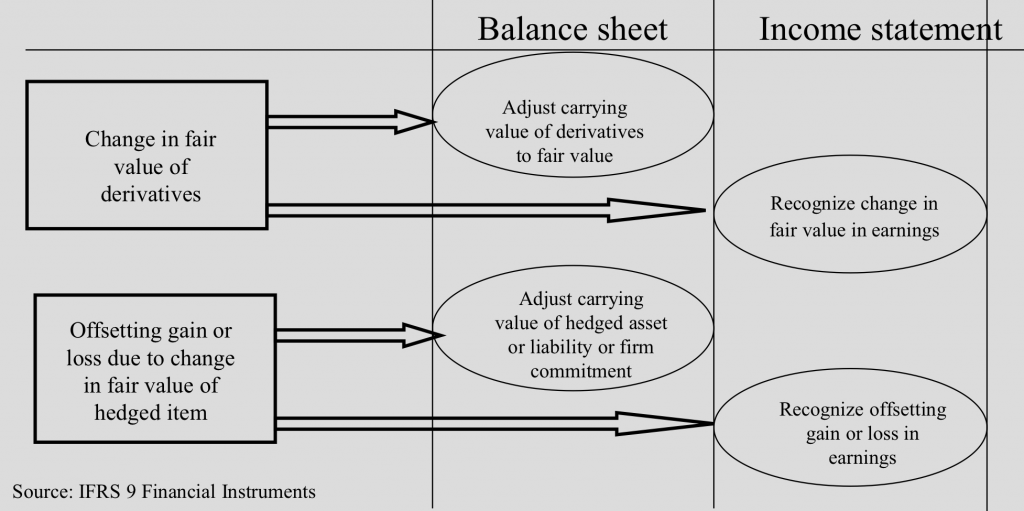

Fair value hedge

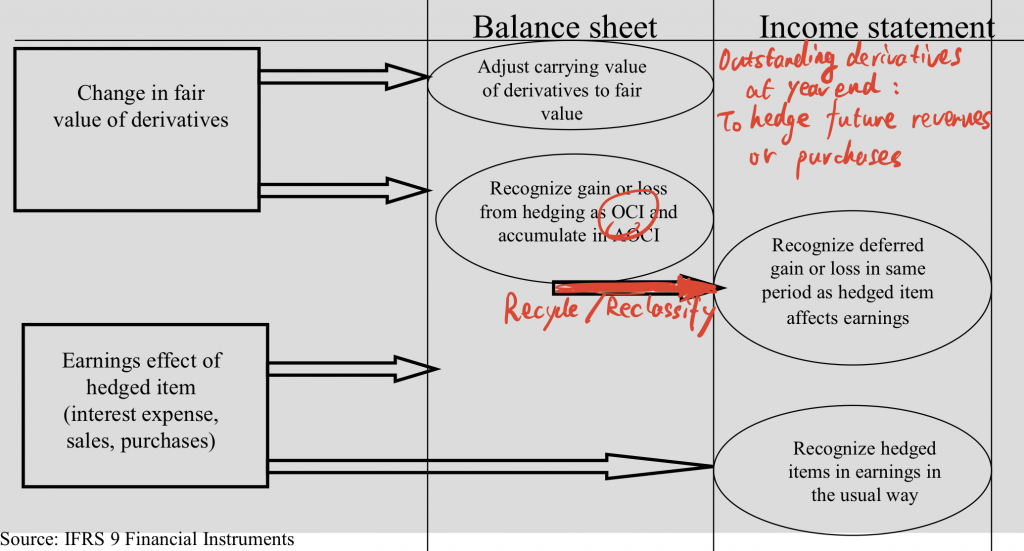

Cash flow hedge

To park gain or loss in OCI before being moved to P/L

To make hedge accounting easier:

- Pros: Let management tell what they really performance

- Cons: Manipulate ( Gain via RE, Loss via OCI )

Criteria for hedge accounting

If the hedge becomes ineffective, the accounting treatment should be moved from hedge accounting to default accounting treatment.

Hedge accounting’s aligning with company’s commercial hedging activities brings easier accounting treatment and better reflection.

Fair value v.s. Historical cost

- Fair value: Earnings are changes in value which are not helpful to forecast future earnings.

- Historical cost: Earnings reflect business model.

If the market is unstable, there will be a deviation between perceived true values and observed (fair) values.

In many cases, we don’t have observable prices. We need to divide instruments to three levels.(?)

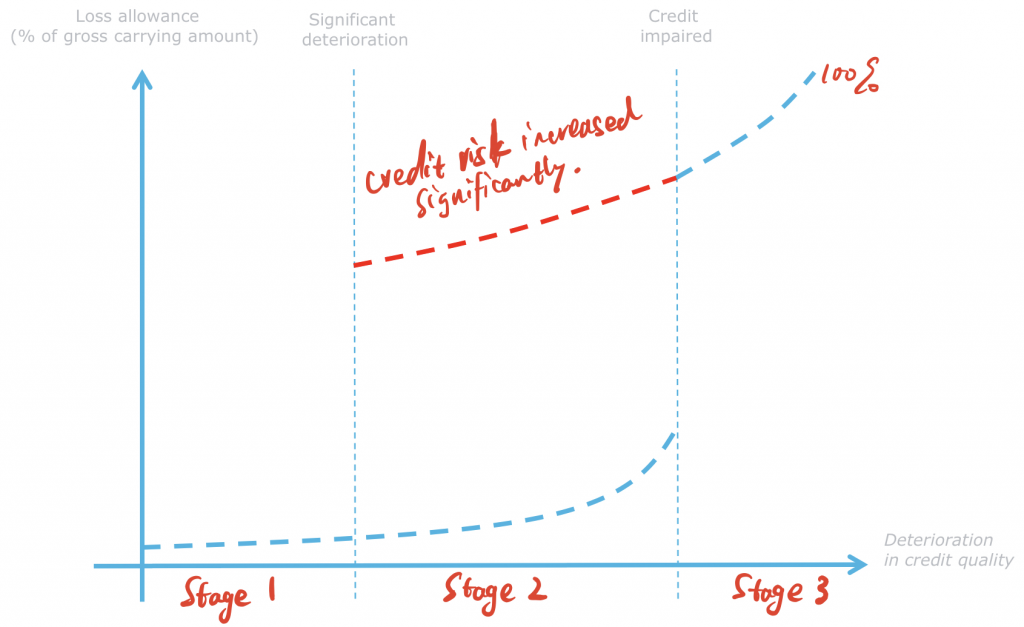

Impairment

If using incurred loss model, the loss may be identified too late.

Expected loss model: more forward-looking

- Moving from stage 1 (12 month loss) to 2 (life time loss) is based on management defined criteria.

- Moving from stage 2 to stage 3 is based upon default.

Hedge accounting v.s. Default accounting treatment

- Derivatives that are used for hedging are subsequently recognised at fair value. Whether these changes are immediately recognized in the income statement depends on the type of hedge accounting.

- In the case of cash flow hedging, the change in fair value is not recognized in the income statement but deferred in other comprehensive income. The gain /loss is then recycled to the income statement to match the gain/loss on the hedged item.

Journal entries

Assuming that the forward contract has a fair value of zero, there will be no journal entry on inception when entering into the contract.

Week 5 Lecture

Provision

A subset of liability

Criteria:

- Present obligation as a result of a past event

- Probable outflow of resources to settle

- Amount of obligation can be reliably estimated

We don’t want company to smooth earnings by using provisions.

Long-term provision is discounted.

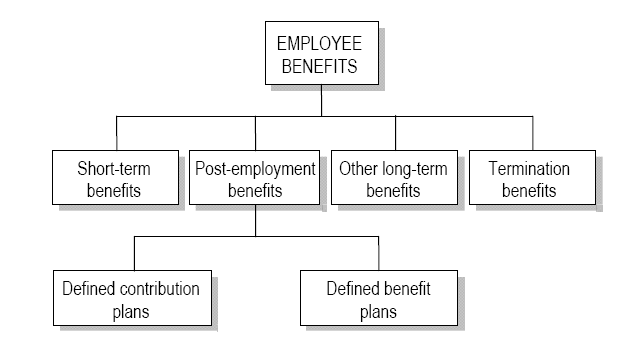

Employee benefits

Short-term benefits are straight forward.

Defined contribution v.s. defined benefit

In a defined contribution plan, a company puts money into a fund, and the return on the fund determines the pension.

In a defined benefit plan, a company promises to pay a certain amount of pension.

Defined contribution: No risk (or less)

Defined benefit: inflation, credit risk, interest rate, longevity (employee’s age)

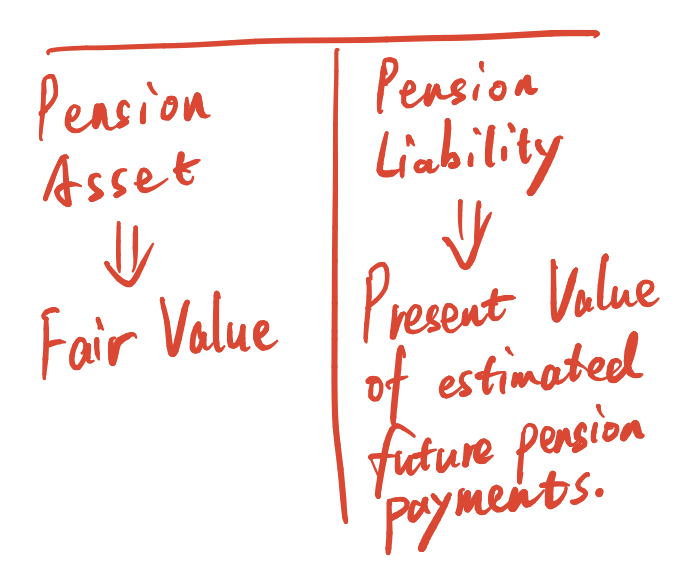

Defined benefit plans

- Deficit -> liability

- Surplus -> asset

Taxes drive the decision whether to fund the scheme.

Unfunded pensions -> no credibility

Accounting standard setters mandate the net approach to recognize funded defined benefit schemes on company balance sheets because pension assets do not belong to the company but belong to company’s employees.

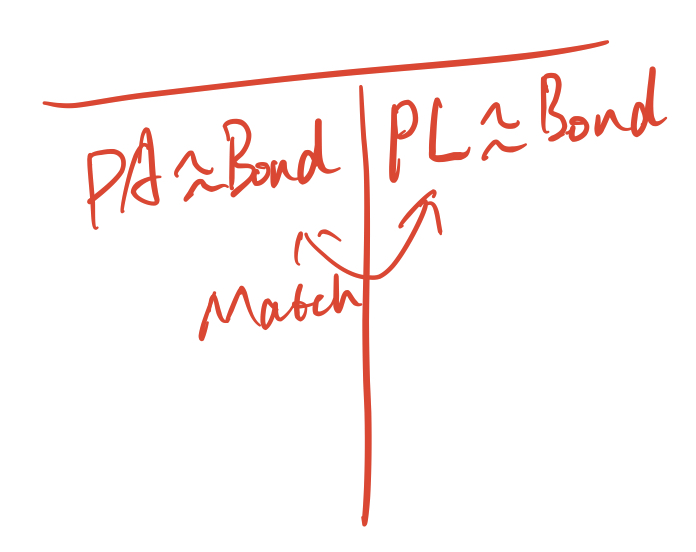

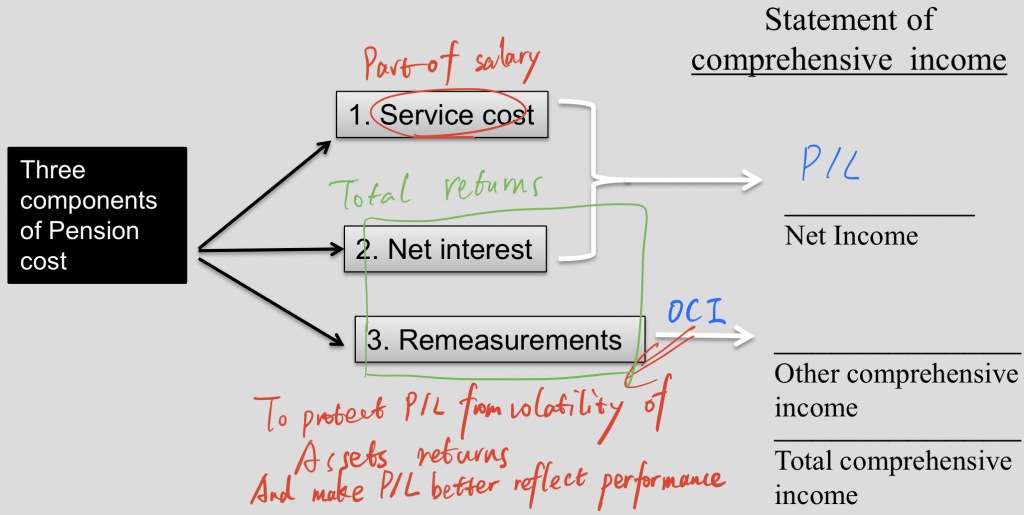

Pension liability behaves like a bond, so pension asset invest (primarily) in bonds. However, equities promises higher returns.

However, the returns are material, so they’re put into OCI.

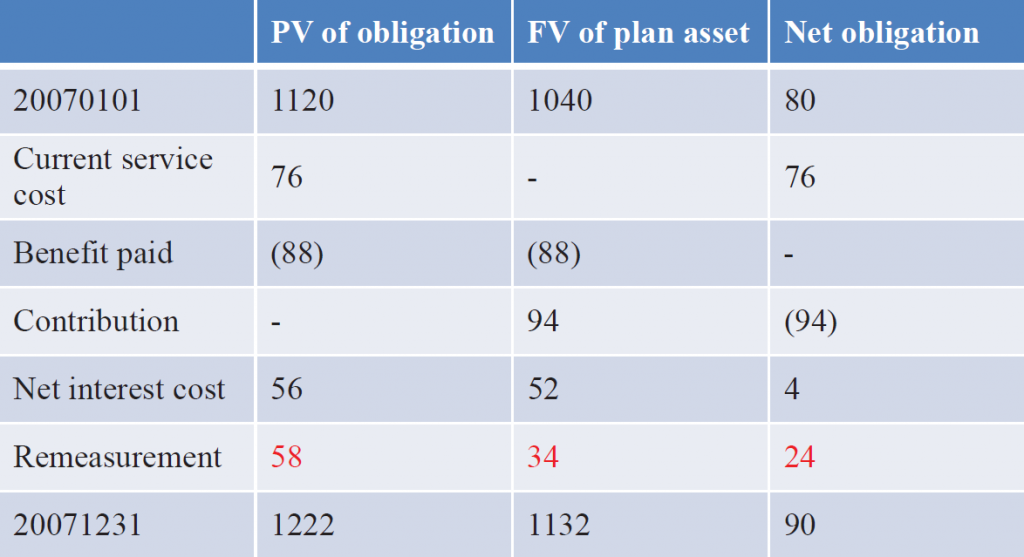

Service costs: Service costs are the present value of pension benefits in a particular accounting period. As these reflect pension benefits earned, these lead to an increase in the pension obligation.

Past service cost: Changes of benefits payable for past service.

Interest cost: Interest cost on the pension obligation arises as the pension obligation is estimated by discounting future pension payments. The interest cost reflect the ‘unwinding of the discount’ as the pension obligation moves closer to settlement.

- Interest ↑ Liability ↓

- Interest ↓ Liability ↑

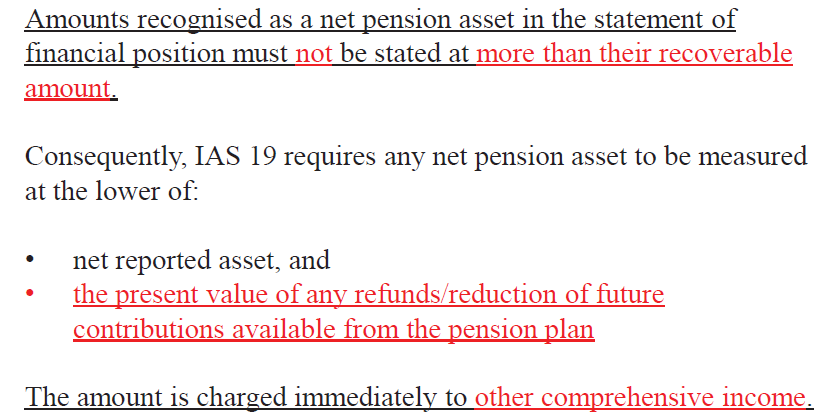

If there’s a surplus, it does not necessarily mean that there’s an asset.

Week 5 Tutorial

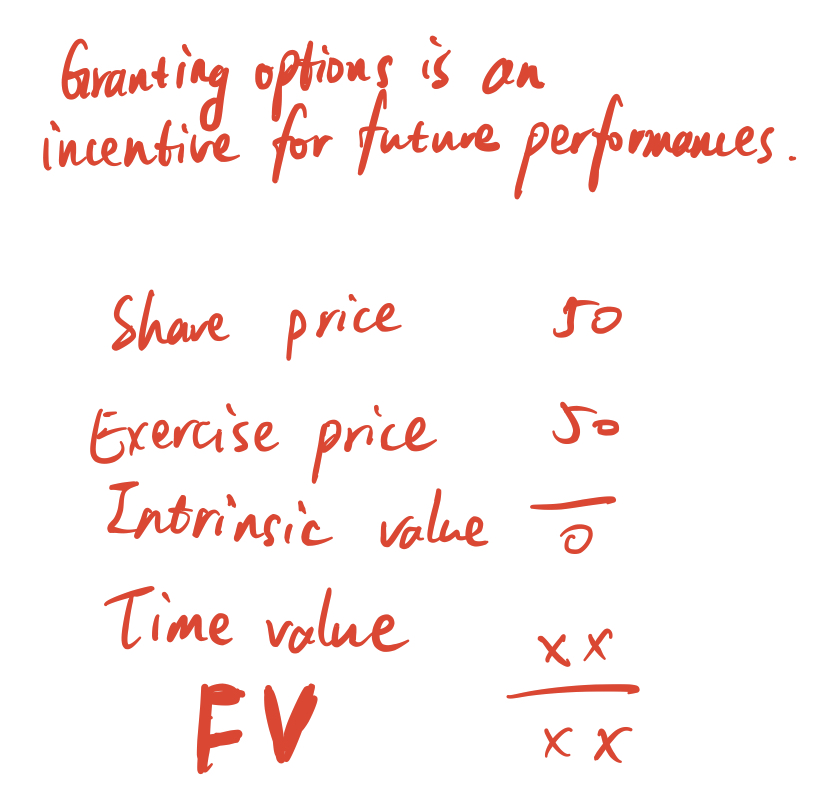

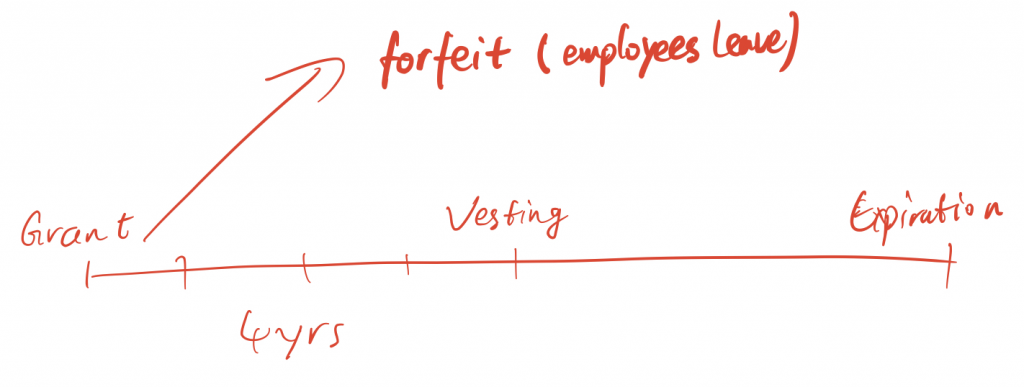

Share-based payment

- Call: buy

- Put: sell

- Equity settled: share itself

- Cash settled: difference between share price and exercise price

Equity-settled share-based payment

NO REVALUATION

Change of share price does not impact expense.

Equity-settled share-based payment can contribute to the difference between basic EPS and diluted EPS.

Cash-settled share-based payment

DB & DC

Week 6 Lecture

Information

Earnings forecast

If a company fails to meet earnings expectation, analysts will think there are something going on, and then they will read financial statements and ask questions. The manager team have to explain what goes wrong.

Better communication

Management commentary: outside the financial statements

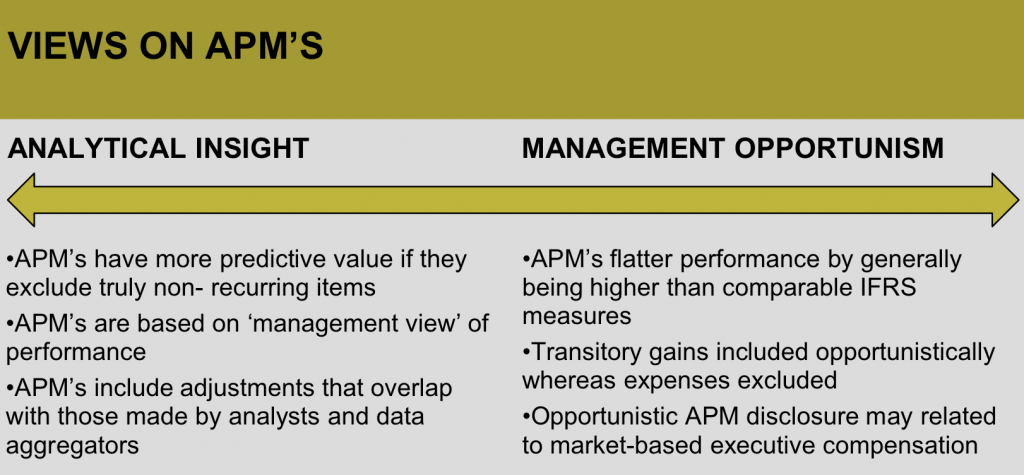

There are not clear definitions of popular subtotals.

Comparability v.s. Telling stories

Comparability v.s. Flexibility

Approaches:

- Introducing subtitles (let analysts understand performance)

- Non-GAAP

Week 6 Tutorial

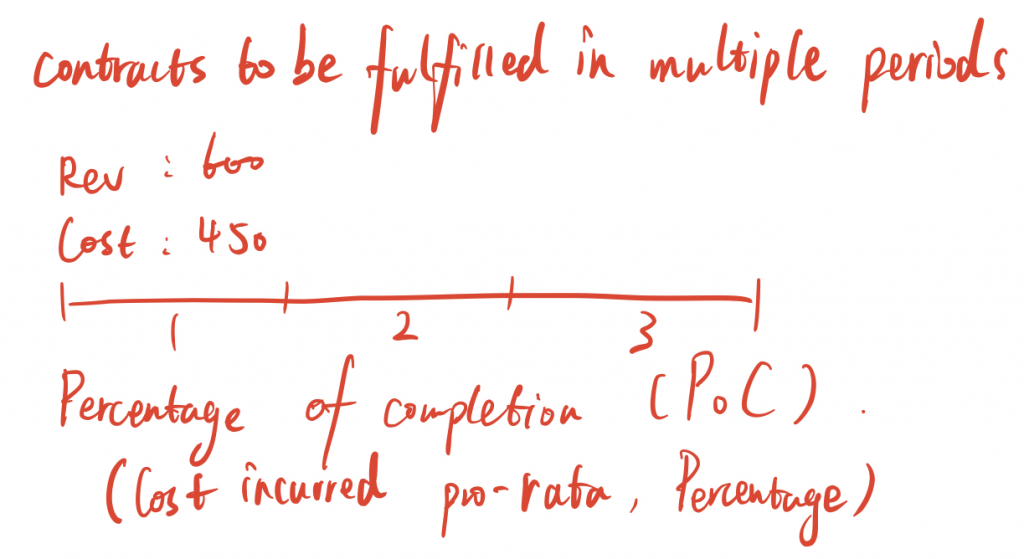

Revenue

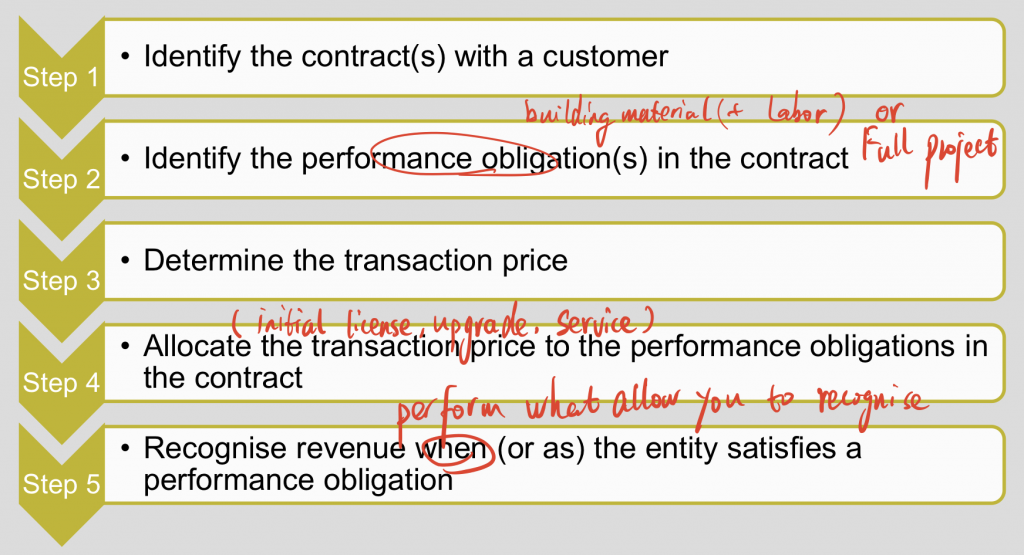

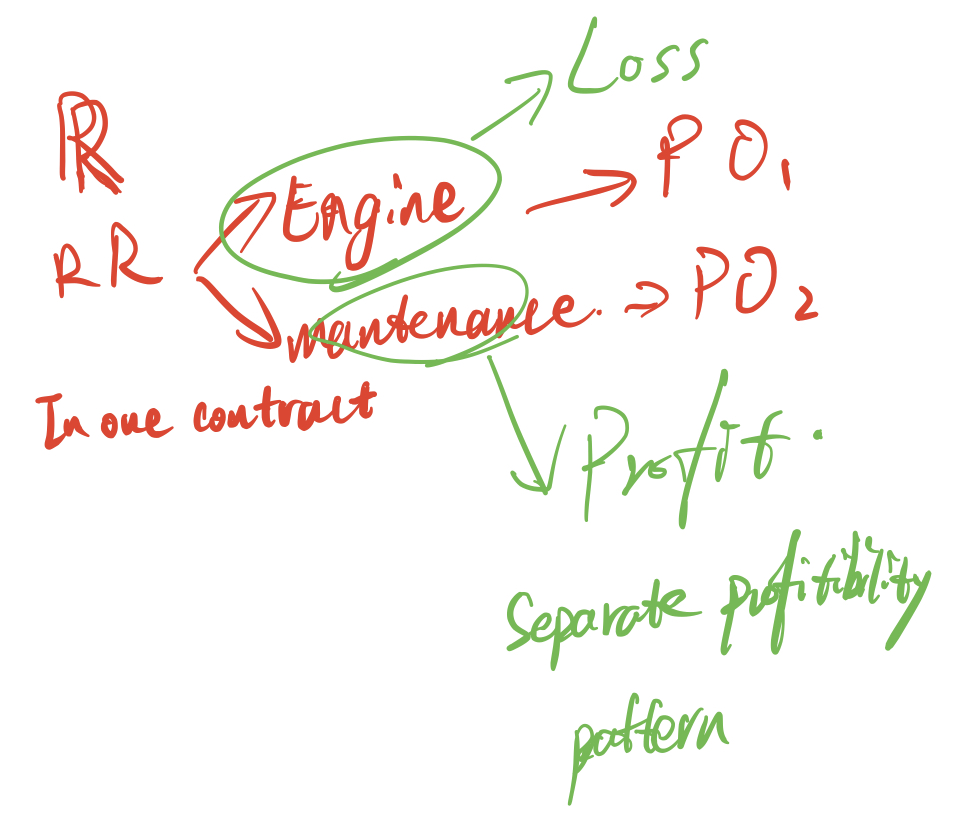

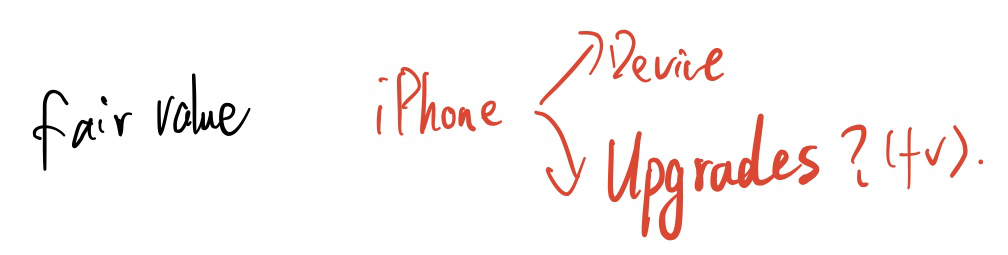

Five Steps

WHEN

Over time or At a moment

Contract costs

Certain contract costs are allowed to be capitalised.

Insurance companies: Loss making in the beginning to get customers on board. –> Very heavily loss-making in the beginning but very profitable in the end.

The END

Last updated at October 17, 2019 15:18 GMT+0200

如果你看到了这里,觉得还OK,可以点一下下方的大拇指,再用手机扫一下显示的二维码,然后输入一个数字。谢谢~