01. Abernethy et al. 2004

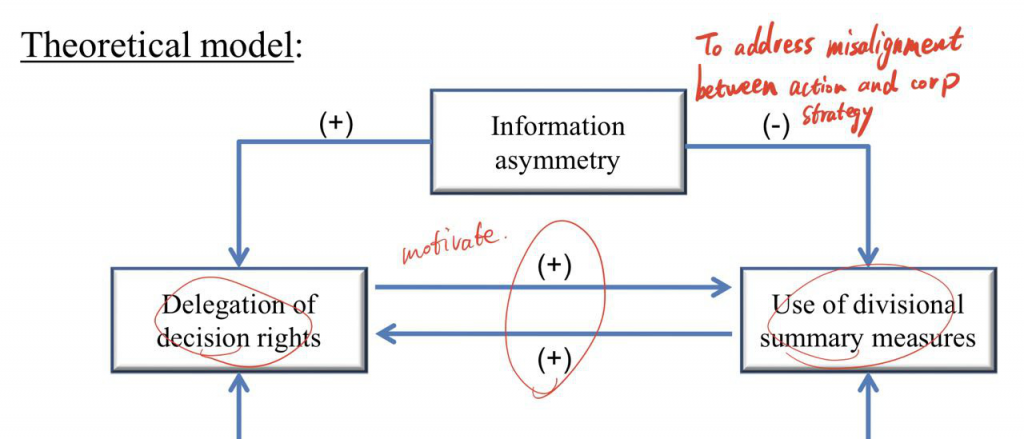

Findings

Greater informational asymmetry between the CEO and the divisions is associated with a greater delegation of decision rights towards divisional managers.

When decision rights are delegated from the CEO to divisional managers, a greater weight is assigned to divisional summary measures of performance.

02. Campbell 2012

Centralise –> Decentralise

Guidelines –> Deviate (Customer-center strategy)

Transition from centralized to decentralized decision making

– From detailed procedures (which loans, which terms) and not allowed to deviate

– To protocols and guidelines are indicative and allowed (encouraged) to deviate (=> required to justify why)

• Strategy: gaining market share by emphasizing member advocacy and service

– Building relationships with members, founded on trust, members come first (MOE)

Customer-center strategy –> Building on trust

–> Measure with performance measures –> Difficult

–> Hire people who fit the strategy

New system employees –> better fit (more aligned with new way of working)

03. J&M 1976

Shareholder as manager (100% owned)

No agency problem –> luxurious ………

95%

Facing 95% cost, other 5% is borne by external shareholders.

Reality: (E.g. owns 5%)

Burns money –> Bear 5% cost himself –> Other 95% borne by external shareholders

The smaller share interest, the less external shareholders suffer from using money in an excessive way (luxury offices, bad projects).

In big firms, managers only faces small negative consequences from their actions.

Agency costs

Agency costs of equity are defined as the sum of:

– Monitoring costs of the principal

• Limit divergence of interests by incurring monitoring costs to limit deviant actions of the agent

– Bonding costs by the agent

• Agent expends resources to guarantee that he will not take certain actions that would harm the principal

– Residual loss

• Resulting divergence of interest as it is not economically efficient to fully align principal’s and agent’s interests

Bonding costs: convince

Residual loss: It’s never possible to align managers’ interest with firm as a whole all the time. The shareholder should accept that managers will not always behave in line with firm’s interest.

04. Bouwens & Kroos 2019

SMEs have financial requests, and then loan officers visit SMEs to collect information.

SMEs do not have audited financial statement and can only provide soft information instead of hard information (financial information).

Loan officers can make decisions on some loans, but other bigger or riskier loans should be decided by the credit committee.

Loan officer can speak very positively for SMEs because there’re only soft information.

Loan officers can increase likelihood of loan approval by the credit committee by communicating their accumulated hard and soft information with an optimistic bias

– Loan officers incentivized to make loans (!!!!)

– Nonverifiable nature enables optimistic communication

Two lending decision outcomes that reflects positively biased communication by loan officers

– Loan rate deviations

– Loan quality adjustments after approval

05. Widener et al. 2008

TBC

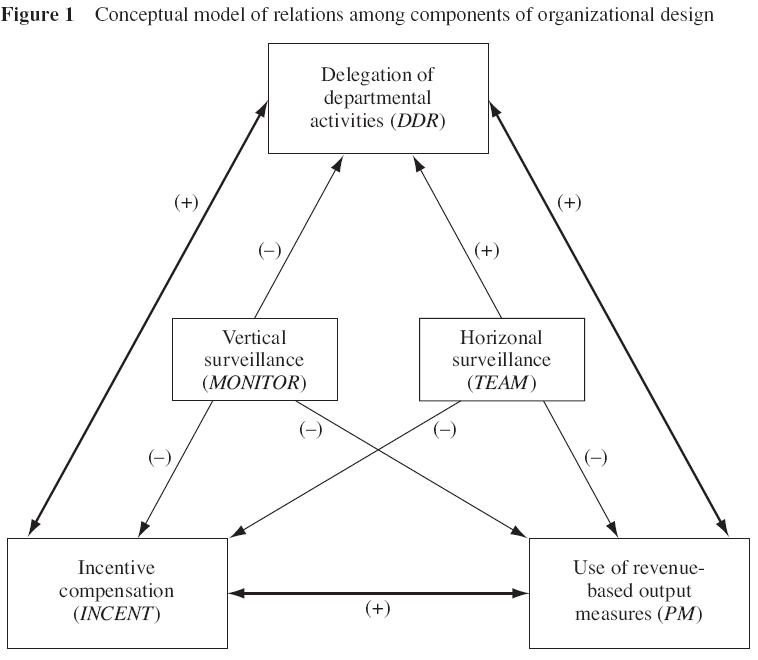

This paper is focused on:

– Interdependencies between: i) delegation of decision rights; ii) performance measurement, iii) incentive compensation

– The relationship between these three components of management control on the one hand, and iv) vertical surveillance (i.e., direct top-level monitoring); and v) horizontal surveillance (i.e., peer monitoring) on the other hand

Some main findings:

– Delegation of decision rights is positively associated with the use of incentives, and the use of incentives and the reliance on output measures are complements

– Firms that use stronger vertical monitoring delegate fewer decision rights to lower-level managers

– Firms that use peer-monitoring through teams use smaller degrees of incentive compensation

06. Grabner & Moers 2013

The MC package can be composed of a set of MC systems and/or of a set of independent MC practices addressing unrelated control problems.

07. Ittner et al. 2003

Two approaches to strategic performance measurement:

- Measurement diversity approach => firms need diverse set of financial and nonfinancial performance measures

- Contingency approach => firms need to align performance measures with their specific strategy/value-drivers

- H1: Organizational performance <–+–> Diverse set of financial and nonfinancial performance measures

- H2: Organizational performance <–+–> Performance measurement practices are aligned with the firm’s strategy

- H3: Organizational performance <–+–> Performance measurement practices are aligned with the firm’s value drivers

- H4: Organizational performance <–+–> Use of alignment techniques

H1 confirmed.

The additional measures provide incremental information on dimensions of the agent’s actions that the principal wishes to motivate.

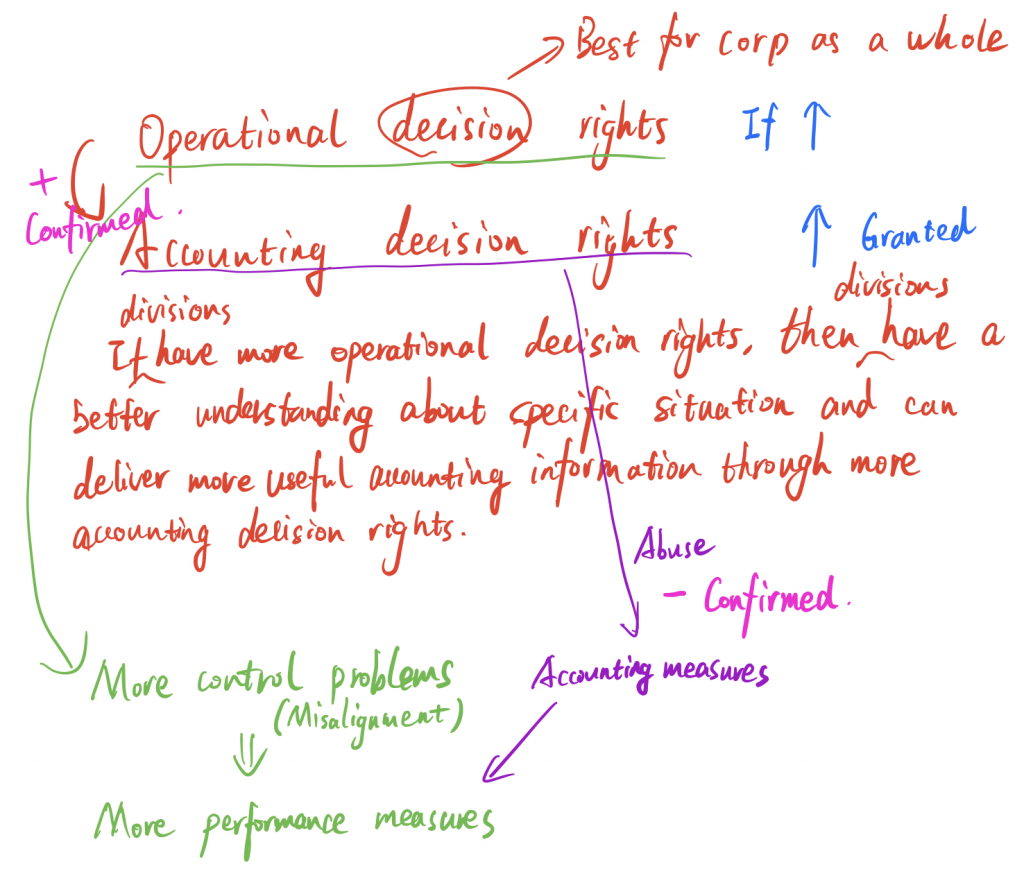

08. Indjejikian & Matejka 2012

09. Ittner et al. 1997

Informativeness Hypothesis

As long as measures can provide information about desired managerial actions, they should be included in the contract to efficiently motivate the manager.

CEO Influence Hypothesis

Non-financial measures are more prone to managerial manipulation.

So if CEO has greater influence or power over the board, the more weight of non-financial measures will be placed.

Power derives from the nomination of remuneration committee.

Results

Firms that pay more focus on innovation, quality and customers cannot so rely on financial measures but also use non-financial measures because non-financial measures are more informative about innovation, customers. Those firms are more likely to add non-financial measures.

10. Banker et al. 2000

Non-financial measures are used because we cannot fully rely on accounting measures. Accounting measures cannot indicate some certain information related to customers, innovation, etc. Financial measures are vary informative about efficiency.

So, firms that focus on differentiation , innovation, high quality and customers have higher reliance on non-financial measures.

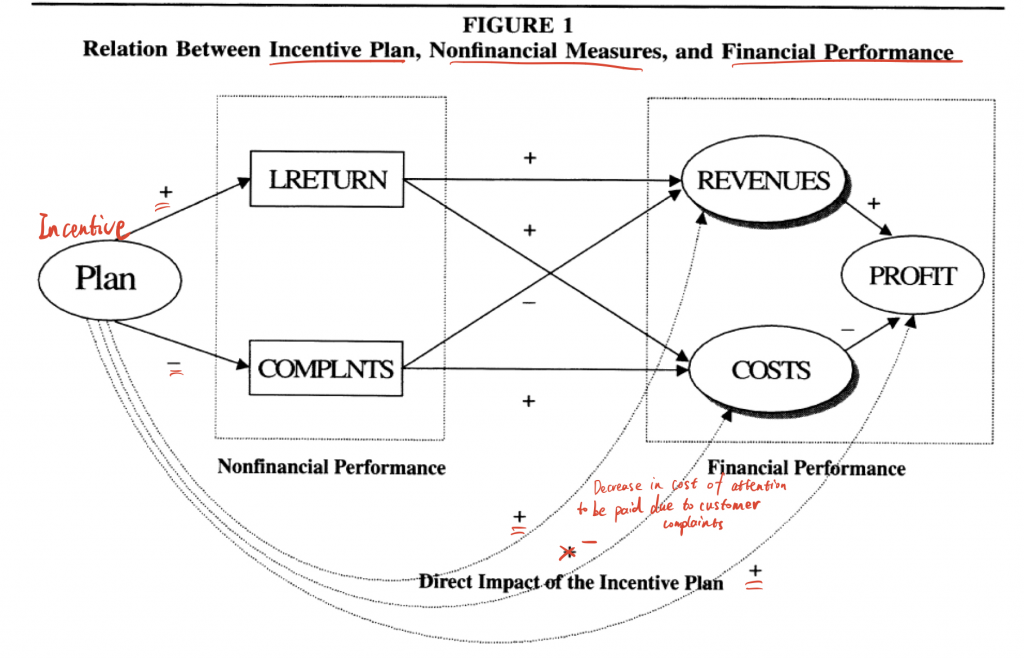

We assume current non-financial measures can predict future financial performance. Non-financial measures reflect current managerial

actions that do not show up in financial performance until later.

Questions

- Whether current non-financial measures lead to future financial performance.

(Non-financial measures – Future financial performance) - whether incentive plans using non-financial measures have an implication on performance.

(Plans – Performance)

11. Dechow & Sloan 1991

CEO retirement –> Unable to enjoy future benefits

R&D expense ↑ –> Profit↓ –> Bonus↓ –> Short-term benefit↓

SO, CEOs spend less on R&D during their final years in office.

UNLESS CEO there are stock-price-based incentives or relay process of CEO secession.

Q: What is horizontal problem?

A: Executives who place little value on future earnings relative current earnings face stronger incentives to improve short-term earnings performance. Executives who are likely to place little value on future earnings are those who have short horizon because they are expecting to leave their position in the nearest future. They want to improve their short-term compensation by rejecting some R&D investments.

12. Wallace 1997

H1

Asset dispositions (disposals) will increase and new investment will decrease for firms following adoption of a residual income-based compensation plan.

Plans lead managers to become more selective in their retention of existing projects and in their choice of new projects following the adoption of a residual income performance measure.

H2

Overall share repurchases and dividend payouts will increase for firms following adoption of a residual income-based compensation plan.

One way to reduce the total charge for capital is to reduce capital through share repurchases and dividends payouts.

H3

Total asset turnover will increase for firms following adoption of a residual income-based compensation plan.

Residual income is also increased by using existing assets more intensively.

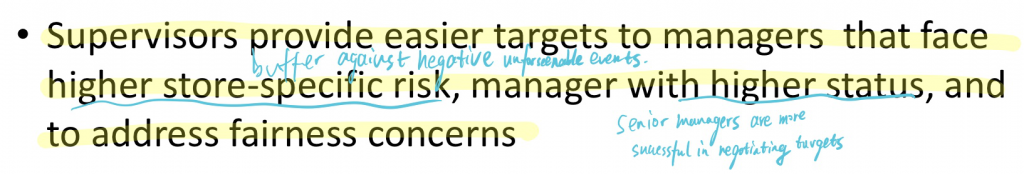

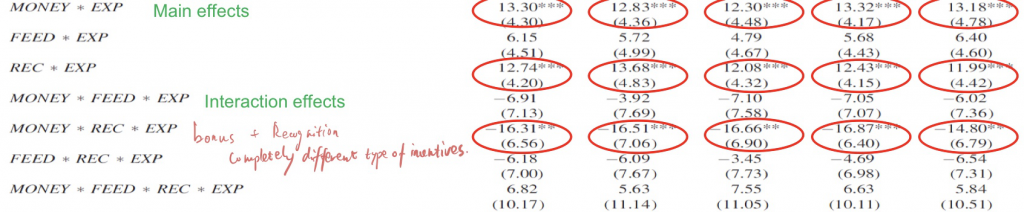

13. Bol et al. 2010

14. Gong et al. 2011

1. Which firms use relative performance evaluation?

Some factors that impact your performance also impact performance of other units.

E.g. Does firm’s performance follow the industry’s performance?

Availability of similar (complexity / performance) peers

Results: Those firms facing common risks.

2. Who is in the group that you are compared with?

Common risk exposure: Same industry, Same firm size

Similar ability: Similar market value equity

Self-serving bias: under-performance(preferred) or over-performance

Results: Above

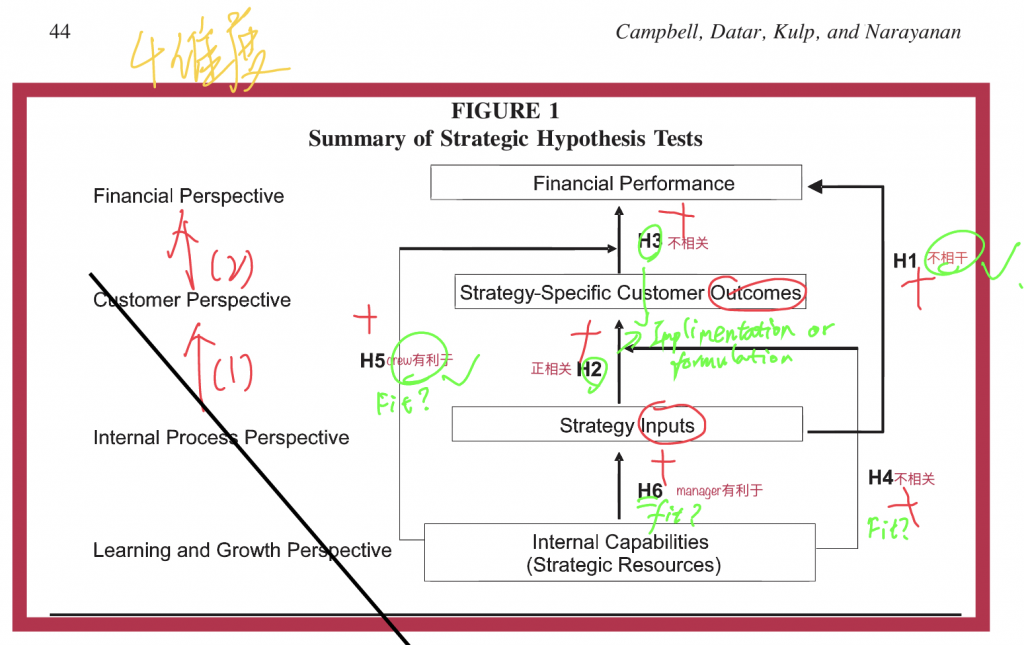

15. Campbell 2005

Results provide evidence that strategically linked firm-specific performance measures can be used (1) to evaluate strategy on a timely basis, and (2) to distinguish between problems, such as strategy formulation, implementation, and fit, that cause strategies to fail.

16. Gibbs et al. 2004

First, the findings suggest that subjective bonuses are used to complement perceived weaknesses in quantitative performance measures and to provide employees insurance against downside risk in their pay. Specifically, use of subjective bonuses is positively related to: (1) the extent of long-term investments in intangibles; (2) the extent of organizational interdependencies; (3) the extent to which the achievability of the formula bonus target is both difficult and leads to significant consequences if not met; and (4) the presence of an operating loss.

Second, we find that the effects of subjective bonuses on pay satisfaction, productivity, and profitability are larger the greater the manager’s tenure, consistent with the idea that subjectivity improves incentive contracting when there is greater trust between the subordinate and supervisor.

Reduce risk (only when there is adequate trust)

17. Coles et al. 2006

If CEO owns more options, then he or she will adopt riskier investment.

Options: No downward risks, only upward potentials

More R&D expenditure, Less capitalized expenditure (PPE), More focused strategy, More leverage

18. Grabner & Moers 2013b

In making promotion decisions, the weight on current job performance decreases with increases in the change in tasks upon promotion, while the weight on subjective assessments of ability increases.

This result basically follows from the premise that, with increased changes in tasks between hierarchical levels, the ability to master the current job says little about the ability needed in the next job, which makes current job performance less informative and increases the emphasis on subjective assessments.

19. Kroos et al. 2017

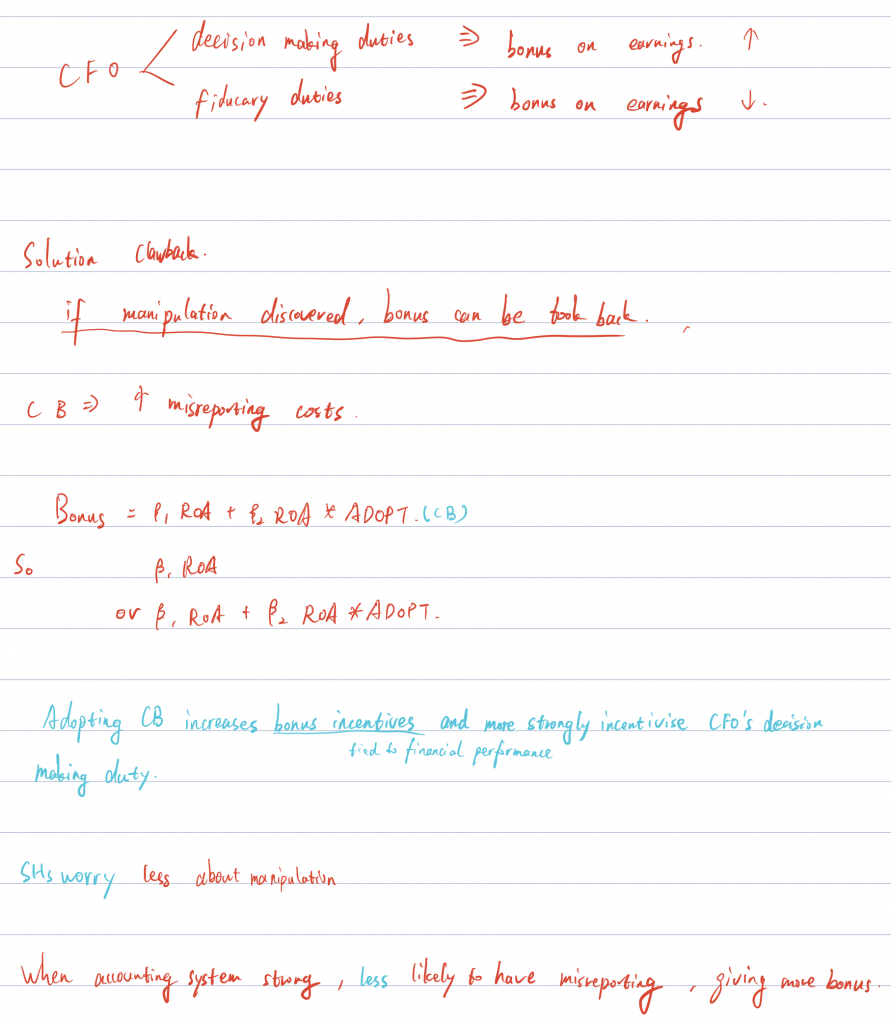

20. Armstrong et al. 2012

21. Dey 2008

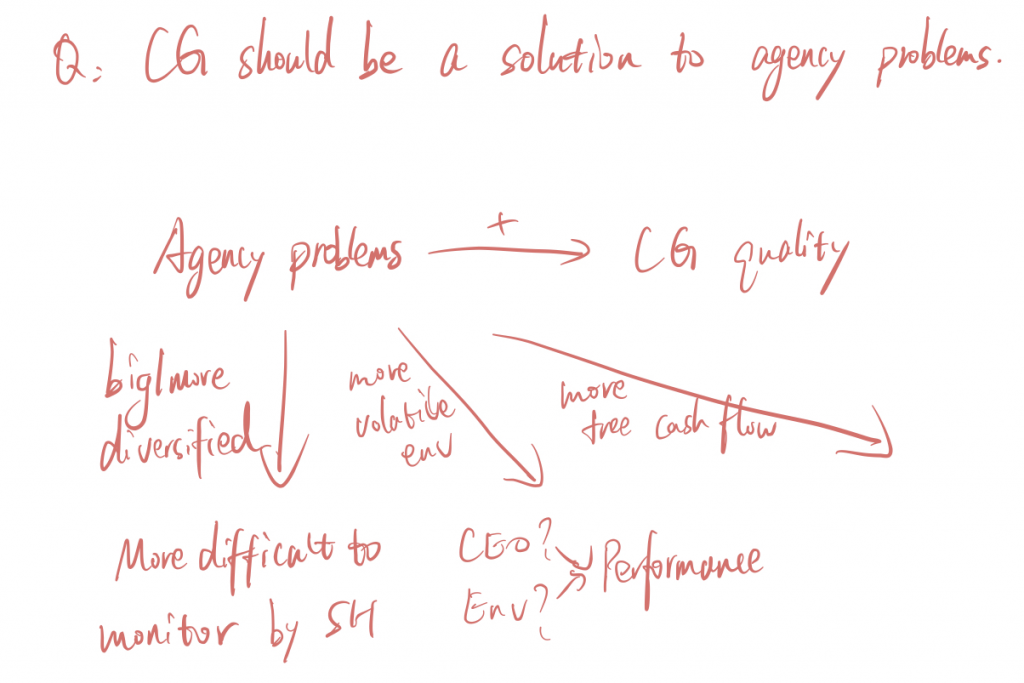

22. Lourenco 2016

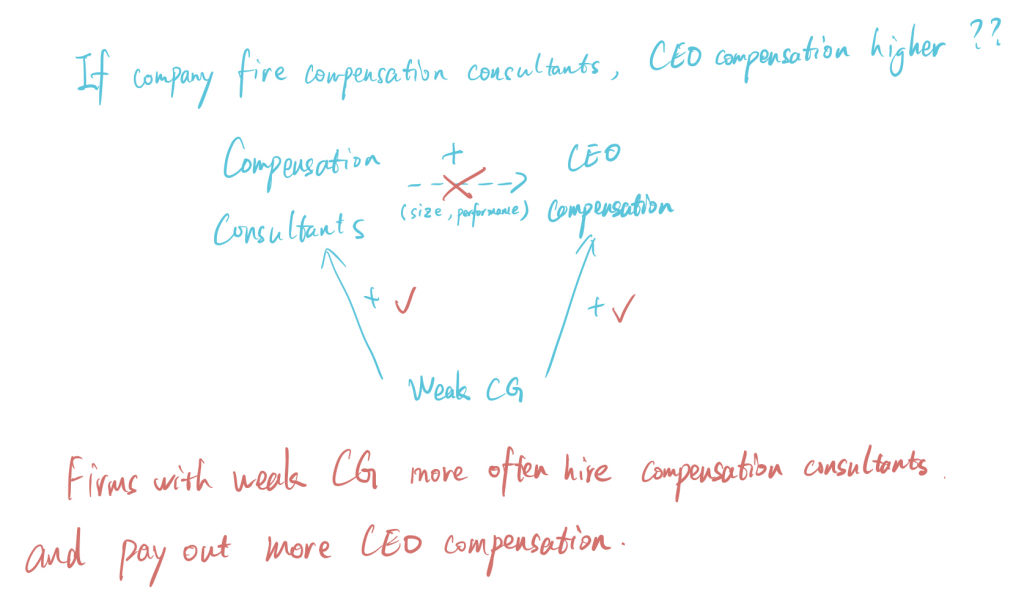

23. Core et al. 1999

Firms with weaker governance structures have greater agency problems; that CEOs at firms with greater agency problems receive greater compensation; and that firms with greater agency problems perform worse.

24. Eyring 2016