Week 1

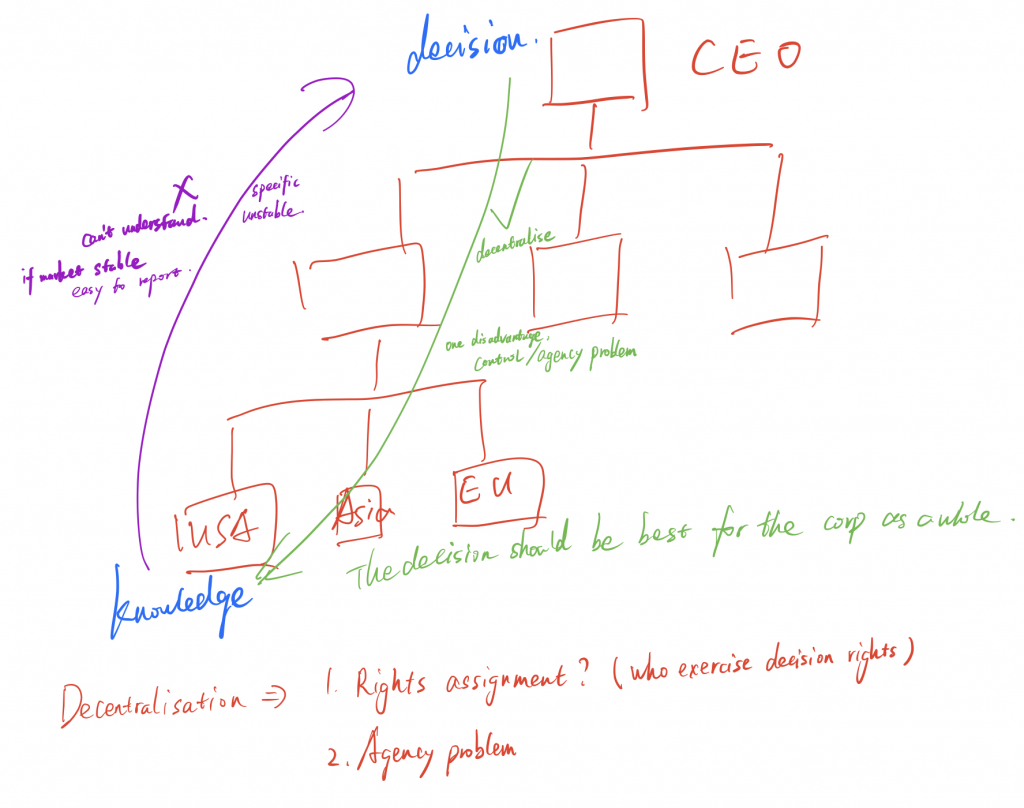

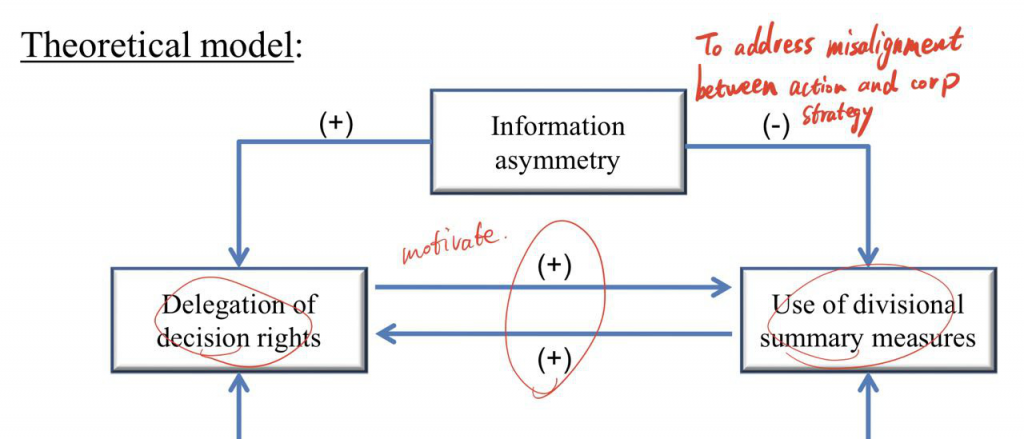

Information asymmetry

You know something others don’t know.

Agency problem

Management control –> Aligning behavior

To ensure everyone works in a desired way

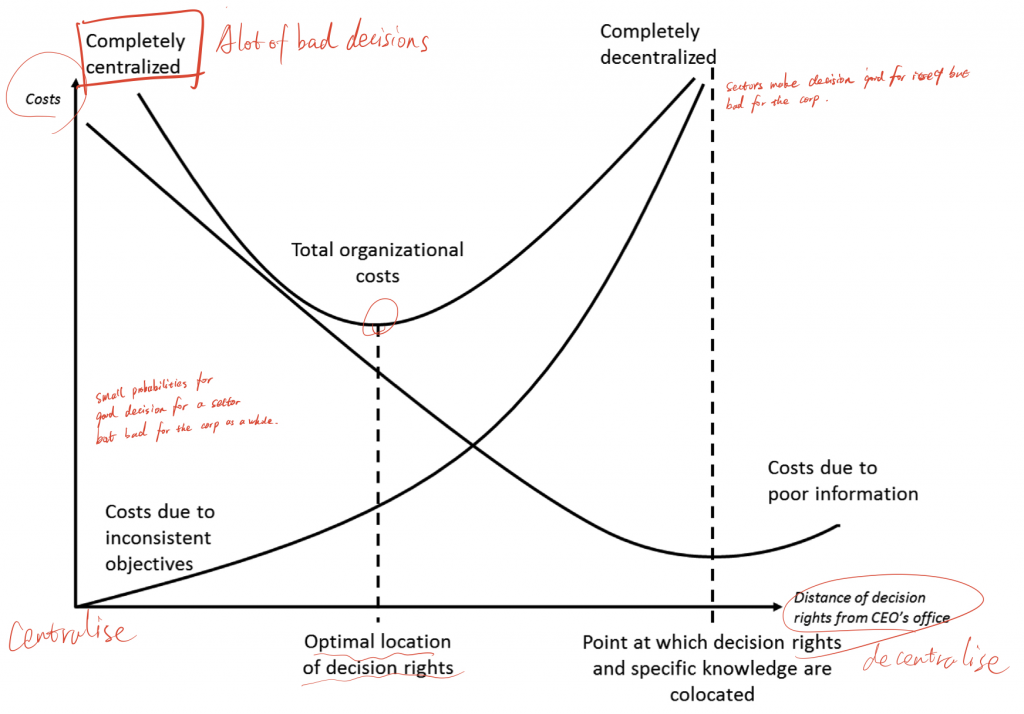

Cost of poor information

v.s.

Cost of inconsistent objectives

Three causes for misalignment:

- Lack of direction

- Lack of motivation

- Lack of ability

If decentralisation meets some problems, then there’re two ways to address problems:

- Avoid (Centralisation× , Eliminate/share risk×)

- Use of comprehensive management control system

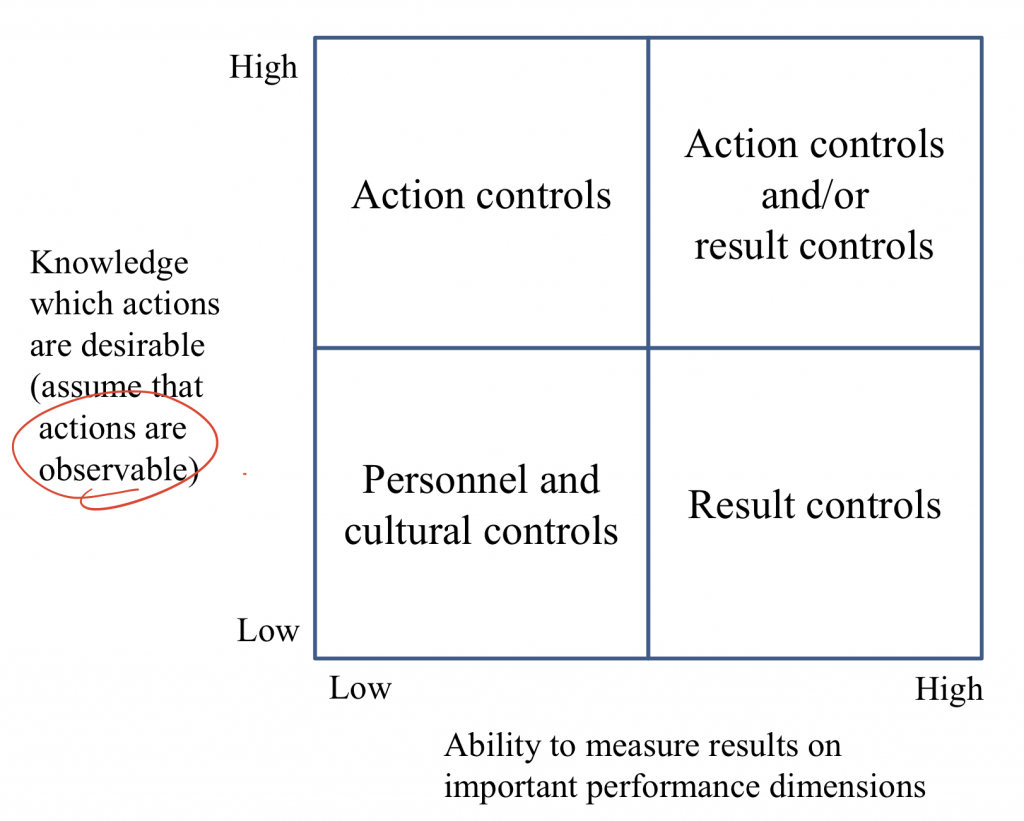

Management control system:

- Result controls (Performance measures and reward/punish)

- Action controls (Do not look at results, info asymmetry cannot use this)

- Personnel and culture controls (hire right people, automatically motivated)

Result controls

It’s employees’ freedom to choose their actions.

Holding employees accountable for delivered results. (Reward / Punish)

Employees who is held accountable must be able to influence the results in a material way.

External situation (Noise)

–> Low performance

–> Risk is imposed on employees

–> Risk premium

–> More costly

Abernethy et al. 2004

Action controls

Immediate controls

Personnel controls

builds on self-control

hiring the right people, behavior like corp’s objectives

Campbell 2012

Cultural controls

Builds on mutual monitoring

People monitoring each other

J&M 1976

Widener et al. 2008

Costs and benefits of control systems

Benefits: accomplishment of organizational objectives and strategies

Cost: Bonuses paid, Shareholder can never perfectly align interests of all people.

Bouwens & Kroos 2019

Week 2

Contingency theory

No universally best management control system that applies to all situations and all organizations

Different methods should be applied to different environment or situations.

Management control system should be designed according to strategy, external environment, technology, org structure, firm size, culture, etc.

Strategy: Corp strategy & Business strategy

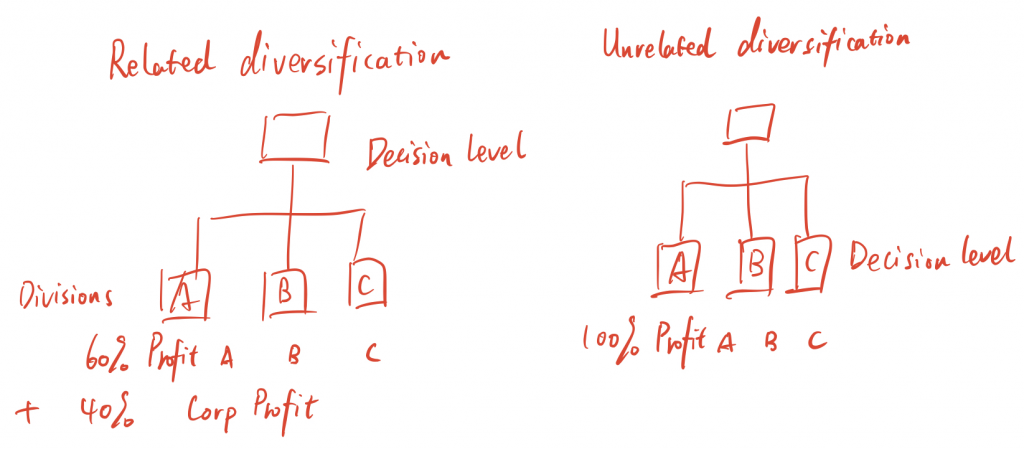

Corp strategy ==> Diversification

Unrelated diversification ==> More information asymmetry

==> Lower decision level & Low-level result controls

Business strategy: Cost leadership or Differentiation

- Cost leadership: Tight result controls & Tight action controls

- Differentiation: Result controls related to customers & Less action controls & More personnel and cultural controls

Culture: Countries

Grabner & Moers 2013

MC package as a way to address multiple MC practices simultaneously.

Performance implications

Ittner et al. 2003

Contingency vs. complementarity

Contingency focuses how individual MC practices fit with context and complementarities focus on how individual MC practices fit together (and with context).

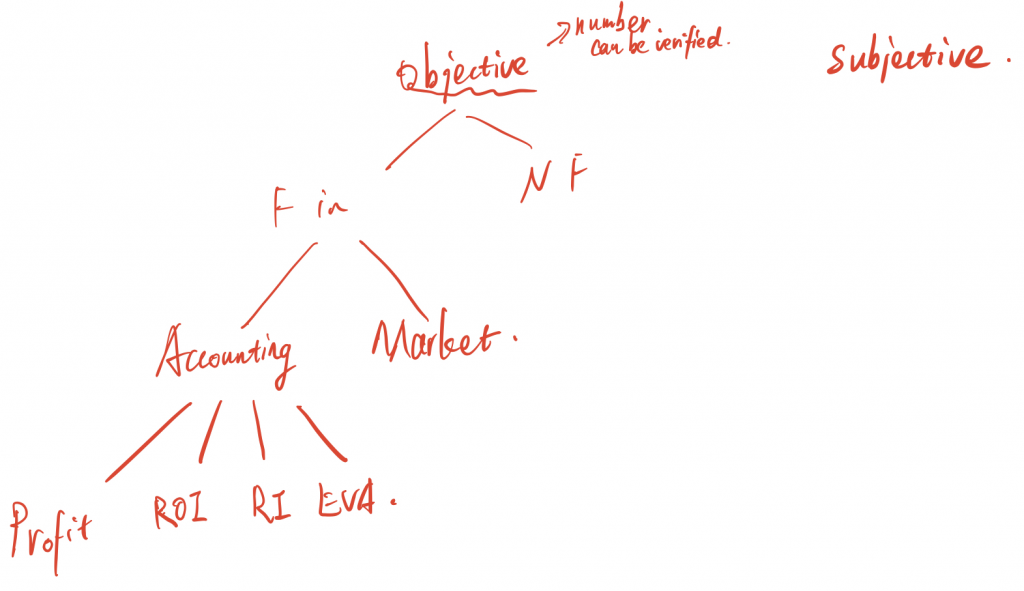

Performance measures

Result control — Focus on outcomes of employee’s actions

Ideal situation: Individual contribution to firm value.

Criteria

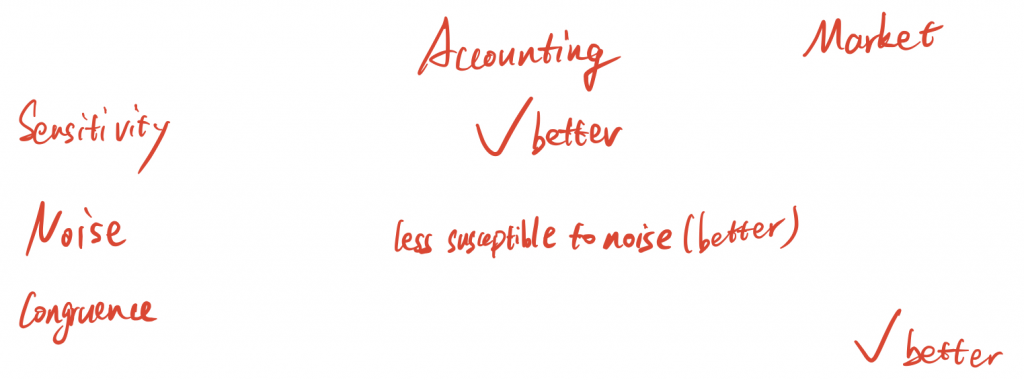

– Sensitivity: to what extent can employee influence measure

– Noise: to what extent is measure influenced by other, external factors

– Congruence: to what extent does increase in measure leads to increase in firm value

– To what extent is measure susceptible to manipulation

Market performance measures

In efficient market, stock price should reflect future cash flows and risk.

Not look at the back but forward-looking

- For executives

- Noisy due to external factors

- Congruent

Accounting performance measures

- Available at many levels (Firm / divisional)

- Facilitate autonomy for lower-level managers

- Sensitivity ↑ (If divisional manager has decision right

- Less noise

- Weak congruence

Weak congruence of accounting measures

– Referred to as backward looking measures (i.e., reflect economic impact of decisions made in the past)

– Due to conservative nature of accounting, poor matching current investments with future benefits

– ‘Price leads earnings’

– Ignores economic value generated if this cannot be measured accurately and objectively (e.g., intangible assets)

Week 3

Accounting measures are less susceptible to noise compared to market measures because they’re based on what have been realized.

Market measures are more congruent.

Accounting measures cannot objectively presents firm’s true value.

Residual Income

RI = Profit – ( CoC * CAP )

Economic Value Added EVA

EVA = Mod Profit – ( CoC * Mod CAP)

Examples of modifications:

• profit reflects capitalization and amortization of intangible investments in R&D and marketing

• Invested capital includes capitalized intangibles

Assume all R&D expenditure are capitalised.

Indjejikian & Matejka 2012

Non-financial measures

Non-financial measures provide more information about whether we are on the right way for the future.

Ittner et al. 1997

Banker et al. 2000

Dechow & Sloan 1991

Wallace 1997

Week 4

- Combination of performance measures: Accounting + Non-finanical

- To set target

- To give bonus as incentives

Performance measures

Non-financial measurement concerns

It’s difficult to adequately measure non-financial measures. They are susceptible to manipulation. It’s likely that extremes are picked up in the measurement.

Ambigious

Difficult to compare across companies and time.

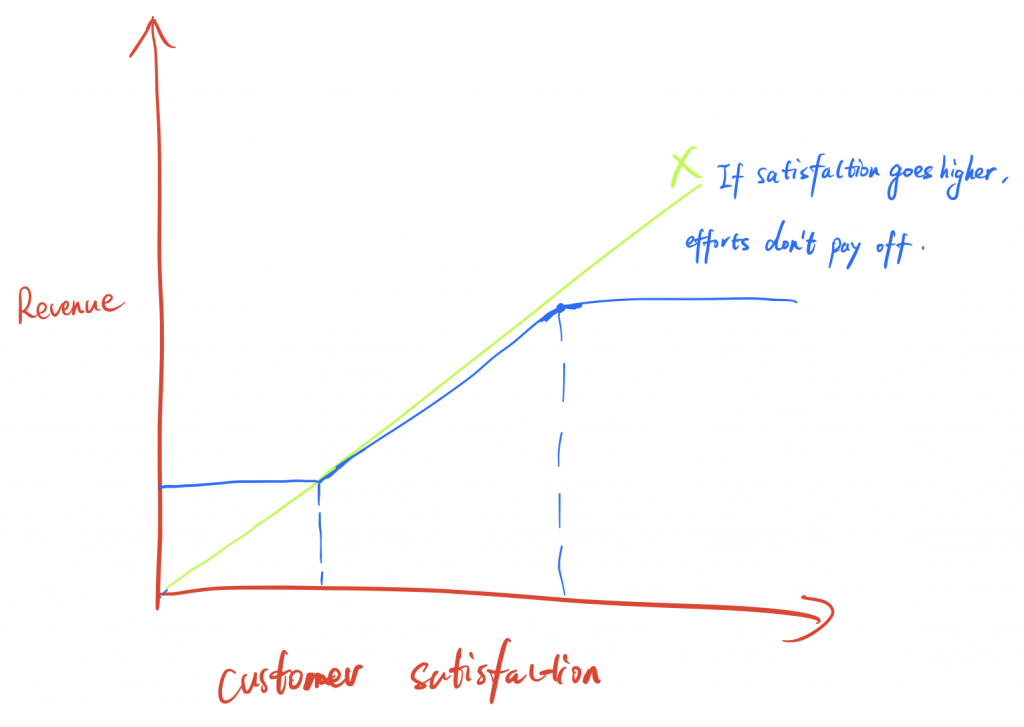

Relation between non-financial measures (E.g. customer satisfactions) and performance (Revenues) may not be positive.

Asymmetry: negative response dissatisfied customer exceeds positive response of satisfied customer

Dissatisfied customers are more likely to make their views known than satisfied customers. (Asymmetry)

Not susceptible to noise.

Non-financial measure itself is snot congruent, but it is congruent when applied with accounting measures. It can affect future accounting measures.

Combination: Accounting + Non-financial

Backward-looking + forward-looking

Subjectivity

- Judgment based on personal impressions

- Not verifiable

- Often qualitative

3 ways:

- Subjective measures

- Subjective weighting (Subjectively decided weight between different objective measures)

- Ex-post subjectivity

Reasons:

- Because some actions cannot be adequately measured in an objective fashion.

- Mitigating potential incongruence effects

- E.g. Whether lowered R&D

- Reduction of risk imposed on managers

- E.g. Recession, Although not realize the target, manager can still get bonus.

Costs:

- Inaccurate

- Supervisor may renege on his pledges

- Uncertainty about measurement creteria

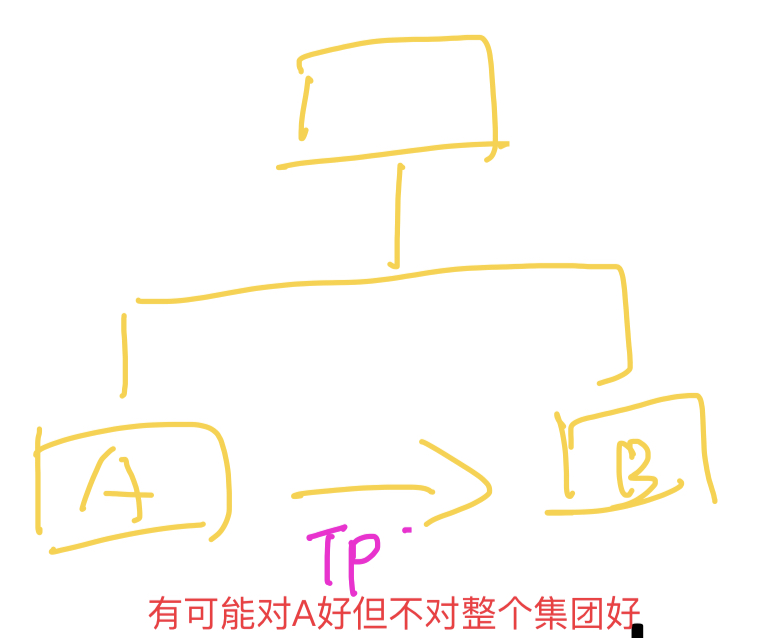

Transfer pricing

Tax rates

Division A acts beneficial to A itself but not beneficial to firm as a whole.

Market price

Liquid market –> reliable price

- Assume TP is lower than market price, then B is happy and A is not happy (prefer to sale externally)

- If A has excess capacity, TP can be lower than MP due to recovered fixed cost.

Variable cost

A decide manufactured less fixed cost

Full cost

Transfer all cost to B

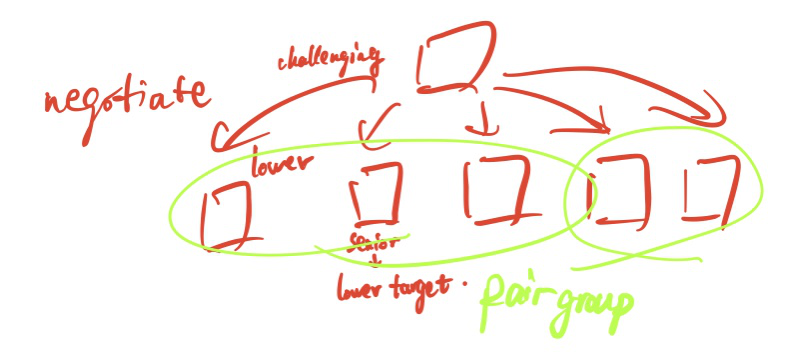

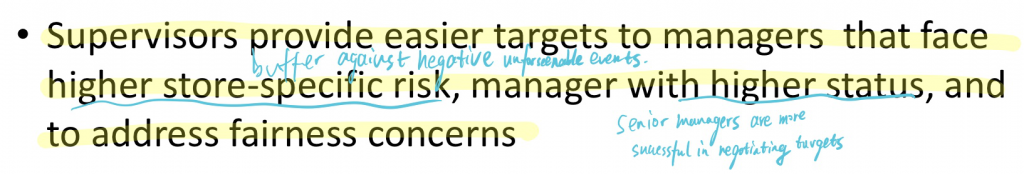

Target setting

Bol et al. 2010

Relative performance evaluation

Purpose: Filter out common noise

Some factors that impact your performance also impact performance of other units.

Gong et al. 2011

Campbell 2005

Gibbs et al. 2004

Week 5

Incentives

Functions

- Effort effect: Incentivise people to work hard

- Selection effect: Characters (Non-risk-reverse or risk-reverse) of employees determine the job they take. Select best people to do job.

- Retention effect: Cost to leave the company. To try to retain them in the firm.

Two choices

- How strong should the incentive be?

- What’s the duration of the incentive?

How strong?

- More suitable if performance measurements are of high quality. (High congruence, low noise)

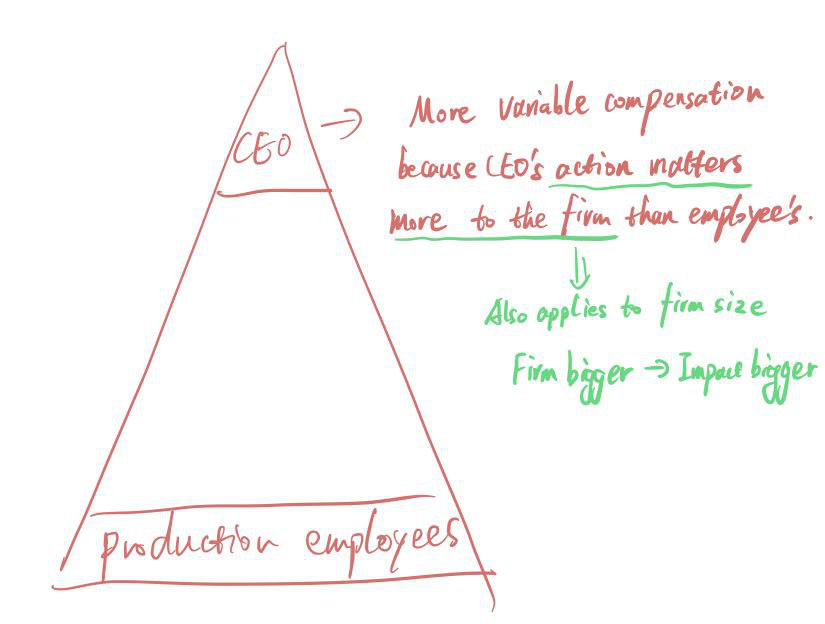

Determinants:

- Impact to the company

- Monitoring difficulty: If more difficult to monitor CEOs, provide more incentives to ensure the alignment.

- Riskiness: More risks from outside, less incentives.

Short-term or long-term

Earnings or Stock price

Salary

Salary is at a fixed amount. It does not provide incentives.

Why pay a little more than the industry?

To create a cost of job loss.

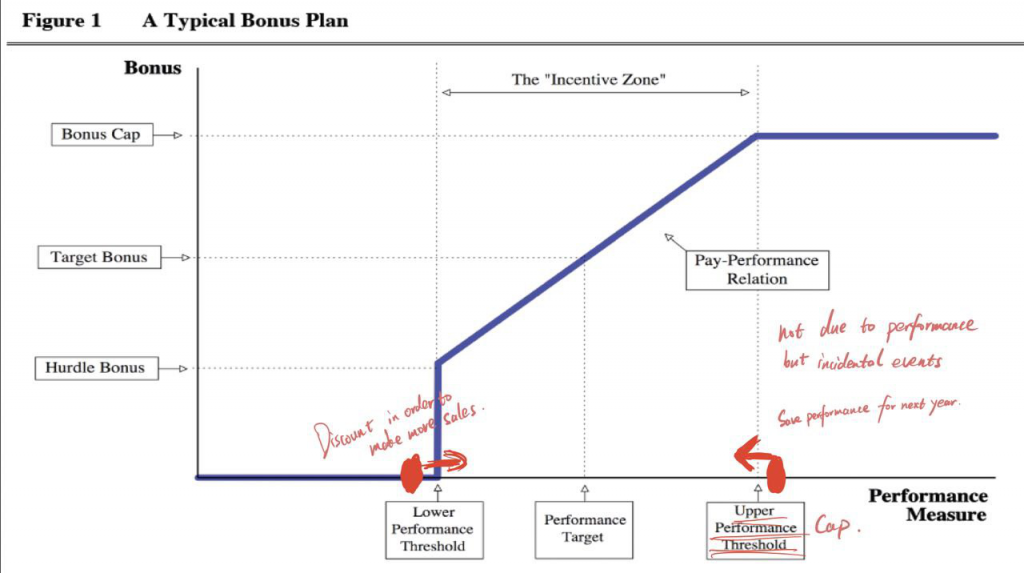

Annual bonus plan

Equity incentives

Grant: What you get in a certain year

Portfolio: The possession of options and stock at the year end

Motivation:

- Give incentive to increase future stock price

- A compensation to past performance

Restricted stock: Trading is restricted for several years

Option: Right to buy in future years.

Equity incentives are poorly aligned with return of shareholders.

If bad performance, result is mainly borne by external shareholders.

Options: Common sense (only upward potential, but no downward risk), Incentivise riskier projects due to potential larger variation

Coles et al. 2006

Dismissal

- Poor performance

- Costs of job loss

Promotions

Promotion-based incentives

Grabner & Moers 2013b

Group-based incentives

Clawback

Kroos et al. 2017

Week 6

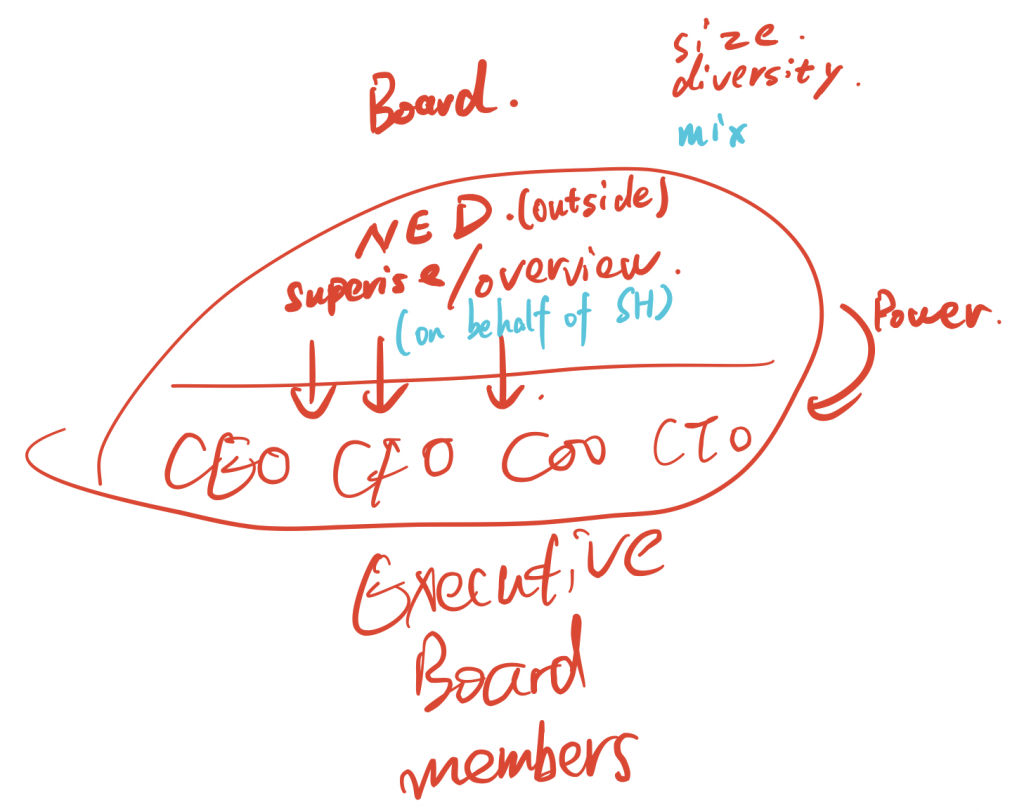

Corporate governance

- Shareholders use CG to safeguard their interests.

Compensation committee

- Often supported by external compensation consultants (NED)

- Quality –> % of outside members (NED)

Armstrong et al. 2012

External governance

- Market

- Institutional shareholders

- Audit quality